The Ultimate Real Estate Mentor tool

Empower Agents and Transform investors with the HEIA Liaison License

As a real estate coach or broker, you guide agents and teams toward success. The HEIA Liaison License equips your coaching with innovative tools, equity-based solutions, and a proven system to help your clients close more deals, grow their income, and dominate their markets.

CLICK BELOW TO WATCH FIRST!

How HEIA Simplifies Real Estate Strategies

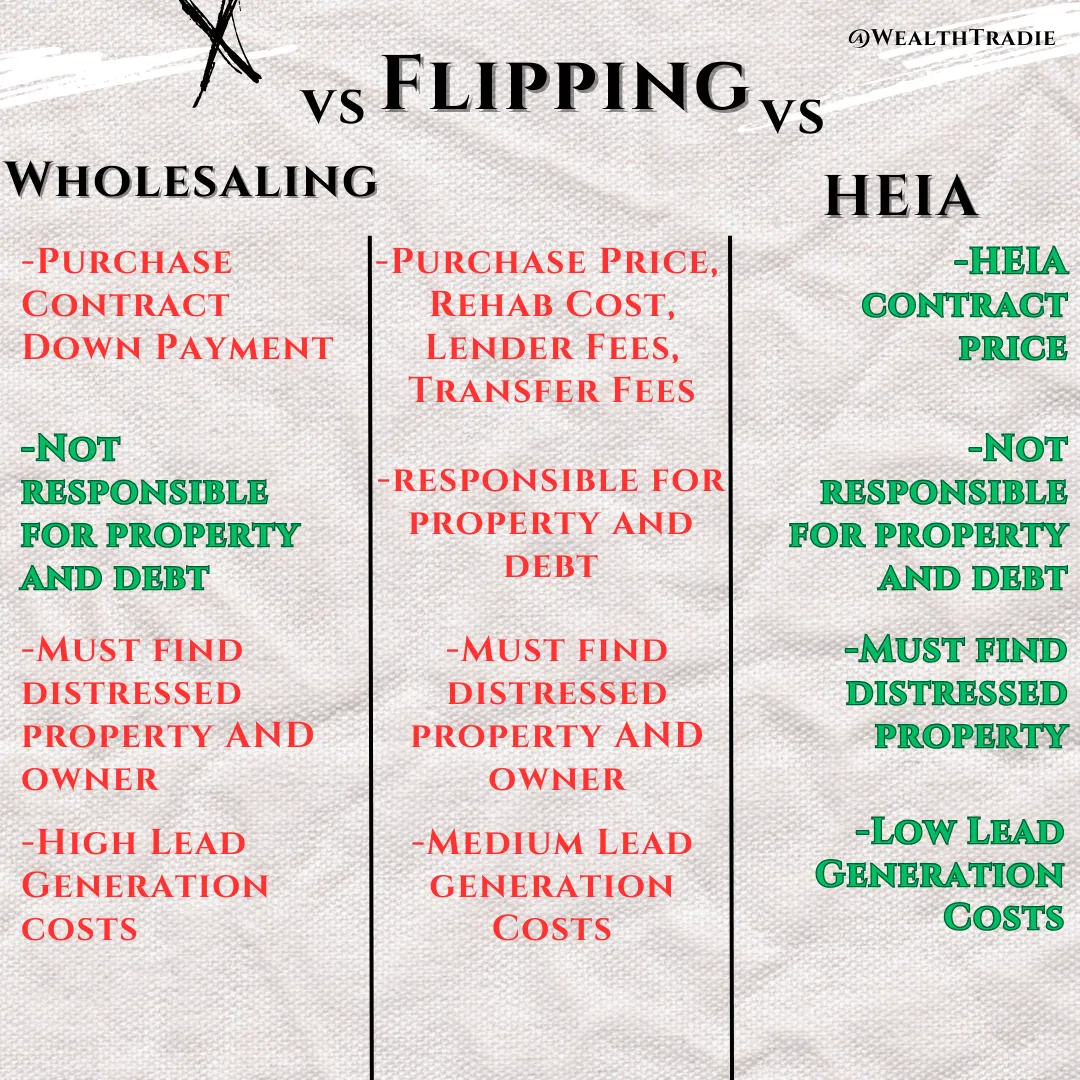

Wholesaling:

Replace risky property negotiations with equity-backed contracts that eliminate capital bottlenecks and costs for full market resales. Think high security novations with cashless renovations on properties.

Realtors Entering Distressed Markets:

Help realtors break into distressed property deals by offering equity-backed solutions to provide homeowners with cashless renovations by securely pushing contractors payment to closing.

Fix-and-Flip:

Fund contractors through HEIA to align their interests with property values and guarantee self accountable work while freeing up capital constraints to scale.

Rentals:

Leverage property equity to finance repairs, improving passive income without upfront liquid costs. Purchase long term real estate appreciation through work instead of liquid capital.

Private Lending:

Transition from profit to equity-based returns for a safer, more profitable lending model on hard construction costs for equity.

30 Day No-Questions Money Back Guarantee

MADE POSSIBLE BY

WealthTradie claims no direct affiliation or profit from these companies

Inflation-Proof Your Coaching Business

tired of navigating the challenges of education scaling models, it’s time to revolutionize your business with a system that delivers real results

The Industry Problem: Why Most Coaching Models Fall Short

Overcomplicated Strategies: Students often fail to master complex methods like wholesaling, flipping, or distressed property investing with low offers to homeowners.

High Risk: Your success depends on your students’ ability to execute. Leaving you vulnerable to inconsistent outcomes with limited quality students.

Limited Scalability: Teaching time-intensive strategies leaves little room for you to grow your own real portfolio.

The WealthTradie Solution: Simplify, Scale, and Succeed

Home Equity Invoice Agreements (HEIA) transform the way real estate mentors operate. This isn’t just a tool, it’s a strategy that integrates coaching, funding, and real estate execution into one seamless model to simplify real estate scaling for all without setting up an education fund model.

Streamlined Execution:

What Makes This a $100 Million Dollar Offer?

100% Revenue Share on WealthTradie Memberships

HERE’S HOW IT WORKS

Mentee's Use HEIA Under Your License

Your students can use your WealthTradie HEIA license for their first deals, giving them hands-on experience with minimal upfront costs.

Frictionless Real Estate Scaling

Bundle HEIA-based strategies into your coaching, helping students succeed faster while scaling your own real estate investments with less capital.

Reduce Coaching Risks

HEIA simplifies strategies like wholesaling, flipping, rentals, and distressed property deals, ensuring students achieve results faster.

Earn 100% of the revenue for every student who joins WealthTradie through your coaching.

Offer Apprentice, Pro, and Master memberships, giving your students access to the tools and resources they need to succeed.

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold anyone Back

Transform Your scaling Game with The

HEIA Liaison License

Before / Old Way

Soft Cost Waste: Money tied up in acquisition and transaction costs

Quality Issues: Scaling and increasing workload, increases complacity

Delayed Returns: Traditional deals take months when capital is needed, leaving funds vulnerable to inflation before you can deploy it securely.

After / New Way

Equity-Backed Security: Gain a stake in appreciating property values without ownership liabilities.

Aligned Interests: Contractors are motivated to maximize value, protecting your students and/or your funds.

Faster Timelines: Deploy capital quickly and see results sooner without Acquisition delays.

30 Day No-Questions Money Back Guarantee

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, with heia founder for 1 hour, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Value: $2,737

Unparalleled Tools for Scaling Like a Pro

With WealthTradie’s Apprentice Membership, you gain exclusive access to premium resources: advanced calculators, property valuation tools, and comprehensive market analysis guides. Plus, enjoy priority support and insider updates on the latest trends and opportunities in real estate.

Bonus 2: Pro Membership

Value: $3,714

Master the Game of Real Estate Wealth

Gain insider knowledge and hands-on training from seasoned experts with the WealthTradie Apprenticeship. This program takes you step by step through proven strategies to scale your fix-and-flip business, master HEIAs, and create sustainable wealth. Learn everything from deal sourcing and negotiation to maximizing profits with equity-based agreements.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Value: $Variant on Performance

Earn While You Scale

Unlock the ultimate side income opportunity with WealthTradie’s Affiliate Membership. With 100% revenue share, you’ll keep all the profits from referring other fix-and-flippers or real estate professionals to HEIA and WealthTradie memberships. Turn your network into a profit machine while helping others break free from traditional lending.

30 Day No-Questions Money Back Guarantee

The Ultimate Real Estate Challenge

The Free Parking Challenge for Coaches

Test the Boldest Real Estate Guarantee Ever

Inspired by Monopoly’s iconic Free Parking Jackpot, the WealthTradie Challenge is your opportunity to challenge the revolutionary Home Equity Invoice Agreement (HEIA) system. With every HEIA purchase, the stakes grow higher as the Free Parking Jackpot builds—but there’s only one way to claim it.

The Challenge

WealthTradie’s bold claim:

Home Equity Invoice Agreements (HEIA) are the most efficient, risk-reducing, and game-changing contracts in real estate today.

Your mission:

If you can disprove HEIA’s guarantees or develop a system that’s more efficient, scalable, or secure, you’ll claim the entire Free Parking Jackpot.

How the Free Parking Jackpot Works

Every HEIA License Purchase Builds the Pot: A portion of every HEIA license purchased through the WealthTradie Challenge is added to the Free Parking spot. The pot grows as more professionals accept the challenge.

Prove the Claims Wrong: Take a deep dive into HEIA contracts and frameworks. If you can prove a flaw in the guarantees or offer a system that outperforms HEIA in efficiency, scalability, or security, the jackpot is yours.

Why Take the Challenge?

Compete for a high-stakes reward. Learn a proven, equity-based system that eliminates common real estate challenges and opens new income streams, whether you claim the jackpot or not.

What’s in it for You

You gain access to the most innovative real estate contract model available today.

Your HEIA opens doors to new revenue streams, advance wealth multiplier calculator, and equity-backed returns.

You’ll join a community of forward-thinking real estate professionals pushing boundaries in the industry.

Are You Ready to Take on Real Estate’s Boldest Challenge?

This is your chance to compete, innovate, and elevate your real estate business. Whether you break HEIA’s claims or adopt it as your next big strategy, you win.

Revolutionary

How others are utilizing HEIA

Home Equity Invoice Agreements Transform Foreclosure Investing

Real estate investors face a common challenge when dealing with foreclosure properties: finding the right balance between risk, capital requirements, and profit margins. The traditional approach of purchasing distressed properties outright, renovating, and reselling them comes with significant risks and capital demands. But what if there was a more efficient way to leverage foreclosure opportunities while minimizing risk and maximizing returns?

Enter the Home Equity Invoice Agreement (HEIA), an innovative financing structure developed by WealthTradie that's revolutionizing how investors approach foreclosure properties. This breakthrough solution allows investors to convert a contractor's monetary invoice into an equity percentage of a property, unlocking value without the need for significant capital investment.

Understanding Home Equity Invoice Agreements

At its core, a HEIA converts a contractor's monetary invoice into a property's equivalent equity percentage. This allows all parties to pay for renovations with the after-repair equity value instead of cash. Unlike traditional financing options such as HELOCs or hard money loans, a HEIA functions as a joint venture deed of trust or novation agreement that gives contractors an equity stake in the property rather than just cash payment.

"A HEIA is a joint venture deed of trust or in essence a novation agreement that allows a contractor's cash invoice to be converted to an equity percentage," explains Shane Walsh, founder of WealthTradie. "The traditional route of HELOCs, hard money, or high-taxed cash transactions is avoided, and the savings of 3-30% is now passed on to the homeowner, contractor, or HEIA liaison at their control instead of a third-party bank or lender's control."

This proprietary protected contract and structure is fundamentally changing how renovation costs are handled in real estate transactions, especially for properties in or approaching foreclosure.

Step-by-Step Implementation During Foreclosure Periods

Implementing a HEIA during a foreclosure redemption period follows a specific process:

1. Identify the opportunity: Target properties that are facing foreclosure, in a redemption period, or owned by homeowners needing to downsize but requiring repairs before selling.

2. Connect the parties: A HEIA Liaison (typically a real estate investor, agent, wholesaler, or general contractor) connects the homeowner with a contractor willing to postpone payment until the renovated property sells.

3. Create the estimate: The contractor provides a detailed estimate breaking down hard costs and business costs.

4. Convert to equity percentage: The liaison helps convert these monetary figures into an equivalent equity percentage based on the property's projected after-repair value, using licensed professionals' assessments.

5. Document and record: The HEIA is signed and officially recorded, securing everyone's profits with both deed and material lien security.

6. Complete renovations: The contractor performs the agreed-upon work.

7. Sell the property: The renovated property is sold at full market value before the foreclosure or redemption period expires.

Even if the property completes the foreclosure process, the HEIA's dual protection mechanism ensures that contractors and liaisons recover at minimum the hard costs of the value added to the property when it transfers to a new owner.

The Dual Protection Mechanism

What makes HEIAs particularly powerful is their dual-layer security system that protects all parties' investments without requiring full property ownership. This mechanism consists of two key components:

Deed Position: Recorded Equity Security

HEIA participants record their equity position through a notarized and recorded instrument, such as a Deed of Trust, Performance Deed, or Equity Agreement Lien (depending on the state). This puts the contractor or HEIA Liaison in an official position on title, subordinate only to existing primary liens like mortgages.

In the event of a foreclosure, this recorded position:

• Gives notice to all parties (lenders, buyers, title companies) that an equity claim exists

• Creates a right to be paid out through a reconveyance or lien release process

• Protects the contractor's or liaison's share of post-improvement equity

Material Lien Rights: Value-Backed Legal Leverage

Separate from the deed, the HEIA relies on material invoice documentation that provides:

• A legally enforceable record of labor and materials contributed

• A foundation for a Mechanic's Lien or Materialman's Lien

• An indisputable record that improvements added real, appraised value

This gives HEIA participants another layer of protection: even if the deed position is challenged, the value created through services remains protected by lien law.

The combination of these two security mechanisms allows participants to avoid full property ownership while still securing their portion of created equity, receive payment before homeowner profits (even in a forced sale), and operate within standard property law protections.

Real Numbers: How HEIAs Work in Practice

To understand the financial benefits of HEIAs, consider this practical example:

A property with a full market value of $1,000,000 needs $100,000 in renovations. The homeowner faces foreclosure proceedings on their first mortgage of $500,000 but cannot afford the necessary repairs.

In a traditional scenario, an investor might offer $550,000 cash, giving the homeowner $50,000 while taking on all renovation costs and risks. The investor would likely use hard money or private capital costing 3-10% of the combined purchase and renovation costs ($650,000).

With a HEIA approach:

1. The investor offers cashless renovations without purchasing the property outright

2. The 3-10% that would normally go to capital providers is redirected to the homeowner or contractor

3. The contractor's $100,000 renovation invoice converts to 10% of the property's $1,000,000 after-repair value

4. The agreement is secured by the HEIA, ensuring all parties receive their fair share only after work completion and property sale

This structure provides additional benefits through potential tax savings, as ordinary income tax can become capital gains tax. Most importantly, homeowners typically receive two to three times the amount they would from traditional cash offers, giving them more resources to move into a new property and avoid future foreclosure situations.

Scaling Your Business with HEIAs

For investors, the HEIA model offers significant advantages for scaling operations:

Reduced capital requirements: Capital needs are minimized or eliminated for the hard costs of property improvements. The contractor doing the work determines these costs, creating built-in self accountability for quality and pricing.

Lower risk profile: Investors don't take full ownership of the property, avoiding the risks associated with purchasing capital, mortgages, and property management responsibilities.

Increased deal flow: With reduced capital requirements and responsibilities, investors can take on more projects simultaneously.

Focus on core competencies: This structure allows investors to concentrate on recognizing opportunities and creating value by facilitating relationships between subject matter experts like contractors and appraisers.

By functioning as HEIA Liaisons, investors can leverage their market knowledge and networking abilities without tying up significant capital in each project.

Avoiding Common Pitfalls

While HEIAs offer numerous advantages, there are potential pitfalls to avoid:

Timing miscalculations: The most common mistake is waiting too long to start renovations. Weather delays, material shortages, or unexpected issues can push timelines beyond foreclosure deadlines.

Communication failures: Ensure all parties clearly understand the scope of work, timeline, and projected sale period. Homeowners must have complete information before agreeing to a HEIA over other options.

Legal oversights: Know your state and county laws regarding foreclosures, liens, and deeds to fully understand security measures and risks. Treat all real estate deadlines as worst-case scenarios and develop contingency plans.

Back-up planning: Always have a refinancing option or potential buyer ready to purchase after renovations to prevent foreclosure from finalizing and potentially compromising everyone's interests.

Material Verification and Quality Assurance

A critical aspect of the HEIA process is ensuring that promised value is actually delivered. This happens through a structured verification process:

1. The scope of work precisely outlines the materials, designs, permits, and other costs needed to add value to the property.

2. To "Perfect" the HEIA equity stake, all parties must sign a completion of work document, confirming the work is actually completed. This protects homeowners from paying for unfinished work.

3. Foreclosure clauses in the HEIA protect contractors and liaisons, guaranteeing at minimum the hard costs of work even if the property sells for less than expected.

4. All parties must agree to the licensed real estate agent's competitive market analysis or licensed appraisal value and risk adjustment before work begins.

The HEIA structure naturally attracts higher-quality contractors willing to postpone payment, as they have skin in the game. This self-accountability reduces risk by aligning financial incentives among all parties, even banks and lenders.

Flexible Equity Structures

Unlike standardized financing options, HEIAs offer remarkable flexibility in equity distribution. The equity percentage allocated to contractors and liaisons varies based on multiple factors:

• The property's condition and foreclosure timeline

• Risk levels and market conditions

• Services provided by each party

• Capital contributions (if any)

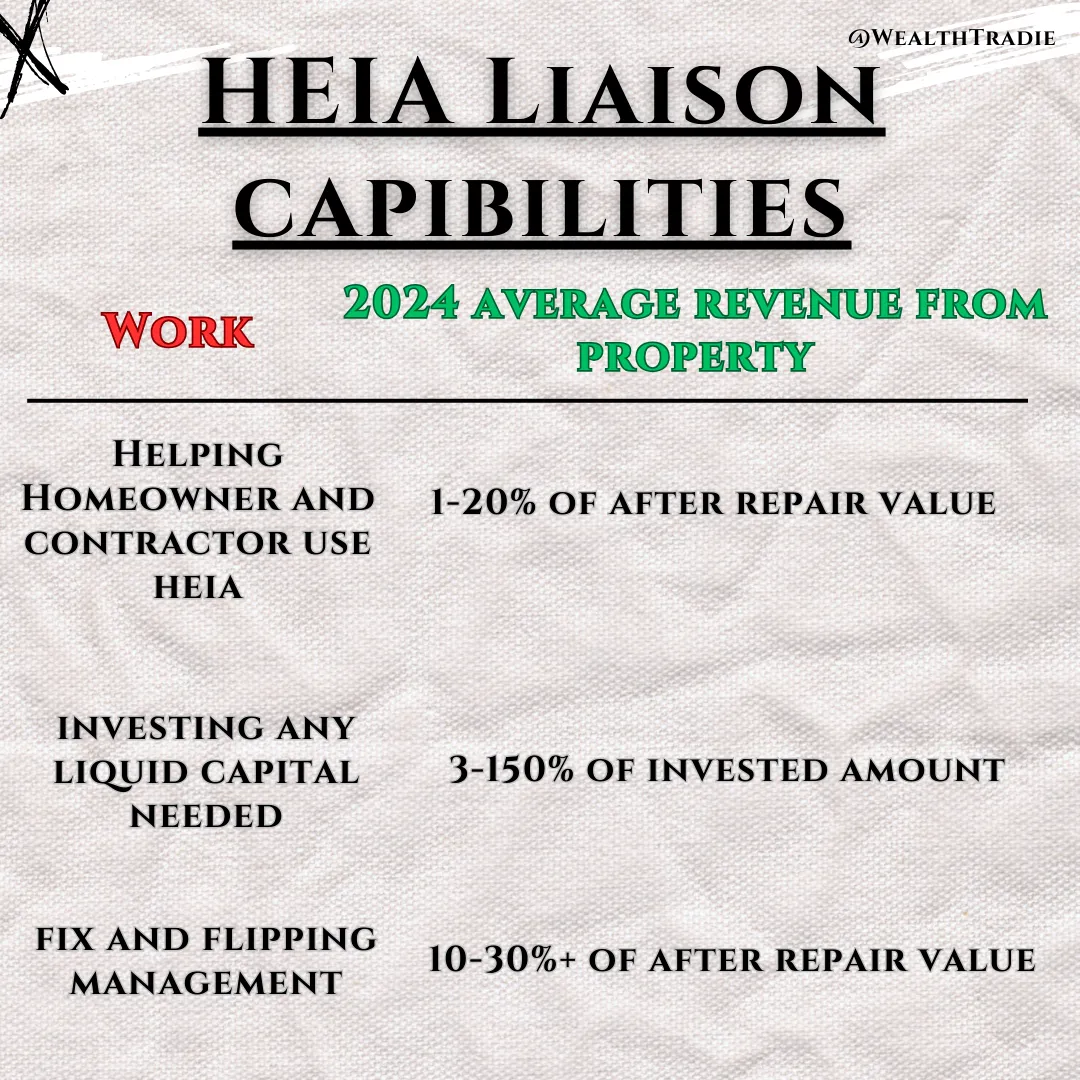

For example, a higher-risk property with less than six months before foreclosure finalization will typically command a higher equity percentage for contractors and liaisons. A liaison simply connecting parties might receive less than 1% of the equity, while one who provides multiple services could earn 10-20%. In development projects, liaisons might take up to 80% of the equity.

The HEIA provides transparency by clearly documenting how equity is allocated based on actual value contribution, making real estate transactions more equitable for all involved.

Advantages Over Other Creative Financing Methods

When compared to other creative financing approaches like subject-to deals or wraparound mortgages, HEIAs offer distinct advantages for foreclosure properties. While subject-to and wraparound mortgages typically require upfront capital to satisfy impending foreclosure obligations, HEIAs can reduce or eliminate this initial capital requirement.

HEIAs also provide faster value capture than the gradual appreciation homeowners must wait for with subject-to deals. Though not as quick as a cash offer, HEIAs typically generate much higher profits for homeowners, contractors, and investors by reducing costs associated with renovations or repairs, transaction, and capital costs. All work that would eventually need to be done regardless of the financing method.

For homeowners facing foreclosure, the HEIA represents a lifeline that traditional financing cannot match with outdated real estate strategies. Instead of walking away with minimal proceeds from a distressed sale, they can capture a significantly larger portion of their property's true market value without needing to qualify for new financing or trust in conventional novation agreements with less accountable contractor and investors.

By implementing Home Equity Invoice Agreements in foreclosure situations, real estate investors can transform their business model, reduce capital requirements, minimize risk, and create win-win scenarios that benefit all parties involved. This innovative approach not only helps individual transactions succeed but enables investors to scale their operations more effectively than traditional fix-and-flip or distressed property investing models ever could. The right path has always been an equitable one in the game.

Ready to Empower Your Students and Build Your Wealth?

Revolutionize Real Estate Coaching with "The Real Game Made Simple"

Simplified Real Estate Strategies

Modernize Your Coaching: Leverage Home Equity Invoice Agreements (HEIA) to transform outdated investing methods like wholesaling, fix-and-flips, and traditional rentals into streamlined, equity-backed solutions.Boost Student Success: Provide your students with a risk-reducing, actionable framework that accelerates deal execution and ensures results.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

Follow us on Youtube

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

Are HEIA contracts better than traditional real estate strategies like wholesaling and flipping?

Yes! HEIA contracts simplify real estate investing by replacing cash-heavy models with equity-backed solutions. They reduce risks, streamline processes, and align contractor interests with property success, making them far more efficient than traditional strategies.

How does the HEIA Liaison License benefit my coaching business?

The HEIA Liaison License allows you to offer your students access to innovative equity-backed contracts, simplifying their path to success. You’ll earn revenue from deals executed through your license and build credibility as a coach with tangible results.

How can HEIA help my students fund deals without upfront capital?

HEIA leverages after repair property equity to pay contractors, removing the need for cash-based financing. This makes it easier for students to secure properties and close deals, even if they lack significant capital for acquisitions.

What kind of revenue can I generate with the HEIA Liaison License?

You earn equity returns on every deal executed through your license and 100% of revenue from any WealthTradie memberships your students purchase. It’s a powerful dual-income stream for your business to retain or let student do it themselves.

Does HEIA address common student challenges like financing and contractor accountability?

Absolutely! HEIA eliminates complex financing hurdles by funding hard costs through equity directly and ensures contractor self accountability by tying their compensation to the property’s value.

How does HEIA simplify my coaching sessions?

With HEIA, you can use ready-made templates, pro training, and frameworks to guide your students through deals. It reduces the need for in-depth training on outdated strategies, saving time while delivering impactful results without so much marketing skills.

Is the HEIA system scalable for both my business and my students?

Yes! HEIA allows you to grow your portfolio while helping your students succeed. Its equity-based model is scalable across multiple deals, making it a win-win for everyone involved. Bringing real estate scaling back to real estate instead of education fund models.

How does the HEIA Liaison License position me as a leader in the real estate industry?

By offering your students a cutting-edge system that simplifies real estate investing, you’ll stand out as a forward-thinking coach who delivers results and builds wealth for your clients and yourself.

What makes HEIA contracts less risky than traditional investing methods?

HEIA focuses on only funding tangible hard costs like labor and materials if the contractor does not, reducing reliance on cash-heavy deals with high acquisition costs. This eliminates unnecessary risks and ties investments directly to the property’s hard value.

How do I get started with the HEIA Liaison License?

It’s easy! Join the WealthTradie Master Membership to purchase your HEIA Liaison License, and start transforming your coaching business and your students’ success today!

30 Day No-Questions Money Back Guarantee

Copyright 2025 | WealthTradie™ | Privacy Policy | Terms & Conditions