The Master strategy for Fix and Flippers

Maximize Your ROI with the HEIA Liaison License for Flippers

Transform your real estate fix and flipping business with the HEIA Liaison License. Unlock equity-based financing, reduce upfront costs, and ensure higher returns for every property you flip. Join the growing network of innovative flippers revolutionizing the game with Home Equity Invoice Agreements.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

MOST Flippers ARe STRUGGLING WITH capital

Why Fix-and-Flippers Choose the HEIA Liaison License

Boost Your Bottom Line

With HEIA (Home Equity Invoice Agreements), you can leverage a property’s equity to purchase property and finance renovations without relying on cash or high-interest loans. Protect your capital and reduce financial exposure while maximizing your profits.

Flip More Properties, Faster

Access equity-based financing for multiple projects simultaneously.

Reduce delays caused by cash flow constraints or traditional hard money financing issues.

Streamline deals and close projects faster with equity backed solutions for homeowners and contractors.

Minimize Your Financial Risk

By tying contractor payments to the property’s equity, HEIA aligns everyone’s interests, ensuring high-quality work that maximizes the property’s market value. When the property appreciates, so does your profit.

Step-by-Step List:

How HEIA Works for Fix-and-Flippers

Secure Properties with Potential

Target homes with untapped equity and potential for significant appreciation.

Use HEIA to Fund Renovations

Turn renovation costs into an equity agreement, reducing upfront construction cash needed with no purchasing capital needed.

Sell the Property and Reap the Rewards

When the property sells, both you and the contractor benefit from it's appreciation, ensuring a win-win outcome.

Revolutionizing the way fix-and-flippers fund and grow their businesses without the stranglehold of lenders and liquid capital.

INTRODUCING:

Key Benefits of the HEIA Liaison License

Increase ROI on Every Flip

Lower upfront and total costs to improve margins.

Align everyone’s goals with equity-based payouts, leading to better results and higher sale prices.

Ensure High-Quality Work

HEIA ties contractor payments to the home’s final value, ensuring quality and accountability throughout the project. No more chasing contractors or compromising on craftsmanship on a liquid budget.

Scale Your Business with Ease

Take on more projects without the capital stress.

Leverage equity to fund renovations across multiple properties at once with no liquid capital.

Don’t let capital constraints or unreliable contractors slow you down. With a HEIA Liaison License, you’ll scale your flipping business, ensure top-quality renovations, and maximize leverage.

Start building smarter today!

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold You Back

Transform Your Fix-and-Flip Game with a

HEIA Liaison License

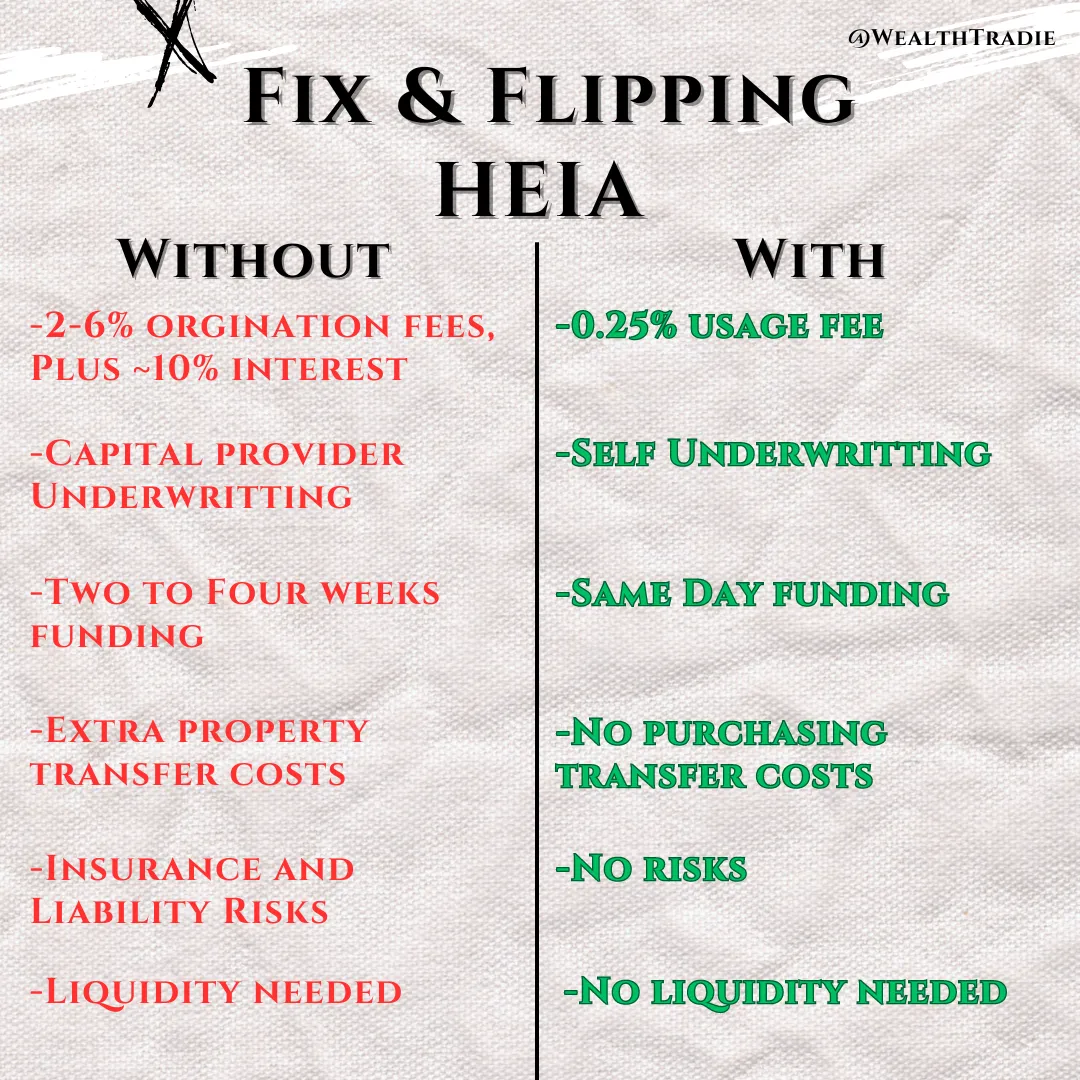

Before / Old Way

Frustration with Funding Delays: Endless paperwork, slow approvals, and missed opportunities because of lender red tape.

Contractor Quality Concerns: Fear of shaddy workmanship or contractors abandoning projects.

Costly Bank Fees and Interest: Paying more to lenders eats into your profits and slows your scaling potential.

Limited Scalability: Dependence on lender timelines and cash flow issues limit the number of projects you can tackle.

Fear of Risk: Worrying about making a bad investment or losing money due to unreliable financing or contractors.

After / New Way

Fast, Flexible Financing: Acquire properties immediately and fund renovations using direct equity, not cash or loans.

Self-Accountable Contractors: tie contractor payouts to property value, ensuring high-quality work.

Lower Costs, Higher Profits: Eliminate traditional lending fees and maximize your profit margin.

Uncapped Growth: Take on more flips simultaneously without waiting on capital or juggling liquidity issues.

Confidence and Control: With HEIA, you have a clear, performance-driven structure to ensure success and scalability.

30 Day No-Questions Money Back Guarantee

Introducing:

WealthTradie Master:

HEIA Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Unparalleled Tools for Scaling Like a Pro

With WealthTradie’s Apprentice Membership, you gain exclusive access to premium resources: advanced calculators, property valuation tools, and comprehensive market analysis guides. Plus, enjoy priority support and insider updates on the latest trends and opportunities in real estate.

Bonus 2: Pro Membership

Master the Game of Real Estate Wealth

Gain insider knowledge and hands-on training from seasoned experts with the WealthTradie Apprenticeship. This program takes you step by step through proven strategies to scale your fix-and-flip business, master HEIAs, and create sustainable wealth. Learn everything from deal sourcing and negotiation to maximizing profits with equity-based agreements.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Scale

Unlock the ultimate side income opportunity with WealthTradie’s Affiliate Membership. With 100% revenue share, you’ll keep all the profits from referring other fix-and-flippers or real estate professionals to HEIA and WealthTradie memberships. Turn your network into a profit machine while helping others break free from traditional lending.

30 Day No-Questions Money Back Guarantee

Revolutionary

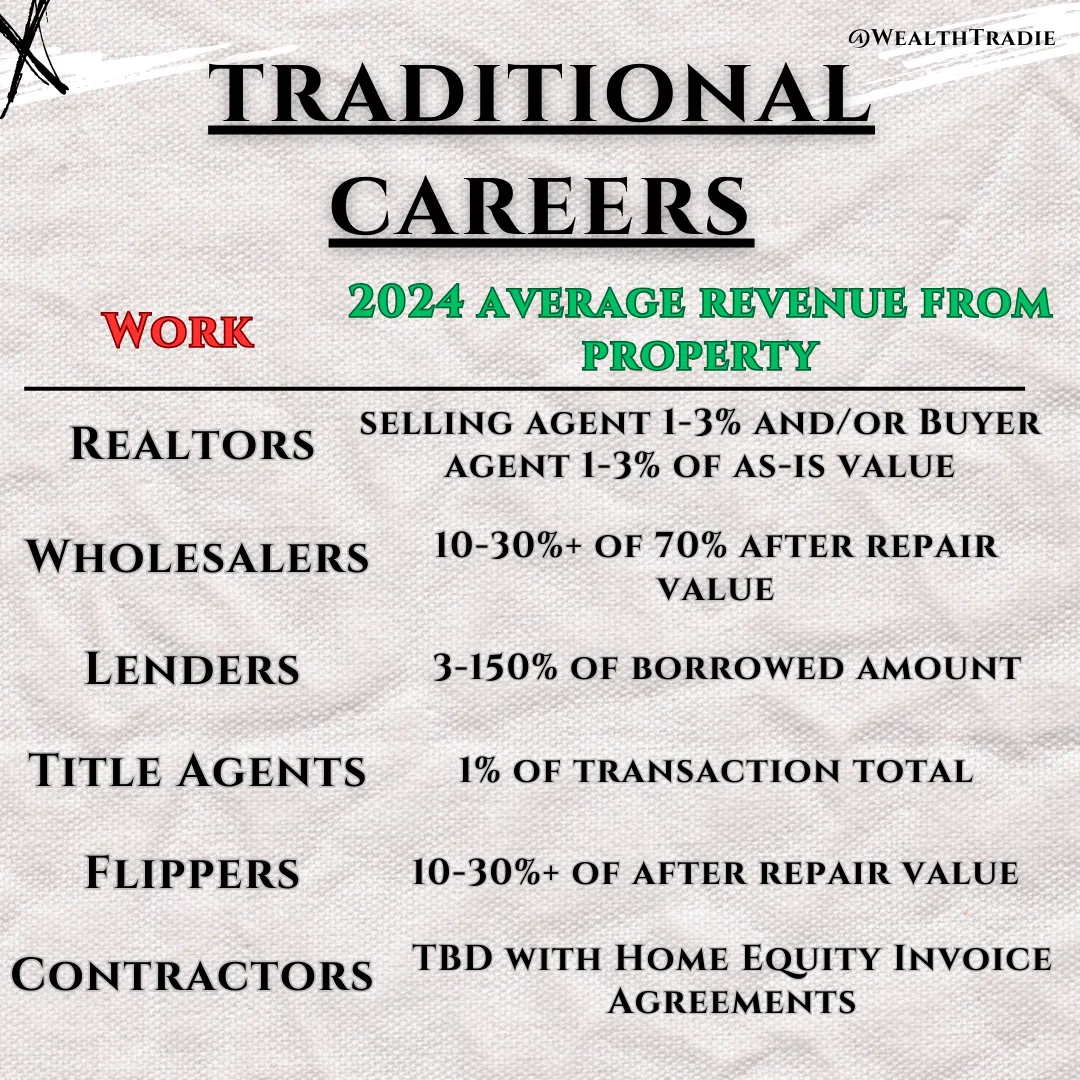

How others are utilizing HEIAs

Business Acquisition Managers Unlock Hidden Real Estate Wealth

Business acquisition managers have found a new frontier. While traditionally focused on optimizing and flipping entire companies, these strategic minds are now turning their attention to a revolutionary approach in real estate and the construction industry: Home Equity Invoice Agreements (HEIAs).

The shift represents more than just a new investment vehicle. It signals a fundamental restructuring of how construction businesses can transform standard payments into lasting wealth through property equity.

This evolution comes at a critical time for both the construction industry and acquisition specialists seeking diversification beyond traditional business purchases.

The HEIA Revolution

Home Equity Invoice Agreements allow construction businesses to convert standard monetary invoices into equity percentages in properties. The concept is elegantly simple yet profound in its implications.

Rather than contractors accepting ordinary cash payments that face heavy taxation, they can now acquire portions of equity in the very properties they improve. This approach creates a win-win scenario: homeowners conserve cash while contractors build wealth through appreciating assets.

Business acquisition managers are discovering these agreements create opportunities 80% easier than conventional methods, providing a revolutionary alternative to traditional construction business purchases.

The mechanics work like this: A contractor starts renovation work on a property. Instead of receiving full payment in cash, they accept a percentage of the property's equity equivalent to their invoice value. As the property appreciates, so does the value of their equity stake. They can even still be distrubuted cash payments based on their equities value to still save on tax's while accepting near the same amount of cash upfront.

For acquisition managers, this presents a unique opportunity to help construction businesses implement a system that dramatically increases their long-term wealth potential and yearly profit.

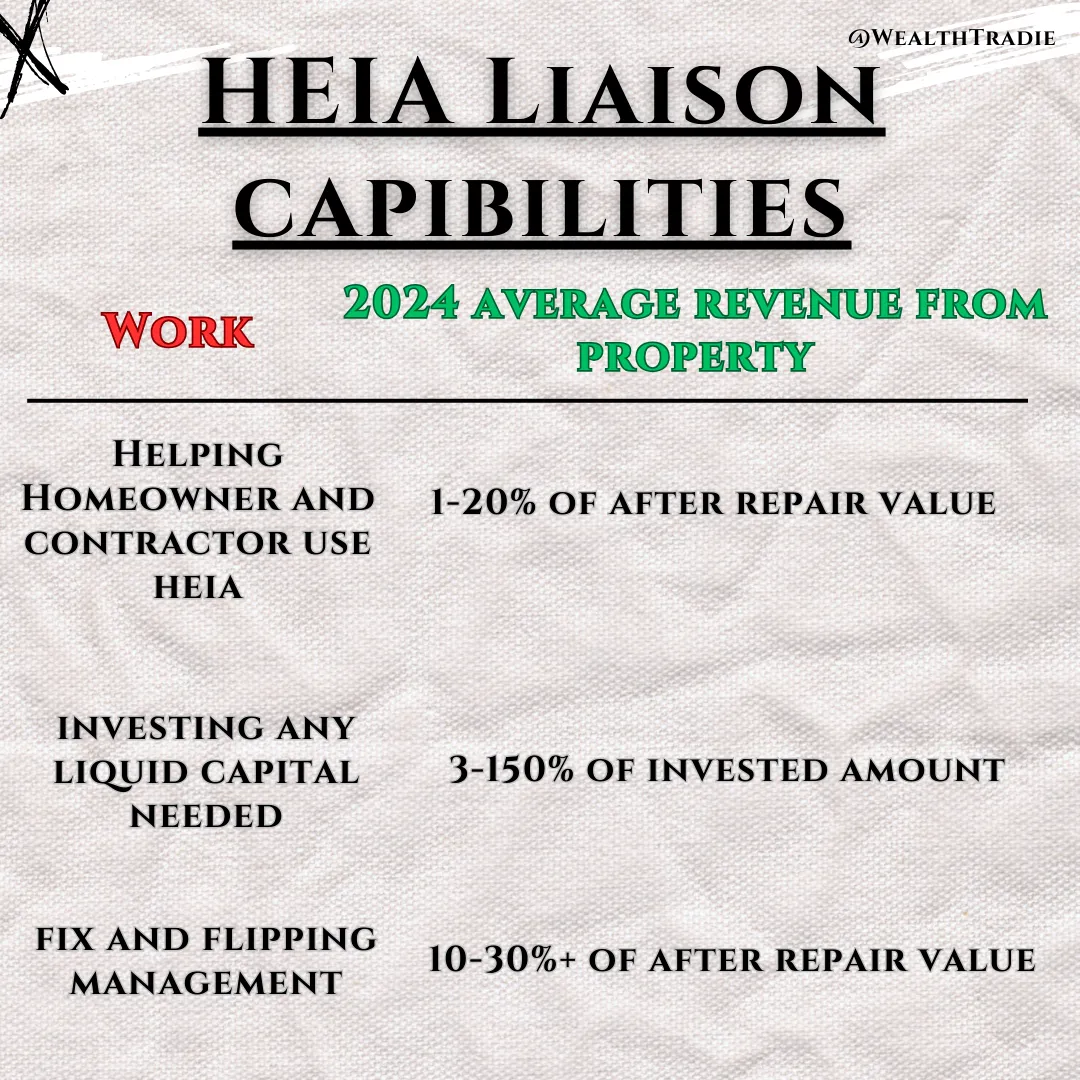

Why Acquisition Managers Are Taking Notice

The appeal for business acquisition managers is multifaceted. First, construction businesses with HEIA capabilities become more valuable acquisition targets due to their diversified revenue streams and equity holdings in actual real estate already.

Second, acquisition managers themselves can participate directly in the real estate market through HEIA liaison licenses, which enable them to connect contractors and homeowners while taking a percentage of the resulting equity arrangements.

This creates a powerful new business model. Acquisition managers can build portfolios of fractional real estate holdings without the capital requirements of traditional property investment or additional liabilities of a construction business.

The tax advantages are equally compelling. By accepting equity instead of cash, contractors can defer tax liabilities until equity positions are liquidated, potentially at more favorable capital gains rates rather than ordinary income tax rates.

Transforming Construction Business Models

For acquisition managers specializing in construction businesses, HEIAs represent a transformative optimization strategy. Implementing these agreements can dramatically improve a construction company's financial profile.

Traditional construction businesses operate on high margins with significant cash flow costs. When acquisition managers introduce HEIAs, they create a pathway to building a real estate portfolio alongside the core construction business.

This dual-revenue model significantly increases business valuation multiples. A construction business with substantial equity holdings becomes more resilient to market fluctuations and more attractive to potential buyers.

The implementation process typically follows three phases:

First, acquisition managers help construction businesses structure appropriate HEIA operational frameworks. Next, they develop systems for evaluating which projects are suitable for equity conversion versus cash payment. Finally, they create portfolio management processes to track and eventually monetize equity positions.

Market Adoption and Growth Trajectory

The HEIA model is gaining traction rapidly across multiple segments of the real estate and construction industry. While initially embraced by renovation contractors, the approach is now spreading to new construction, property management, and real estate development.

HEIAs offer a groundbreaking equity-based solution designed to combat predatory lending practices in real estate, allowing contractors, business managers, and investors to convert standard monetary construction invoices into equity percentages without needing traditional loans or high-interest rates controled by third party banks and lenders.

Business acquisition managers are particularly well-positioned to accelerate this adoption curve. Their expertise in optimizing business models and identifying strategic opportunities makes them natural evangelists for the HEIA approach.

The market potential is substantial. With approximately 3.7 million construction businesses in the United States alone, the opportunity to transform even a fraction of these operations through HEIAs represents billions in potential equity value for everyone to share.

Implementation Challenges and Solutions

Despite the compelling advantages, implementing HEIAs isn't without challenges. Acquisition managers must navigate several key hurdles when introducing these agreements to construction businesses.

Valuation methodology stands as the primary challenge. Determining the fair equity percentage for a given invoice amount requires sophisticated understanding of both construction costs and real estate valuation principles.

Legal documentation represents another significant hurdle. HEIA agreements must be carefully structured to protect all parties while complying with relevant securities regulations and real estate laws. Public recording procedures are needed to be known or hired out to a title company.

Finally, portfolio management processes must be established. Construction businesses accustomed to simple cash transactions need systems for tracking, managing, and eventually monetizing diverse equity holdings apprciating .

Acquisition managers add tremendous value by bringing solutions to each of these challenges. Their experience with complex business transactions and optimization strategies positions them perfectly to implement HEIAs into construction business's.

The Future Landscape

As HEIAs continue gaining adoption, several trends are emerging that will shape the future landscape for business acquisition managers in the home service business.

First, specialized acquisition firms focusing exclusively on HEIA-enabled construction businesses are beginning to form. These firms recognize the unique value proposition and are developing expertise specifically for this market segment.

Second, technology platforms facilitating HEIA transactions are emerging. These platforms streamline documentation, valuation, and portfolio management, making implementation significantly easier for acquisition managers and construction businesses alike that use electronic signatures.

Third, financial institutions are starting to recognize HEIAs as legitimate assets against which construction businesses can borrow from HEIA Liaison's. This creates additional leverage opportunities for acquisition managers to optimize liquid capital structures too.

For forward-thinking acquisition managers, the opportunity is clear: by helping construction businesses implement HEIAs, they can simultaneously increase business valuations and create new revenue streams through equity participation in real estate wealth.

Taking Action

Business acquisition managers interested in exploring the HEIA opportunity should begin by thoroughly understanding the legal and financial frameworks involved. This includes studying successful implementation benefits and connecting with organizations specializing in these agreements.

The next step involves identifying construction businesses that would benefit most from HEIA implementation. Ideal candidates include established operations with strong reputations for quality work but struggling with cash flow or growth limitations.

Finally, acquisition managers should develop systematic implementation approaches that can be replicated across multiple construction businesses, creating scalable value-add strategies.

The construction industry has long been characterized by thin margins and limited wealth-building opportunities. Through HEIAs, business acquisition managers now have a powerful tool to transform this dynamic, creating substantial value for themselves and the construction businesses they serve.

The revolution in construction wealth building has begun. Business acquisition managers who recognize this opportunity early stand to benefit tremendously as the approach gains wider market adoption.

Master the Strategies That Turn Fix-and-Flip Projects into Real Estate Wealth

"The Real Game Made Simple"

–Your Beginning to Fix and Flip Wealth

it’s your ultimate guide to scaling and succeeding in the fix-and-flip business. Packed with actionable insights and strategies, it equips you with the tools to maximize profits, streamline projects, and make smarter decisions in a competitive market.

Why The Real Game Made Simple

is a must-read for fix-and-flippers:

✅ Maximize Your Returns:

Learn how to use Home Equity Invoice Agreements (HEIAs) to reduce upfront capital needs and boost profits on every flip.

✅ Streamline Your Process:

Uncover strategies to manage timelines, contractors, and budgets with precision.

✅ Build Long-Term Wealth:

Go beyond flipping—discover how to align your projects with equity-based strategies for lasting financial success.

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

How does a Home Equity Invoice Agreement (HEIA) work?

HEIA allows Homeowners and HEIA Liaisons to finance renovations by leveraging a property’s equity instead of upfront cash or loans. Contractors are paid through a percentage of the property’s value after the work is completed, aligning their success with the property. This eliminates the need for traditional lenders and their fees, giving you more control and flexibility.

What if the contractor doesn’t deliver high-quality work?

With HEIA, contractors are held accountable because their payout is tied to the property’s value. The better the work, the higher the property’s value—and their earnings. This built-in motivation ensures quality work and on-time project completion within the time period specified, or loose out on entire equity on HEIA.

Is HEIA only for experienced fix-and-flippers?

Not at all! Whether you’re just starting or already scaling your business, HEIA provides a straightforward solution to fund and execute projects without relying on banks or lenders. Plus, our WealthTradie Apprenticeship bonus equips beginners with all the tools they need to succeed.

What if the property value doesn’t increase as expected?

HEIA accounts for market fluctuations through a risk reduction rate agreed upon upfront. This safeguards both Homeowner and the Contractor, ensuring a fair equity exchange based on realistic property and market conditions.

How do I know this is the right choice for me?

If you’re tired of lender delays, high costs, and limited scalability, HEIA is the perfect solution. It provides fast, flexible funding, ensures quality work, and reduces overall project costs, making it ideal for anyone in the fix-and-flip industry.

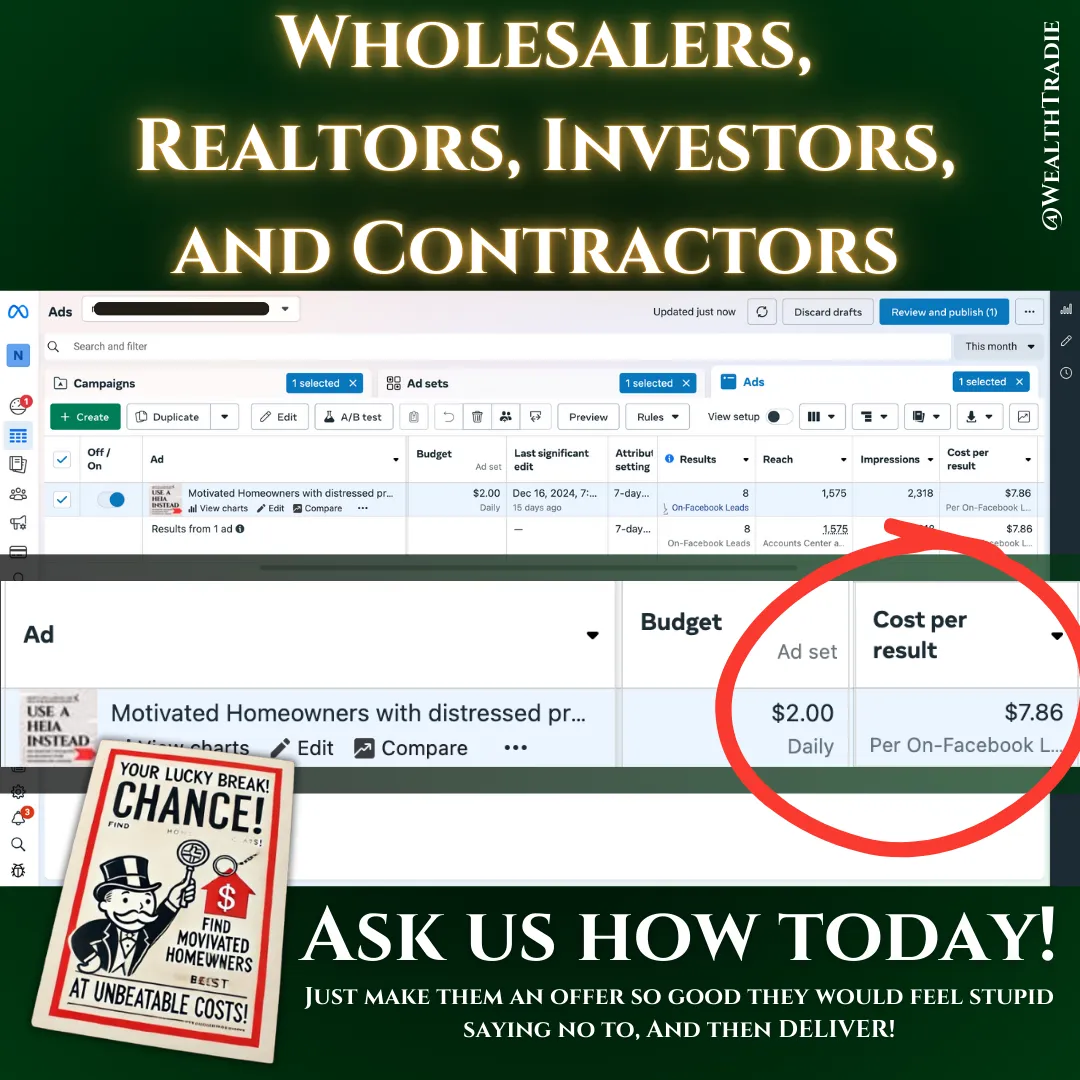

What kind of support do I get after becoming a HEIA Liaison?

You’ll have access to our Pro Membership training, priority support, and detailed resources that guide you through every step of using HEIA effectively. Plus, our community of WealthTradie professionals is always available to help with questions or challenges. WealthTradie push's their Homeowner leads directly to the nearest Liaison to the property. Providing you with free homeowner leads

Is there a guarantee?

Yes! We stand behind the value of HEIA and the WealthTradie system with a satisfaction guarantee. If you don’t see how HEIA can transform your business, let us know within 30 days for a full refund.

How can I make additional income with this program?

Through our 100% Revenue Share Affiliate Membership, you can earn uncapped income by referring others to HEIA and WealthTradie memberships. It’s a great way to generate extra revenue while helping others break free from traditional lending. This allows you to still scale using the previously most available scaling model in the real estate industry, Education.

Do I need a HEIA Liaison License to use a HEIA?

If you already are a Homeowner or Contractor, you do not need to have a HEIA Liaison License to use a HEIA. A Liaison is optional to use weather a contractor or homeowner need assistance in their real estate project.

Do I need a real estate license?

No, you don’t need a real estate license to be a HEIA Liaison. Unlike traditional real estate transactions, HEIA is structured as a joint venture agreement, not a real estate sales contract. As a Liaison, your role is to facilitate equity-based agreements between homeowners and contractors, aligning their interests for mutual benefit. This falls outside the scope of activities that require a real estate license, making it a unique and powerful tool for anyone looking to work in real estate without the licensing hurdles.

If you do, or have ever had a real estate license, we offer a 50% DISCOUNT ON A HEIA LIAISON LICENSE.

Can HEIA help me scale my flipping business?

Yes! With equity-based financing, you can take on more projects simultaneously, growing your portfolio and profits.

30 Day No-Questions Money Back Guarantee

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

Copyright 2025 | WealthTradie™ | Privacy Policy | Terms & Conditions