The Master strategy for Fix and Flippers

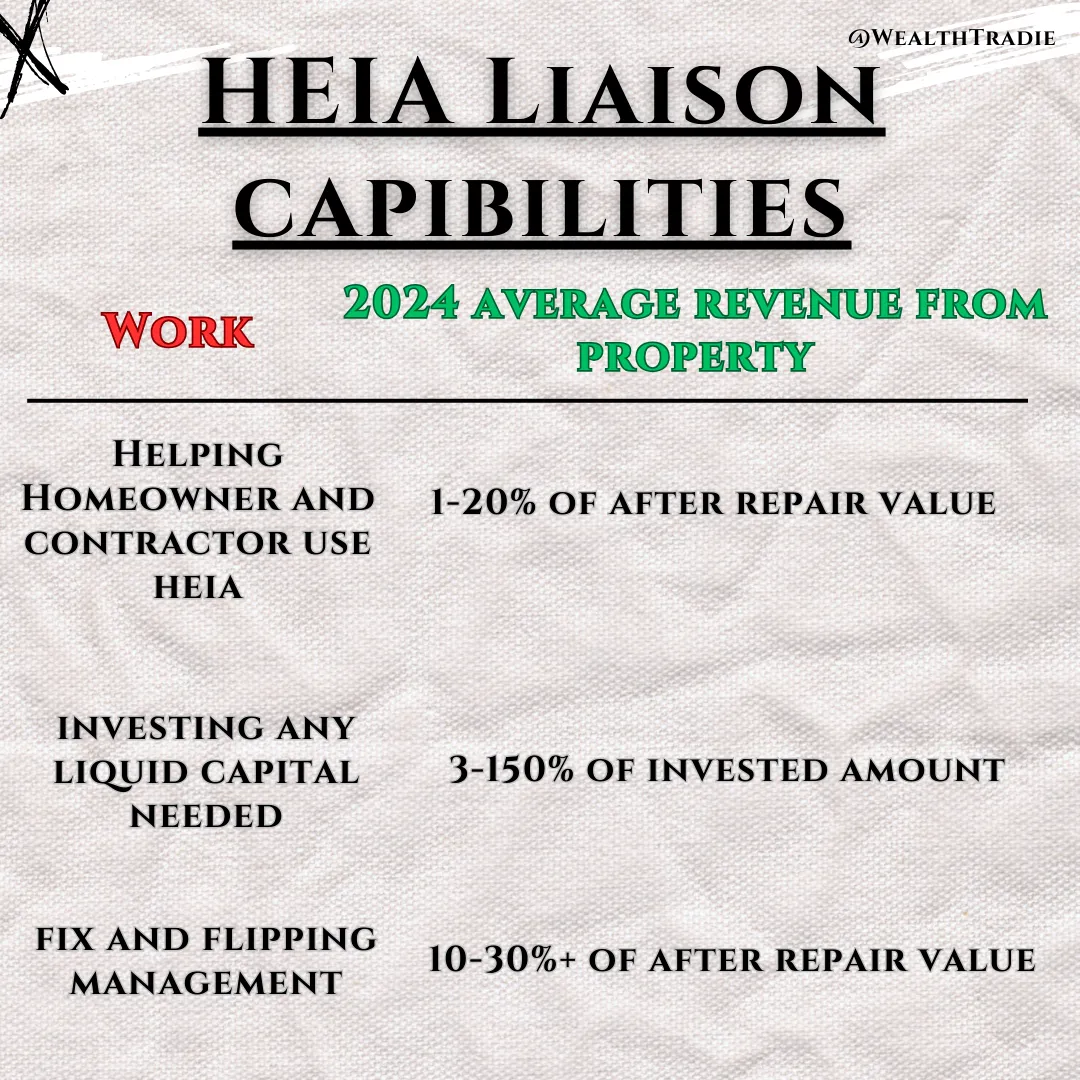

Maximize Your ROI with the HEIA Liaison License for Flippers

Transform your real estate fix and flipping business with the HEIA Liaison License. Unlock equity-based financing, reduce upfront costs, and ensure higher returns for every property you flip. Join the growing network of innovative flippers revolutionizing the game with Home Equity Invoice Agreements.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

MOST Flippers ARe STRUGGLING WITH capital

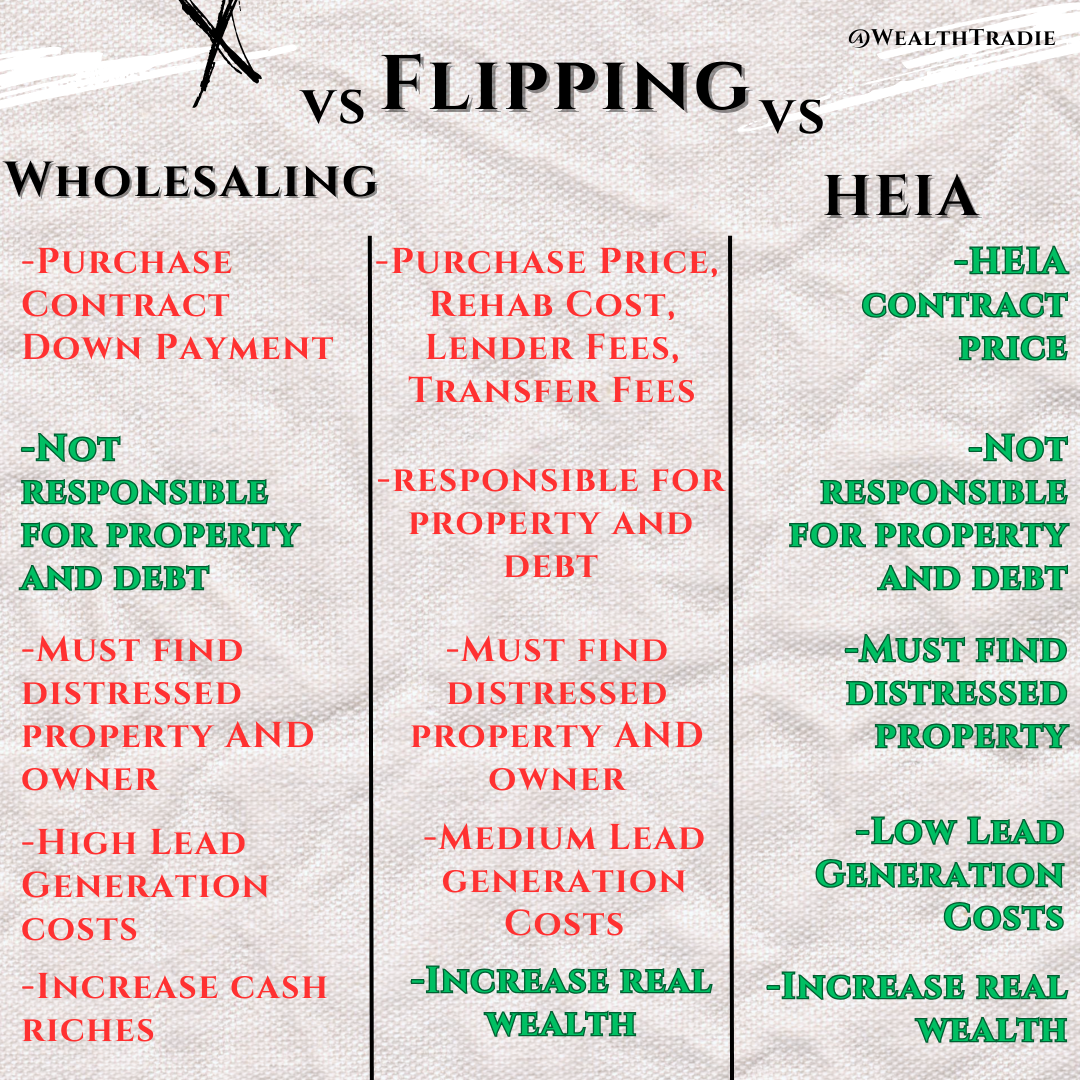

Why Fix-and-Flippers Choose the HEIA Liaison License

Boost Your Bottom Line

With HEIA (Home Equity Invoice Agreements), you can leverage a property’s equity to purchase property and finance renovations without relying on cash or high-interest loans. Protect your capital and reduce financial exposure while maximizing your profits.

Flip More Properties, Faster

Access equity-based financing for multiple projects simultaneously.

Reduce delays caused by cash flow constraints or traditional hard money financing issues.

Streamline deals and close projects faster with equity backed solutions for homeowners and contractors.

Minimize Your Financial Risk

By tying contractor payments to the property’s equity, HEIA aligns everyone’s interests, ensuring high-quality work that maximizes the property’s market value. When the property appreciates, so does your profit.

Step-by-Step List:

How HEIA Works for Fix-and-Flippers

Secure Properties with Potential

Target homes with untapped equity and potential for significant appreciation.

Use HEIA to Fund Renovations

Turn renovation costs into an equity agreement, reducing upfront construction cash needed with no purchasing capital needed.

Sell the Property and Reap the Rewards

When the property sells, both you and the contractor benefit from it's appreciation, ensuring a win-win outcome.

Revolutionizing the way fix-and-flippers fund and grow their businesses without the stranglehold of lenders and liquid capital.

INTRODUCING:

Key Benefits of the HEIA Liaison License

Increase ROI on Every Flip

Lower upfront and total costs to improve margins.

Align everyone’s goals with equity-based payouts, leading to better results and higher sale prices.

Ensure High-Quality Work

HEIA ties contractor payments to the home’s final value, ensuring quality and accountability throughout the project. No more chasing contractors or compromising on craftsmanship on a liquid budget.

Scale Your Business with Ease

Take on more projects without the capital stress.

Leverage equity to fund renovations across multiple properties at once with no liquid capital.

Don’t let capital constraints or unreliable contractors slow you down. With a HEIA Liaison License, you’ll scale your flipping business, ensure top-quality renovations, and maximize leverage.

Start building smarter today!

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold You Back

Transform Your Fix-and-Flip Game with a

HEIA Liaison License

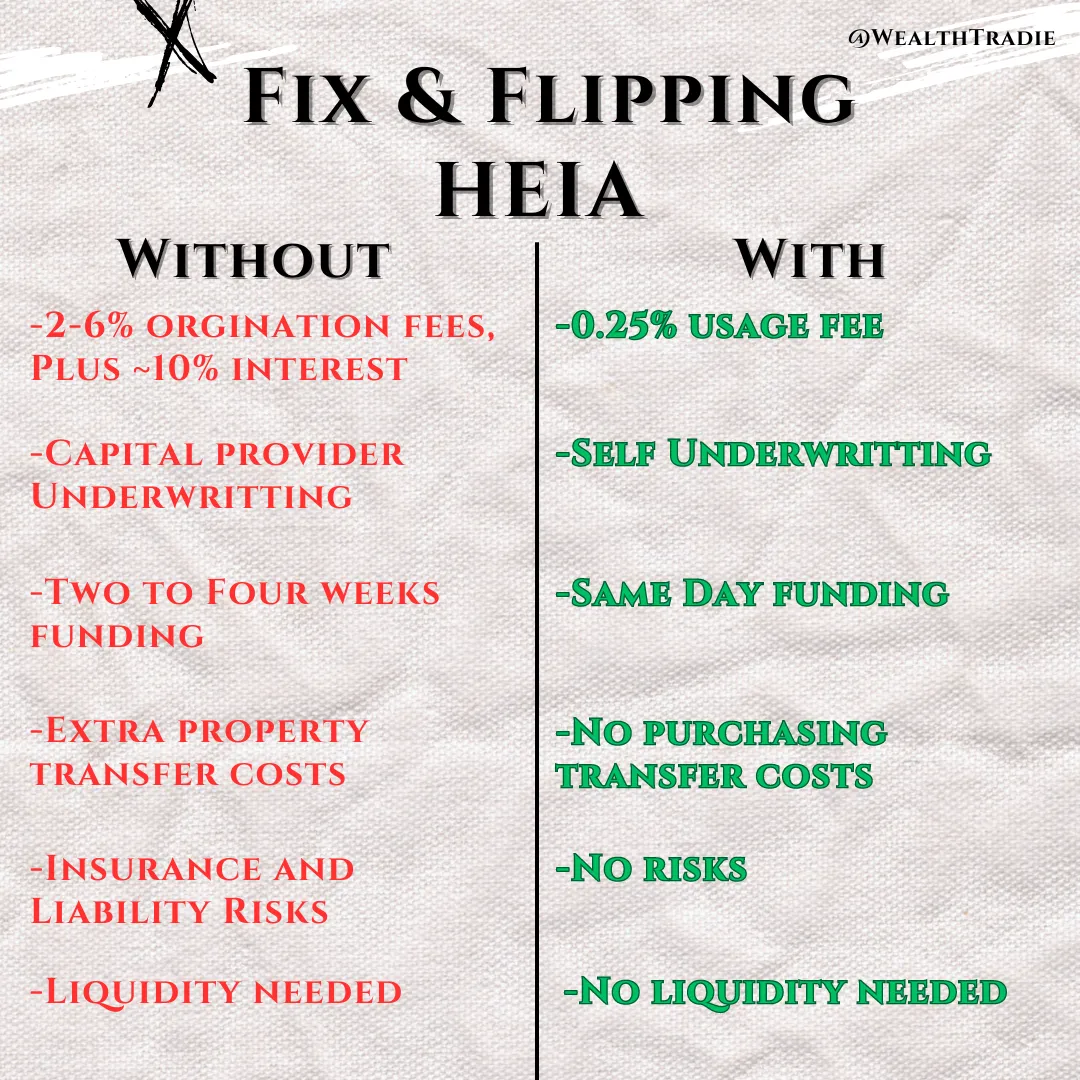

Before / Old Way

Frustration with Funding Delays: Endless paperwork, slow approvals, and missed opportunities because of lender red tape.

Contractor Quality Concerns: Fear of shaddy workmanship or contractors abandoning projects.

Costly Bank Fees and Interest: Paying more to lenders eats into your profits and slows your scaling potential.

Limited Scalability: Dependence on lender timelines and cash flow issues limit the number of projects you can tackle.

Fear of Risk: Worrying about making a bad investment or losing money due to unreliable financing or contractors.

After / New Way

Fast, Flexible Financing: Acquire properties immediately and fund renovations using direct equity, not cash or loans.

Self-Accountable Contractors: tie contractor payouts to property value, ensuring high-quality work.

Lower Costs, Higher Profits: Eliminate traditional lending fees and maximize your profit margin.

Uncapped Growth: Take on more flips simultaneously without waiting on capital or juggling liquidity issues.

Confidence and Control: With HEIA, you have a clear, performance-driven structure to ensure success and scalability.

30 Day No-Questions Money Back Guarantee

Introducing:

WealthTradie Master:

HEIA Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Unparalleled Tools for Scaling Like a Pro

With WealthTradie’s Apprentice Membership, you gain exclusive access to premium resources: advanced calculators, property valuation tools, and comprehensive market analysis guides. Plus, enjoy priority support and insider updates on the latest trends and opportunities in real estate.

Bonus 2: Pro Membership

Master the Game of Real Estate Wealth

Gain insider knowledge and hands-on training from seasoned experts with the WealthTradie Apprenticeship. This program takes you step by step through proven strategies to scale your fix-and-flip business, master HEIAs, and create sustainable wealth. Learn everything from deal sourcing and negotiation to maximizing profits with equity-based agreements.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Scale

Unlock the ultimate side income opportunity with WealthTradie’s Affiliate Membership. With 100% revenue share, you’ll keep all the profits from referring other fix-and-flippers or real estate professionals to HEIA and WealthTradie memberships. Turn your network into a profit machine while helping others break free from traditional lending.

30 Day No-Questions Money Back Guarantee

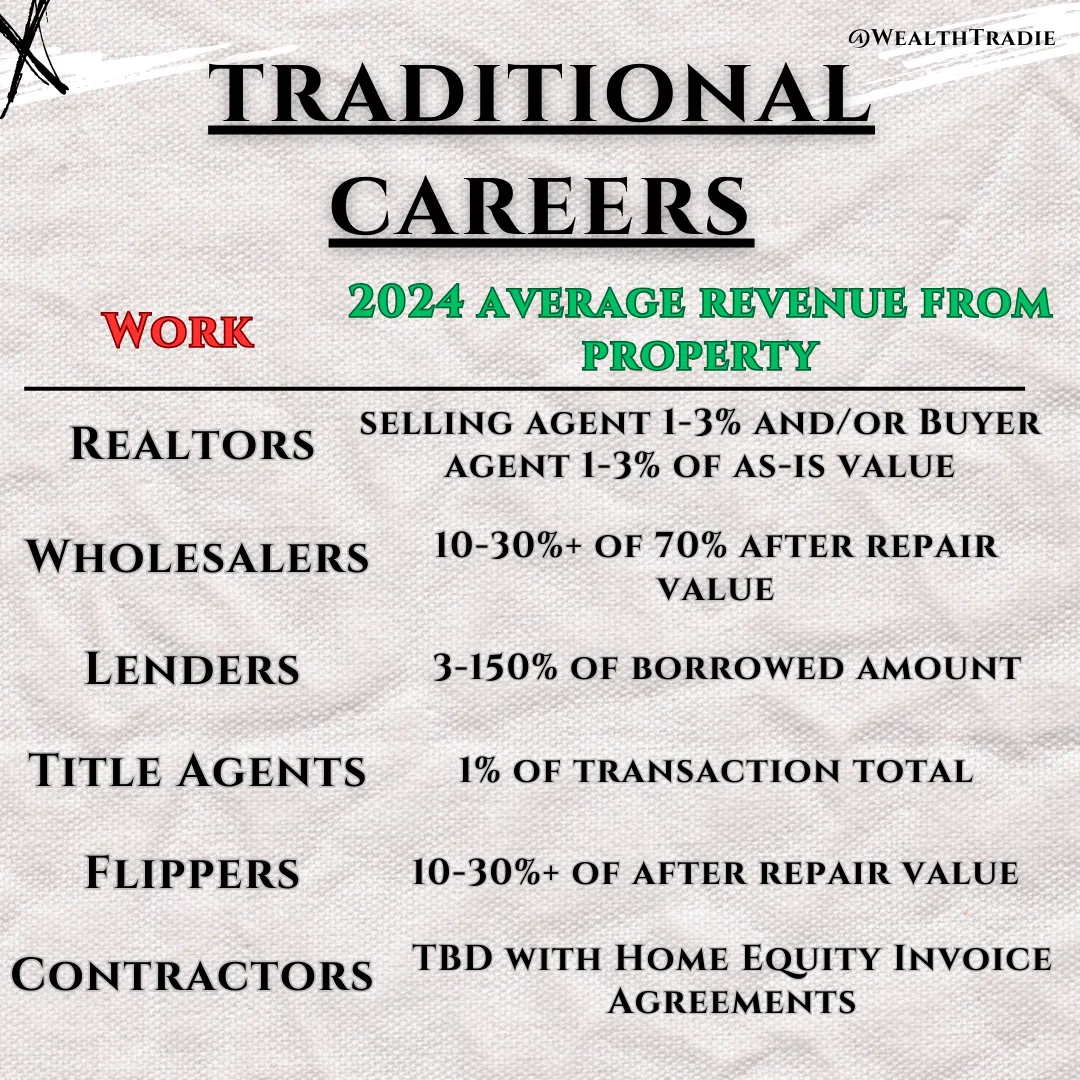

Revolutionary

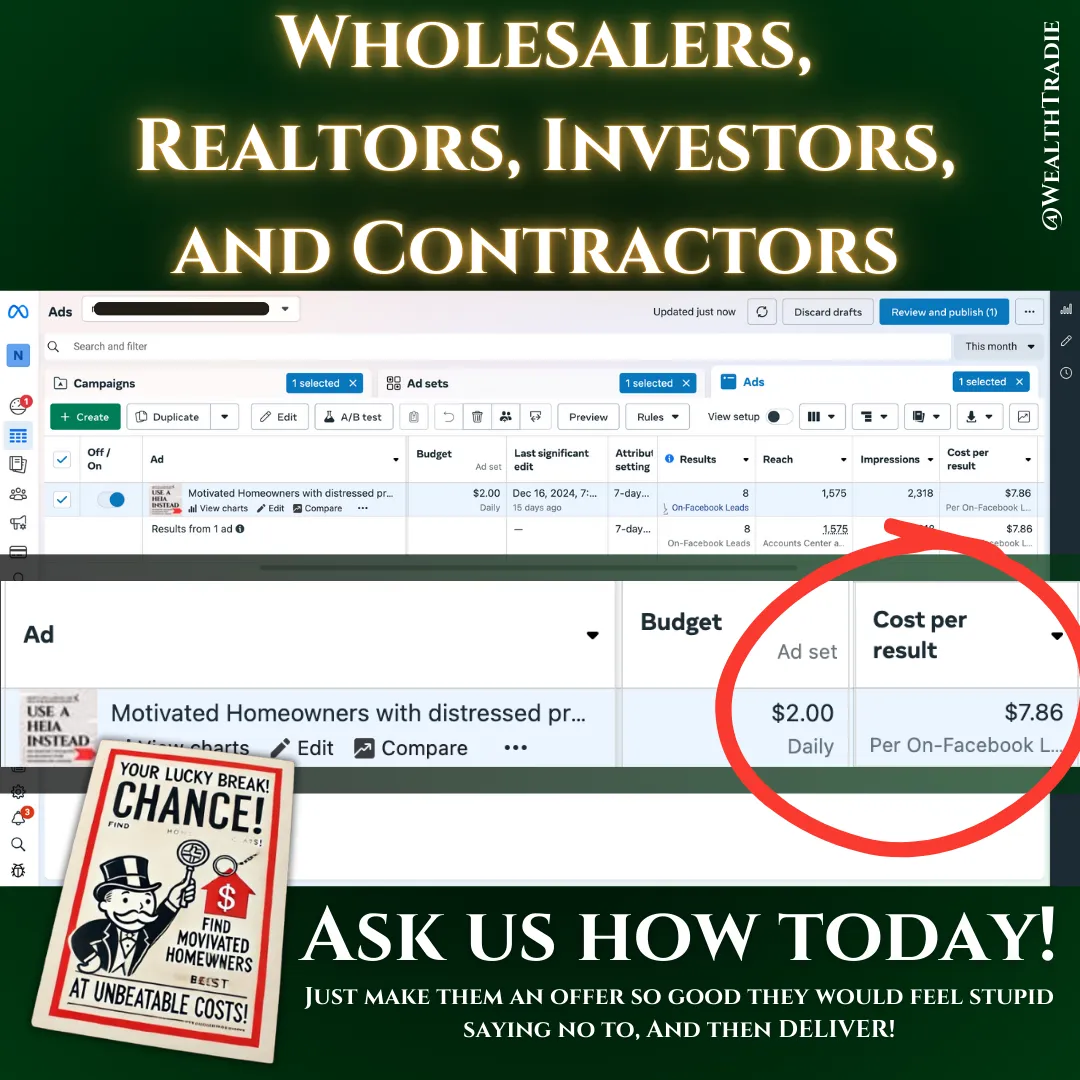

How others are utilizing HEIAs

Master the Strategies That Turn Fix-and-Flip Projects into Real Estate Wealth

"The Real Game Made Simple"

–Your Beginning to Fix and Flip Wealth

it’s your ultimate guide to scaling and succeeding in the fix-and-flip business. Packed with actionable insights and strategies, it equips you with the tools to maximize profits, streamline projects, and make smarter decisions in a competitive market.

Why The Real Game Made Simple

is a must-read for fix-and-flippers:

✅ Maximize Your Returns:

Learn how to use Home Equity Invoice Agreements (HEIAs) to reduce upfront capital needs and boost profits on every flip.

✅ Streamline Your Process:

Uncover strategies to manage timelines, contractors, and budgets with precision.

✅ Build Long-Term Wealth:

Go beyond flipping—discover how to align your projects with equity-based strategies for lasting financial success.

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

How does a Home Equity Invoice Agreement (HEIA) work?

HEIA allows Homeowners and HEIA Liaisons to finance renovations by leveraging a property’s equity instead of upfront cash or loans. Contractors are paid through a percentage of the property’s value after the work is completed, aligning their success with the property. This eliminates the need for traditional lenders and their fees, giving you more control and flexibility.

What if the contractor doesn’t deliver high-quality work?

With HEIA, contractors are held accountable because their payout is tied to the property’s value. The better the work, the higher the property’s value—and their earnings. This built-in motivation ensures quality work and on-time project completion within the time period specified, or loose out on entire equity on HEIA.

Is HEIA only for experienced fix-and-flippers?

Not at all! Whether you’re just starting or already scaling your business, HEIA provides a straightforward solution to fund and execute projects without relying on banks or lenders. Plus, our WealthTradie Apprenticeship bonus equips beginners with all the tools they need to succeed.

What if the property value doesn’t increase as expected?

HEIA accounts for market fluctuations through a risk reduction rate agreed upon upfront. This safeguards both Homeowner and the Contractor, ensuring a fair equity exchange based on realistic property and market conditions.

How do I know this is the right choice for me?

If you’re tired of lender delays, high costs, and limited scalability, HEIA is the perfect solution. It provides fast, flexible funding, ensures quality work, and reduces overall project costs, making it ideal for anyone in the fix-and-flip industry.

What kind of support do I get after becoming a HEIA Liaison?

You’ll have access to our Pro Membership training, priority support, and detailed resources that guide you through every step of using HEIA effectively. Plus, our community of WealthTradie professionals is always available to help with questions or challenges. WealthTradie push's their Homeowner leads directly to the nearest Liaison to the property. Providing you with free homeowner leads

Is there a guarantee?

Yes! We stand behind the value of HEIA and the WealthTradie system with a satisfaction guarantee. If you don’t see how HEIA can transform your business, let us know within 30 days for a full refund.

How can I make additional income with this program?

Through our 100% Revenue Share Affiliate Membership, you can earn uncapped income by referring others to HEIA and WealthTradie memberships. It’s a great way to generate extra revenue while helping others break free from traditional lending. This allows you to still scale using the previously most available scaling model in the real estate industry, Education.

Do I need a HEIA Liaison License to use a HEIA?

If you already are a Homeowner or Contractor, you do not need to have a HEIA Liaison License to use a HEIA. A Liaison is optional to use weather a contractor or homeowner need assistance in their real estate project.

Do I need a real estate license?

No, you don’t need a real estate license to be a HEIA Liaison. Unlike traditional real estate transactions, HEIA is structured as a joint venture agreement, not a real estate sales contract. As a Liaison, your role is to facilitate equity-based agreements between homeowners and contractors, aligning their interests for mutual benefit. This falls outside the scope of activities that require a real estate license, making it a unique and powerful tool for anyone looking to work in real estate without the licensing hurdles.

If you do, or have ever had a real estate license, we offer a 50% DISCOUNT ON A HEIA LIAISON LICENSE.

Can HEIA help me scale my flipping business?

Yes! With equity-based financing, you can take on more projects simultaneously, growing your portfolio and profits.

30 Day No-Questions Money Back Guarantee

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

Copyright 2025 | WealthTradie™ | Privacy Policy | Terms & Conditions