"Turning Hard Money into bullet proof money with proprietary contract structures"

The Master strategy for Lenders

The Power of Home Equity Invoice Agreements (HEIAs) for Lenders

Home Equity Invoice Agreements (HEIAs) are revolutionizing real estate lending by allowing lenders to directly invest in hard costs (materials and labor) rather than speculative property or quality values. This innovative financing model ensures higher security, direct asset-backed investments, and a scalable opportunity to fund more properties than ever before with deed and mechanical lien protection.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

endless construction need liquid capital and lenders now have a safe, secured, and wealthy way to fund real estate equity in the SIMPLEST way; through the construction of it

Why HEIAs Are the Future of Secured Real Estate Lending

🔹More Control– Invest in the real value creation process rather than fluctuating property prices with extra middlemen.

🔹Higher Security– A proprietary performance backed Deed, ensuring your investment is legally protected with double protection of mechanic liens regardless of deed position.

🔹More Deals, Less Risk– Fund multiple projects securely at once instead of locking capital into one high-risk property with less structure protection.

🔹Fast Liquidity– Get repaid faster than traditional real estate investments through higher structure and work quality, allowing for higher reinvestment cycles.

🔹Guaranteed ROI Potential– Partner with

contractors and homeowners who have a direct incentive to complete projects on time and at the highest value for everyone to share equitably.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Change the Game for Lenders

HERE’S HOW IT WORKS

Invest in Tangible Hard Costs

Traditional real estate lending relies on speculative values, exposing capital to market swings. HEIAs secure your investment with direct material and value accountability. protecting your downside while still tying you to the upside of market appreciation.

Secure Investments with Proprietary Deed

Unlike risky loans, HEIAs are secured by recorded equity on the deed. giving you priority repayment and an extra layer of security with direct material lien capabilities over deed positions in certain states

Unlock More Lending Opportunities

Traditional real estate requires large capital per deal. HEIAs let you scale by funding specific improvements across multiple properties, not full purchases with additional risks.

Take control of your real estate investments with a smarter, safer, and more scalable strategy. Become an HEIA Liaison today and start investing in secured, debt-free, equity-based real estate deals!

30 Day No-Questions Money Back Guarantee

Unlock the $36 Trillion Home Equity Market

The Future of Real Estate Financing

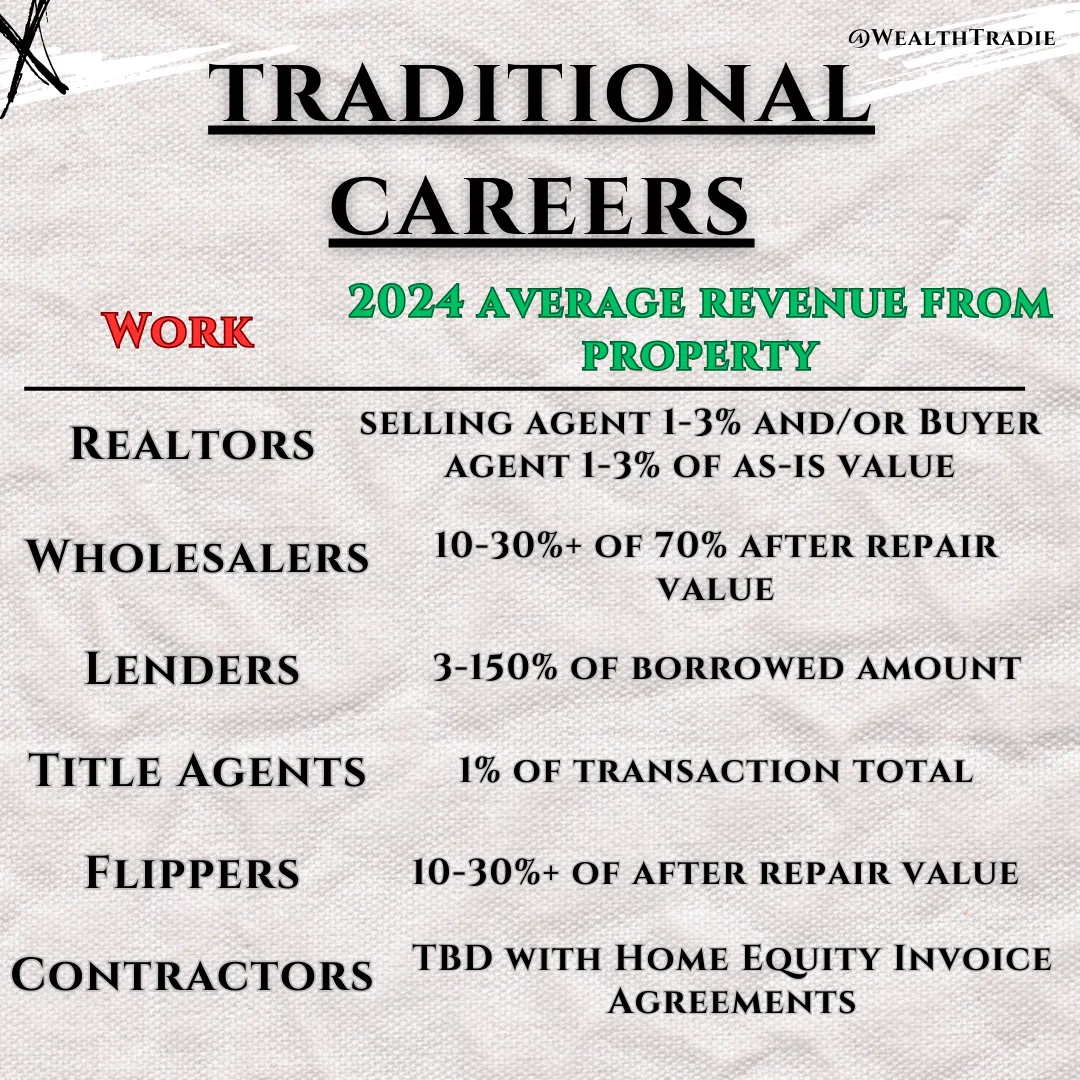

Before / Old Way

Speculative Value: Abstract market purchase values and costs that are subject to change

Relying on borrower: Relying on borrower credit and payments history for returns

limited to large, slow moving deals: Large purchase prices of property with slow moving acquisition processes

Market Fluctuations: Secured with borrower potential for default

Consistent management: Requires Mortgage payments, meaning borrower default can stall returns

After / New Way

Tangible hard costs: Real materials and labour that increases the homes actual value

backed by deed of trust: Dependant on property hard costs and its connected properties full value

fund multiple properties with the same amount: Invest in improvements rather then full purchases to speed up transactions

secured by added value: Secured by property's real improvements

Funds directly to contractor: Funds go directly to contractor with no management

30 Day No-Questions Money Back Guarantee

🔥 Exclusive 50% Discount for Licensed Loan Officers 🔥

Your Loan Officer License Just Became a Key to Unprecedented Wealth

—But Only for a Limited Time!

If you are a licensed Loan Officer, you’re already a trusted expert in your field. Now, WealthTradie invites you to elevate your career with the HEIA Liaison License, exclusively available at 50% off for a limited time.

This is your opportunity to:

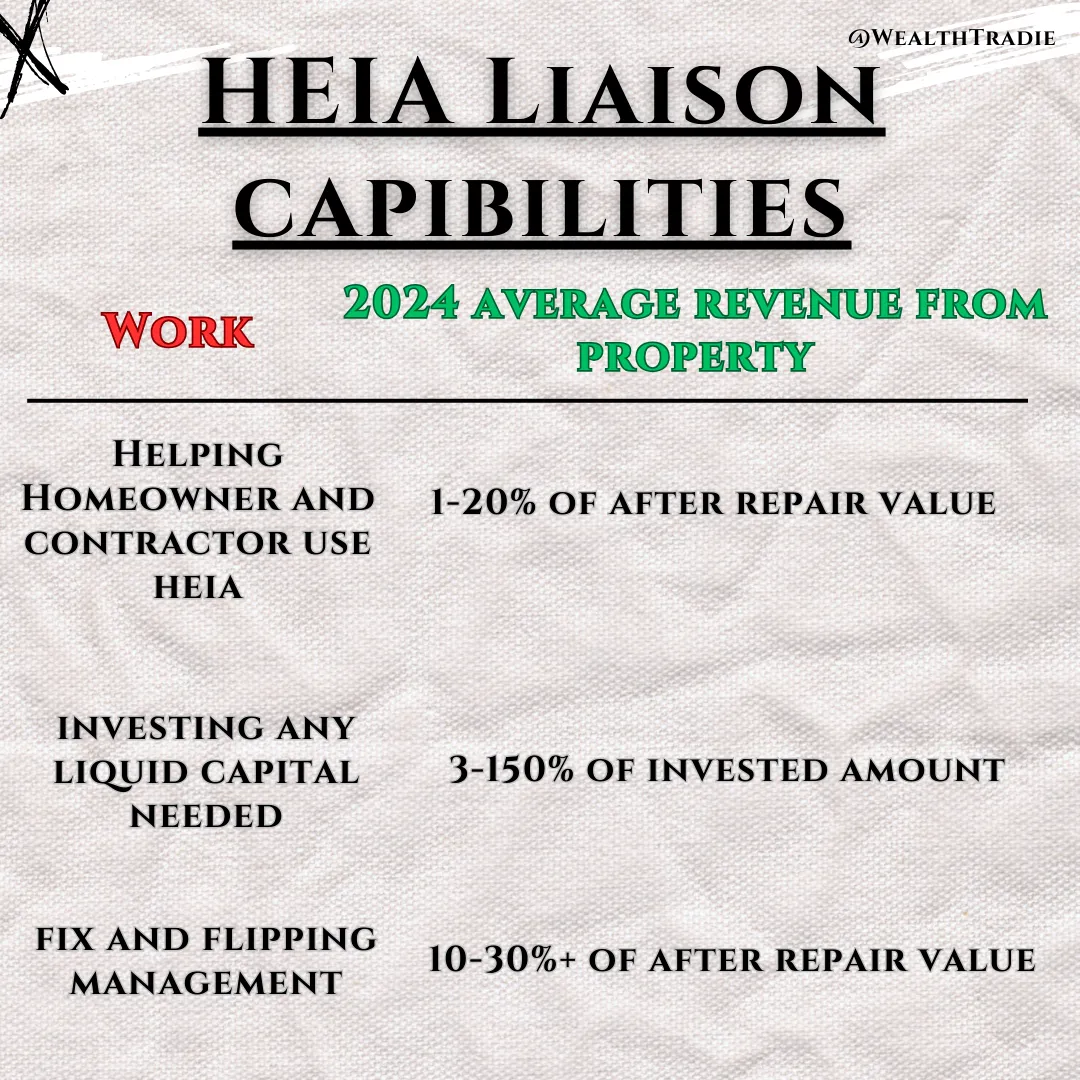

✅Earn 100% revenue share by helping homeowners and contractors leverage Home Equity Invoice Agreements (HEIAs).

✅ Offer innovative equity-based financing solutions that deepen trust with buyers and sellers.

✅ Stand out in your market as a Loan Broker who provides next-level services.

Why is this offer exclusive?

We want to empower licensed Loan Officers like YOU to lead the charge in transforming the equity industry.

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Lenders

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

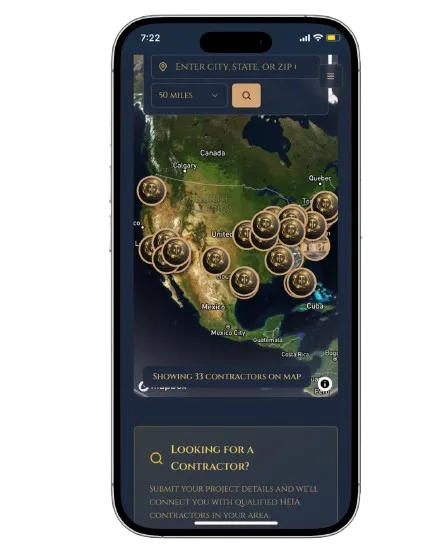

Connect with a contractor today!

We wouldn't be at the tip of the spear leading this movement without understanding how hard it is to teach an old dog (investors) new tricks. don't believe our shiny red dress, connect with the boots on the ground and see for yourself with your current properties. WE guarantee that you will be able to see the difference and want your license on your next project.

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Your All-in-One Toolbox for Scaling Success

The WealthTradie Apprentice Membership provides access to premium tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. Additionally, gain access to an exclusive support network of real estate professionals to help you troubleshoot and optimize your strategies.

Bonus 2: Pro Membership

Master the Art of Real Estate Success

The WealthTradie Pro Membership gives you step-by-step training to implement HEIA in your business. Learn how to attract homeowners, negotiate equity-based deals, and create win-win solutions for sellers and contractors alike. From beginner-friendly guidance to advanced deal strategies, this program equips you with everything you need to grow your business confidently.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Build Your Business

As a 100% revenue share affiliate, you can introduce HEIA and WealthTradie memberships to other real estate professionals while keeping 100% of the referral income. This provides an additional revenue stream that grows alongside your core real estate business.

These bonuses are designed to help you scale faster, work smarter, and earn more. With the WealthTradie Apprenticeship, Pro Membership, and Affiliate Program, you’ll have everything you need to dominate your market.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

Business Acquisition Managers Unlock Hidden Real Estate Wealth

Business acquisition managers have found a new frontier. While traditionally focused on optimizing and flipping entire companies, these strategic minds are now turning their attention to a revolutionary approach in real estate and the construction industry: Home Equity Invoice Agreements (HEIAs).

The shift represents more than just a new investment vehicle. It signals a fundamental restructuring of how construction businesses can transform standard payments into lasting wealth through property equity.

This evolution comes at a critical time for both the construction industry and acquisition specialists seeking diversification beyond traditional business purchases.

The HEIA Revolution

Home Equity Invoice Agreements allow construction businesses to convert standard monetary invoices into equity percentages in properties. The concept is elegantly simple yet profound in its implications.

Rather than contractors accepting ordinary cash payments that face heavy taxation, they can now acquire portions of equity in the very properties they improve. This approach creates a win-win scenario: homeowners conserve cash while contractors build wealth through appreciating assets.

Business acquisition managers are discovering these agreements create opportunities 80% easier than conventional methods, providing a revolutionary alternative to traditional construction business purchases.

The mechanics work like this: A contractor starts renovation work on a property. Instead of receiving full payment in cash, they accept a percentage of the property's equity equivalent to their invoice value. As the property appreciates, so does the value of their equity stake. They can even still be distrubuted cash payments based on their equities value to still save on tax's while accepting near the same amount of cash upfront.

For acquisition managers, this presents a unique opportunity to help construction businesses implement a system that dramatically increases their long-term wealth potential and yearly profit.

Why Acquisition Managers Are Taking Notice

The appeal for business acquisition managers is multifaceted. First, construction businesses with HEIA capabilities become more valuable acquisition targets due to their diversified revenue streams and equity holdings in actual real estate already.

Second, acquisition managers themselves can participate directly in the real estate market through HEIA liaison licenses, which enable them to connect contractors and homeowners while taking a percentage of the resulting equity arrangements.

This creates a powerful new business model. Acquisition managers can build portfolios of fractional real estate holdings without the capital requirements of traditional property investment or additional liabilities of a construction business.

The tax advantages are equally compelling. By accepting equity instead of cash, contractors can defer tax liabilities until equity positions are liquidated, potentially at more favorable capital gains rates rather than ordinary income tax rates.

Transforming Construction Business Models

For acquisition managers specializing in construction businesses, HEIAs represent a transformative optimization strategy. Implementing these agreements can dramatically improve a construction company's financial profile.

Traditional construction businesses operate on high margins with significant cash flow costs. When acquisition managers introduce HEIAs, they create a pathway to building a real estate portfolio alongside the core construction business.

This dual-revenue model significantly increases business valuation multiples. A construction business with substantial equity holdings becomes more resilient to market fluctuations and more attractive to potential buyers.

The implementation process typically follows three phases:

First, acquisition managers help construction businesses structure appropriate HEIA operational frameworks. Next, they develop systems for evaluating which projects are suitable for equity conversion versus cash payment. Finally, they create portfolio management processes to track and eventually monetize equity positions.

Market Adoption and Growth Trajectory

The HEIA model is gaining traction rapidly across multiple segments of the real estate and construction industry. While initially embraced by renovation contractors, the approach is now spreading to new construction, property management, and real estate development.

HEIAs offer a groundbreaking equity-based solution designed to combat predatory lending practices in real estate, allowing contractors, business managers, and investors to convert standard monetary construction invoices into equity percentages without needing traditional loans or high-interest rates controled by third party banks and lenders.

Business acquisition managers are particularly well-positioned to accelerate this adoption curve. Their expertise in optimizing business models and identifying strategic opportunities makes them natural evangelists for the HEIA approach.

The market potential is substantial. With approximately 3.7 million construction businesses in the United States alone, the opportunity to transform even a fraction of these operations through HEIAs represents billions in potential equity value for everyone to share.

Implementation Challenges and Solutions

Despite the compelling advantages, implementing HEIAs isn't without challenges. Acquisition managers must navigate several key hurdles when introducing these agreements to construction businesses.

Valuation methodology stands as the primary challenge. Determining the fair equity percentage for a given invoice amount requires sophisticated understanding of both construction costs and real estate valuation principles.

Legal documentation represents another significant hurdle. HEIA agreements must be carefully structured to protect all parties while complying with relevant securities regulations and real estate laws. Public recording procedures are needed to be known or hired out to a title company.

Finally, portfolio management processes must be established. Construction businesses accustomed to simple cash transactions need systems for tracking, managing, and eventually monetizing diverse equity holdings apprciating .

Acquisition managers add tremendous value by bringing solutions to each of these challenges. Their experience with complex business transactions and optimization strategies positions them perfectly to implement HEIAs into construction business's.

The Future Landscape

As HEIAs continue gaining adoption, several trends are emerging that will shape the future landscape for business acquisition managers in the home service business.

First, specialized acquisition firms focusing exclusively on HEIA-enabled construction businesses are beginning to form. These firms recognize the unique value proposition and are developing expertise specifically for this market segment.

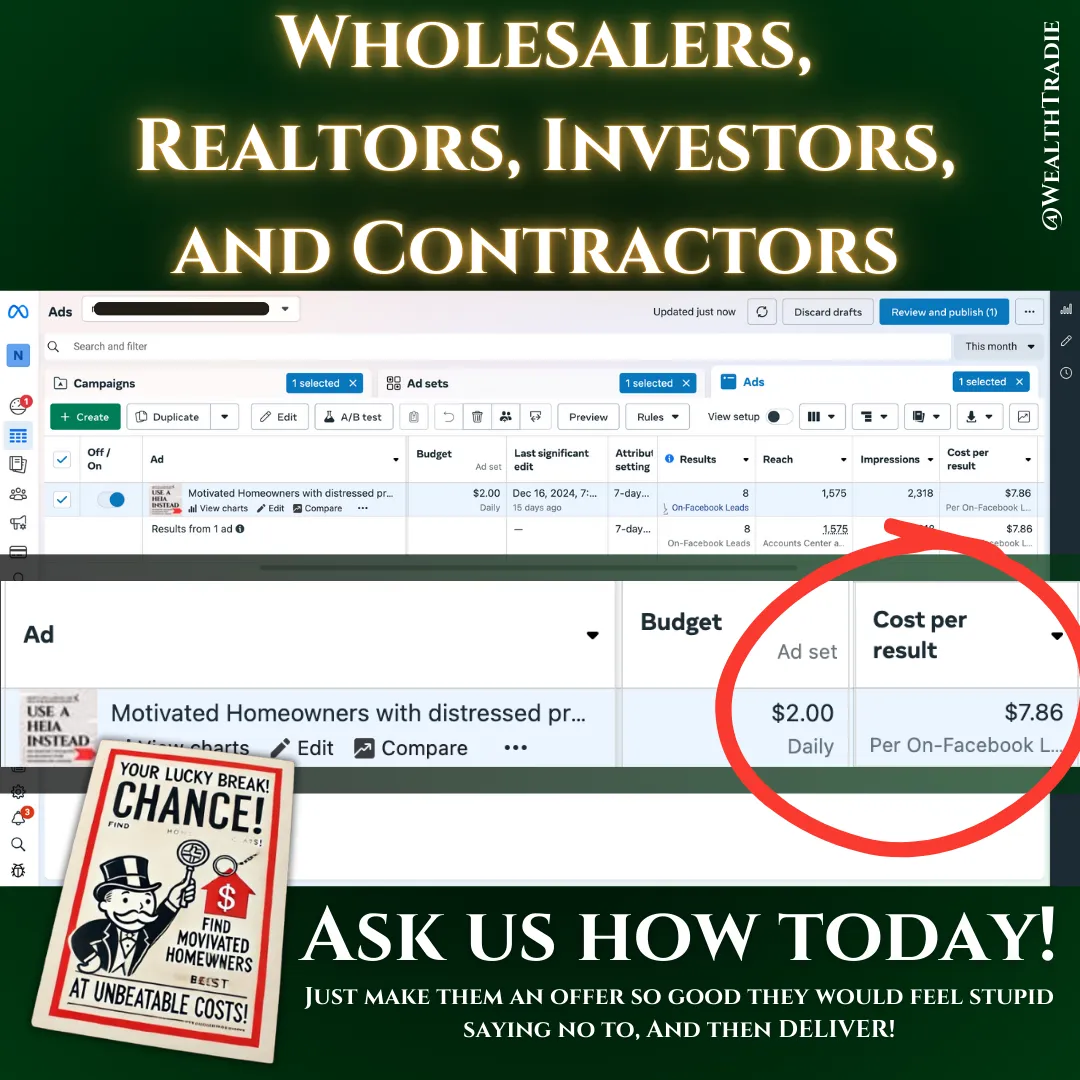

Second, technology platforms facilitating HEIA transactions are emerging. These platforms streamline documentation, valuation, and portfolio management, making implementation significantly easier for acquisition managers and construction businesses alike that use electronic signatures.

Third, financial institutions are starting to recognize HEIAs as legitimate assets against which construction businesses can borrow from HEIA Liaison's. This creates additional leverage opportunities for acquisition managers to optimize liquid capital structures too.

For forward-thinking acquisition managers, the opportunity is clear: by helping construction businesses implement HEIAs, they can simultaneously increase business valuations and create new revenue streams through equity participation in real estate wealth.

Taking Action

Business acquisition managers interested in exploring the HEIA opportunity should begin by thoroughly understanding the legal and financial frameworks involved. This includes studying successful implementation benefits and connecting with organizations specializing in these agreements.

The next step involves identifying construction businesses that would benefit most from HEIA implementation. Ideal candidates include established operations with strong reputations for quality work but struggling with cash flow or growth limitations.

Finally, acquisition managers should develop systematic implementation approaches that can be replicated across multiple construction businesses, creating scalable value-add strategies.

The construction industry has long been characterized by thin margins and limited wealth-building opportunities. Through HEIAs, business acquisition managers now have a powerful tool to transform this dynamic, creating substantial value for themselves and the construction businesses they serve.

The revolution in construction wealth building has begun. Business acquisition managers who recognize this opportunity early stand to benefit tremendously as the approach gains wider market adoption.

Best tools for real estate financing professionals

"The Real Game Made Simple"

–A Must-Read

is more than just a book – it’s your guide to unlocking success in the real estate industry. Packed with actionable insights and real-world strategies, it’s designed to help realtors navigate challenges, build wealth, and thrive in a competitive market.

Here’s why top real estate agents are calling it a

game-changer:

✅ Deepen Your Expertise:

Learn how to align with clients' needs, understand market dynamics, and position yourself as the go-to realtor in your area.

✅ Build Wealth Smarter:

Explore innovative equity-based strategies, like HEIAs, to elevate your client relationships and close deals that benefit everyone.

✅ Avoid Common Pitfalls:

Uncover hidden industry challenges and learn how to sidestep them with confidence.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

What makes HEIA lending safer than traditional real estate loans?

HEIAs are secured by a Deed of Trust, ensuring lenders have a legal claim to the property’s equity. Unlike traditional loans or deeds that rely on borrower credit and fluctuating market values, HEIAs are backed by tangible home improvements—real, measurable assets that increase the property’s worth.

How does lending on HEIAs allow me to invest in more properties at once?

Instead of locking your capital into a single, large mortgage or home purchase, HEIAs allow you to fund the hard costs (materials, labor, renovations) of multiple properties simultaneously. This diversification spreads risk and accelerates return cycles.

What guarantees that my investment is protected?

HEIAs are legally structured with recorded Deeds of Trust, ensuring lenders are prioritized for repayment before any unsecured creditors. Your investment is secured by the property itself and not dependent on borrower credit scores or fluctuating appraisals. You are guaranteed your equity as soon as you sign, and as long as you perform and do not break your agreement. You receive your equity value when the home is sold or the end of the HEIA term set.

Who actually receives my funding in an HEIA deal?

Unlike traditional real estate loans that send money to homeowners or third parties, HEIA funding goes directly to self accountable contractors who are paid in the properties equity too—ensuring transparency, accountability, and proper use of funds.

What happens if a homeowner sells their home before the HEIA is paid off?

If the home is sold, lenders receive their payout first, before any profits go to the homeowner and contractor. Because HEIAs are tied directly to home equity, the transaction is settled automatically at closing, ensuring timely repayment.

Can I liquidate my investment faster than traditional real estate loans?

Yes! HEIA investments offer faster liquidity cycles because they are based on project completions, not long-term mortgages. Once the home is improved and sold, your capital can be quickly reinvested into new HEIA deals without traditional transaction and underwriting times.

How do HEIAs reduce the risk of foreclosure?

Since HEIAs don’t rely on traditional loan payments, there’s no risk of missed mortgage payments or defaults impacting your return. Your repayment is tied to property appreciation, home equity, and successful renovation completion. If the home goes to foreclosure, the hard costs (material and labour) of the HEIA project are protected and follow the homeowner and/or property if not satisfied.

Why is lending on home improvements better than lending on speculative home values?

Traditional real estate investments depend on market speculation—which fluctuates with interest rates and economic conditions. HEIAs focus on tangible improvements that directly increase property value, making them a more stable, predictable investment with direct equity compensation.

What kinds of returns can I expect from HEIA lending?

Returns vary based on property type and project scope, but HEIA lenders often achieve higher returns with shorter hold times compared to traditional real estate investing. Since funds are secured by home equity and tied to improvement value, ROI is predictable and scalable.

How do I get started as an HEIA lender?

Becoming an HEIA lender is simple. You can start funding secure, equity-backed real estate deals immediately by partnering with vetted HEIA contractors and homeowners in need of capital. Grab a HEIA Liaison license and start funding contractors today!

30 Day No-Questions Money Back Guarantee

Copyright 2026 | WealthTradie™ | Privacy Policy | Terms & Conditions