"Turning Hard Money into bullet proof money with proprietary contract structures"

The Master strategy for Lenders

The Power of Home Equity Invoice Agreements (HEIAs) for Lenders

Home Equity Invoice Agreements (HEIAs) are revolutionizing real estate lending by allowing lenders to directly invest in hard costs (materials and labor) rather than speculative property or quality values. This innovative financing model ensures higher security, direct asset-backed investments, and a scalable opportunity to fund more properties than ever before with deed and mechanical lien protection.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

endless construction need liquid capital and lenders now have a safe, secured, and wealthy way to fund real estate equity in the SIMPLEST way; through the construction of it

Why HEIAs Are the Future of Secured Real Estate Lending

🔹More Control– Invest in the real value creation process rather than fluctuating property prices with extra middlemen.

🔹Higher Security– A proprietary performance backed Deed, ensuring your investment is legally protected with double protection of mechanic liens regardless of deed position.

🔹More Deals, Less Risk– Fund multiple projects securely at once instead of locking capital into one high-risk property with less structure protection.

🔹Fast Liquidity– Get repaid faster than traditional real estate investments through higher structure and work quality, allowing for higher reinvestment cycles.

🔹Guaranteed ROI Potential– Partner with

contractors and homeowners who have a direct incentive to complete projects on time and at the highest value for everyone to share equitably.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Change the Game for Lenders

HERE’S HOW IT WORKS

Invest in Tangible Hard Costs

Traditional real estate lending relies on speculative values, exposing capital to market swings. HEIAs secure your investment with direct material and value accountability. protecting your downside while still tying you to the upside of market appreciation.

Secure Investments with Proprietary Deed

Unlike risky loans, HEIAs are secured by recorded equity on the deed. giving you priority repayment and an extra layer of security with direct material lien capabilities over deed positions in certain states

Unlock More Lending Opportunities

Traditional real estate requires large capital per deal. HEIAs let you scale by funding specific improvements across multiple properties, not full purchases with additional risks.

Take control of your real estate investments with a smarter, safer, and more scalable strategy. Become an HEIA Liaison today and start investing in secured, debt-free, equity-based real estate deals!

30 Day No-Questions Money Back Guarantee

Unlock the $36 Trillion Home Equity Market

The Future of Real Estate Financing

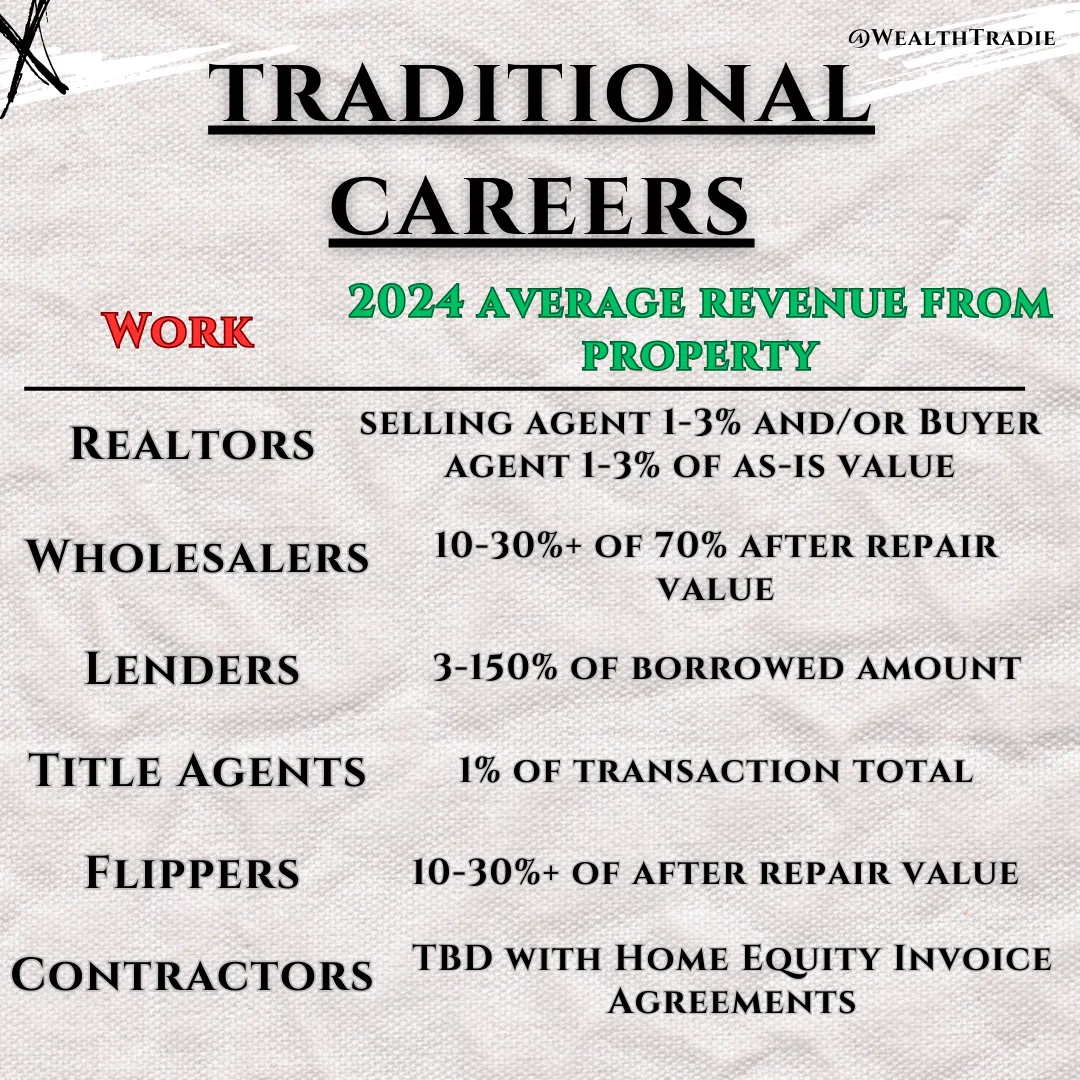

Before / Old Way

Speculative Value: Abstract market purchase values and costs that are subject to change

Relying on borrower: Relying on borrower credit and payments history for returns

limited to large, slow moving deals: Large purchase prices of property with slow moving acquisition processes

Market Fluctuations: Secured with borrower potential for default

Consistent management: Requires Mortgage payments, meaning borrower default can stall returns

After / New Way

Tangible hard costs: Real materials and labour that increases the homes actual value

backed by deed of trust: Dependant on property hard costs and its connected properties full value

fund multiple properties with the same amount: Invest in improvements rather then full purchases to speed up transactions

secured by added value: Secured by property's real improvements

Funds directly to contractor: Funds go directly to contractor with no management

30 Day No-Questions Money Back Guarantee

🔥 Exclusive 50% Discount for Licensed Loan Officers 🔥

Your Loan Officer License Just Became a Key to Unprecedented Wealth

—But Only for a Limited Time!

If you are a licensed Loan Officer, you’re already a trusted expert in your field. Now, WealthTradie invites you to elevate your career with the HEIA Liaison License, exclusively available at 50% off for a limited time.

This is your opportunity to:

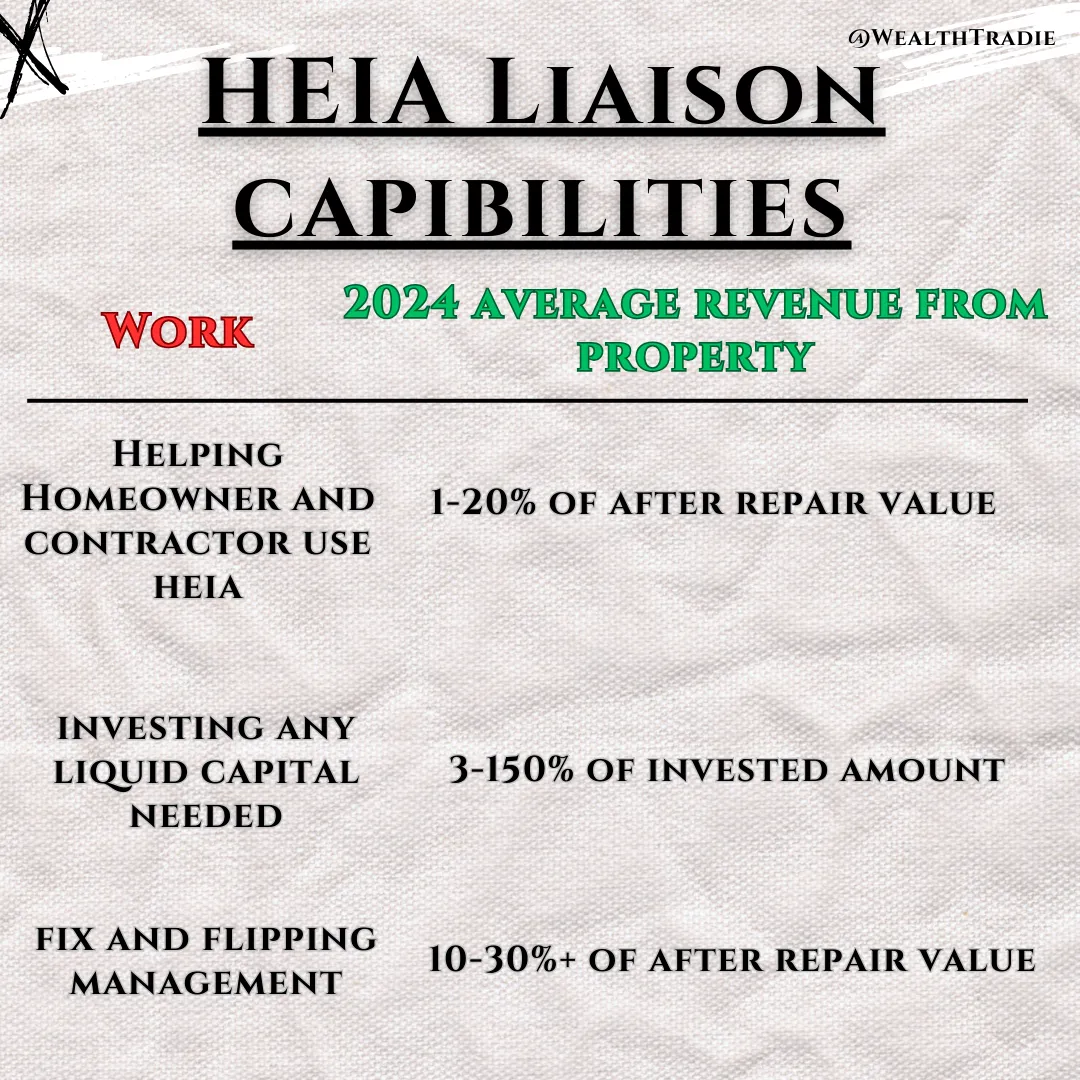

✅Earn 100% revenue share by helping homeowners and contractors leverage Home Equity Invoice Agreements (HEIAs).

✅ Offer innovative equity-based financing solutions that deepen trust with buyers and sellers.

✅ Stand out in your market as a Loan Broker who provides next-level services.

Why is this offer exclusive?

We want to empower licensed Loan Officers like YOU to lead the charge in transforming the equity industry.

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Lenders

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Your All-in-One Toolbox for Scaling Success

The WealthTradie Apprentice Membership provides access to premium tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. Additionally, gain access to an exclusive support network of real estate professionals to help you troubleshoot and optimize your strategies.

Bonus 2: Pro Membership

Master the Art of Real Estate Success

The WealthTradie Pro Membership gives you step-by-step training to implement HEIA in your business. Learn how to attract homeowners, negotiate equity-based deals, and create win-win solutions for sellers and contractors alike. From beginner-friendly guidance to advanced deal strategies, this program equips you with everything you need to grow your business confidently.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Build Your Business

As a 100% revenue share affiliate, you can introduce HEIA and WealthTradie memberships to other real estate professionals while keeping 100% of the referral income. This provides an additional revenue stream that grows alongside your core real estate business.

These bonuses are designed to help you scale faster, work smarter, and earn more. With the WealthTradie Apprenticeship, Pro Membership, and Affiliate Program, you’ll have everything you need to dominate your market.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

This Hack Saves Homeowners Thousands on Home Renovations

Picture this: You're standing in your outdated kitchen, dreaming of sleek countertops and shiny new appliances. But then reality hits - renovations cost a fortune. Or do they? A game-changing approach is turning the home improvement world on its head, allowing homeowners to afford top-quality renovations without breaking the bank.

The Renovation Dilemma

For years, homeowners have faced a tough choice: settle for less-than-stellar work or empty their savings for quality renovations. It's a lose-lose situation that's left countless dream homes stuck in limbo.

But what if there was a way to have your cake and eat it too?

Enter the Home Equity Invoice Agreement (HEIA)

HEIA isn't just another acronym in the alphabet soup of home financing. It's a revolutionary tool that's changing how homeowners approach renovations. But what exactly is it?

Simply put, HEIA allows you to convert a regular monetary construction invoice into an equivalent equity percentage of your property. It's like paying for your renovations with a slice of your home's future value, rather than cold, hard cash.

How HEIA Works Its Magic

Let's break it down:

1. You find a contractor you love, but their bid seems out of reach.

2. Instead of scrambling for a loan or settling for a cheaper option, you use HEIA.

3. The cost of the renovation is converted into a percentage of your home's equity.

4. The contractor gets paid in equity, which grows as your home value increases.

5. You get the high-quality renovation you want, without the immediate financial strain.

Why It's a Win-Win

For homeowners, HEIA means access to top-tier contractors and materials without the need for hefty upfront payments or high-interest loans. You're essentially investing in your home's future value to improve its present condition.

Contractors benefit too. They're incentivized to do their absolute best work, knowing that the better the renovation, the more the home's value - and their equity stake - will increase as their costs and taxes are diminished.

The Brains Behind the Innovation

HEIA isn't just a theoretical concept. It's the brainchild of Shane Walsh, a man with decades of experience in construction and real estate investing. Walsh's journey from growing up in a family construction business to becoming a Marine, homeowner, and real estate investor gave him unique insights into the pain points of home renovation financing.

"I've seen firsthand how traditional financing options can leave both homeowners and contractors shortchanged," Walsh explains. "HEIA is designed to solve the myriad pains I encountered as a contractor, homeowner, and investor across different real estate sector intersections."

Real-World Impact

The potential impact of HEIA is huge. Imagine a world where:

- Homeowners can choose the best contractors, not just the most affordable ones.

- Contractors are rewarded for quality work with a stake in the property's future value.

- The overall quality of home renovations improves, boosting property values across neighborhoods.

It's not just about prettier homes - it's about creating a fairer, more efficient renovation ecosystem.

Is HEIA Right for You?

While HEIA sounds like a dream come true, it's important to consider your specific situation. If you're planning to sell your home in the near future, for example, you'll need to factor in the equity you've promised to your contractor.

However, for many homeowners, HEIA could be the key to unlocking renovations that were previously out of reach. It's a tool that allows you to invest in your home's future while enjoying its benefits today.

The Future of Home Renovations

As HEIA gains traction, it has the potential to reshape the entire home renovation landscape. We could see a shift towards higher-quality work, fairer compensation for contractors, and more satisfied homeowners.

The days of settling for subpar renovations or drowning in debt to afford quality work might soon be behind us. With innovative solutions like HEIA, the dream of a beautifully renovated home is becoming more accessible than ever.

So the next time you're standing in that outdated kitchen, dreaming of a makeover, remember: with tools like HEIA, your dream renovation might be more attainable than you think. The future of home improvements is here, and it's looking brighter - and more affordable - than ever when using a HEIA.

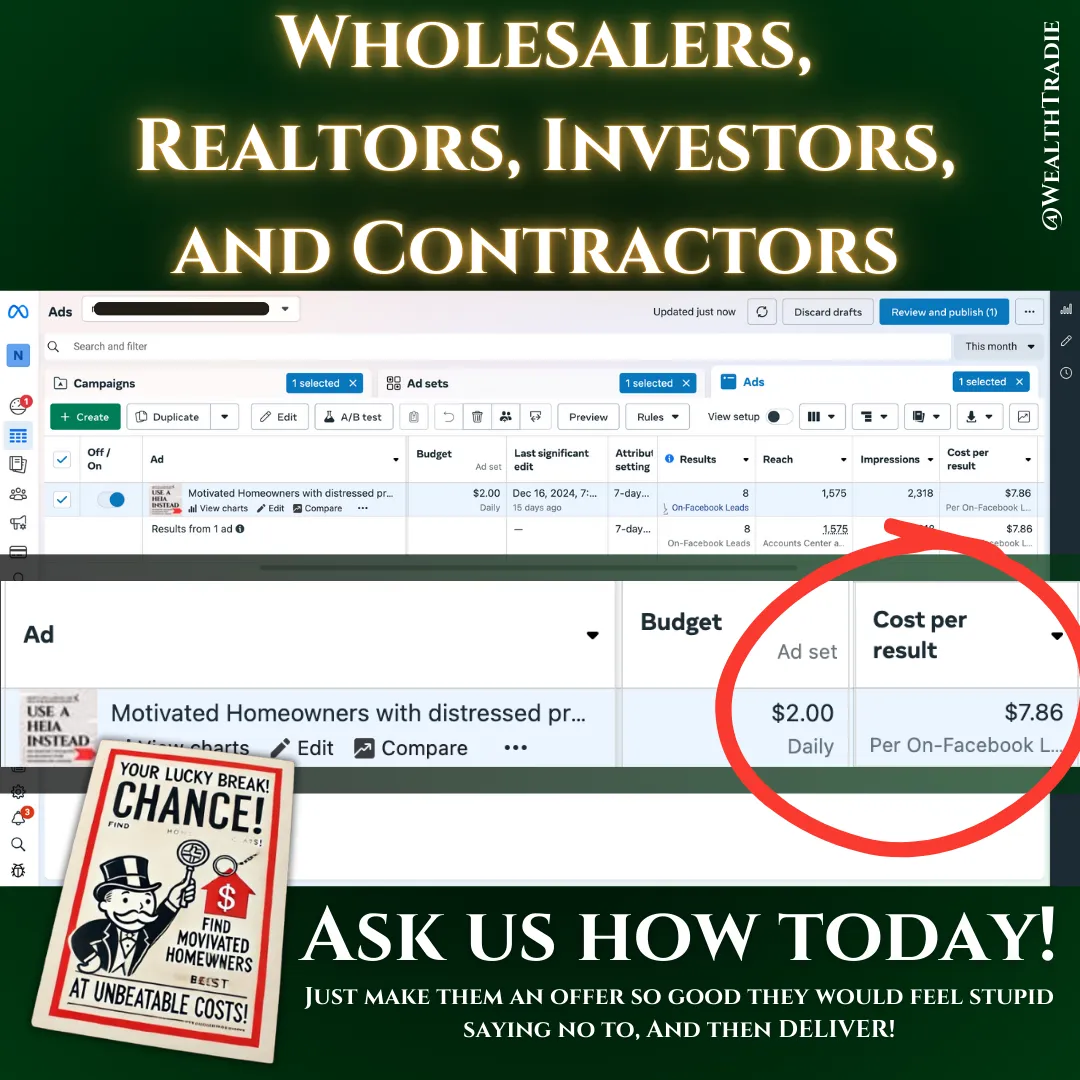

Best tools for real estate financing professionals

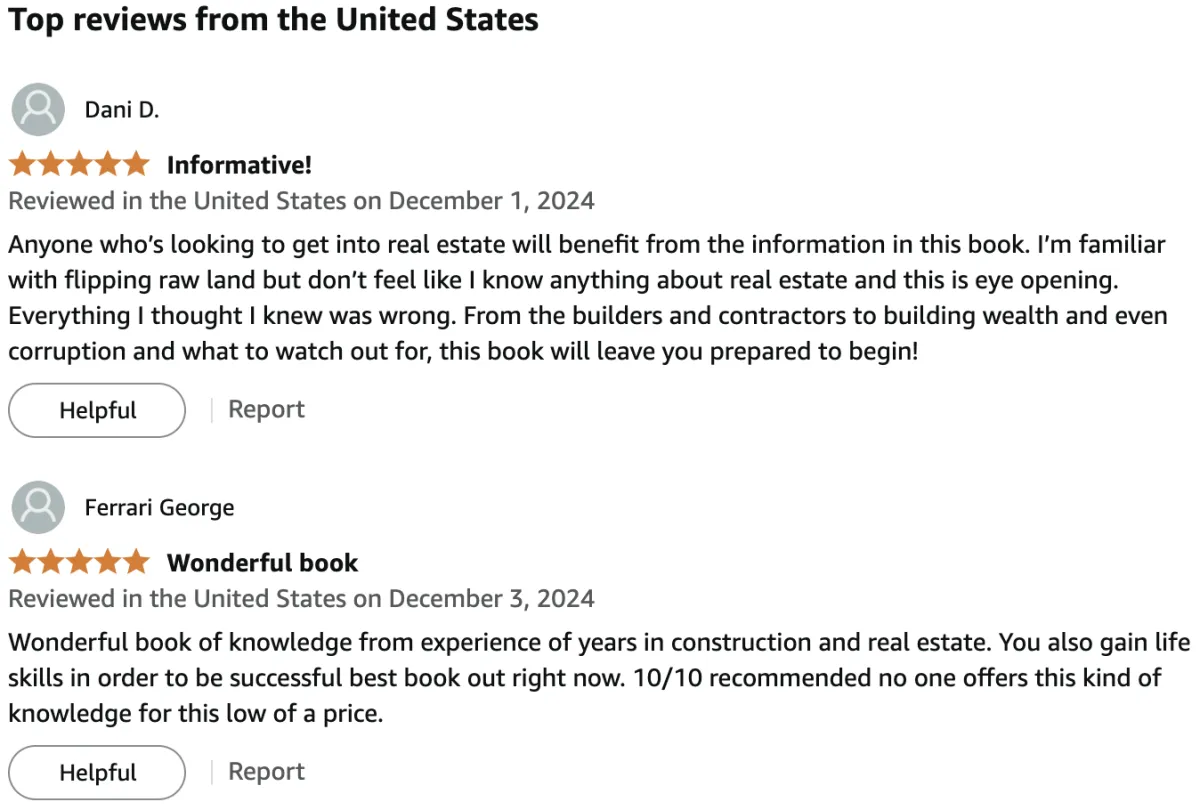

"The Real Game Made Simple"

–A Must-Read

is more than just a book – it’s your guide to unlocking success in the real estate industry. Packed with actionable insights and real-world strategies, it’s designed to help realtors navigate challenges, build wealth, and thrive in a competitive market.

Here’s why top real estate agents are calling it a

game-changer:

✅ Deepen Your Expertise:

Learn how to align with clients' needs, understand market dynamics, and position yourself as the go-to realtor in your area.

✅ Build Wealth Smarter:

Explore innovative equity-based strategies, like HEIAs, to elevate your client relationships and close deals that benefit everyone.

✅ Avoid Common Pitfalls:

Uncover hidden industry challenges and learn how to sidestep them with confidence.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

What makes HEIA lending safer than traditional real estate loans?

HEIAs are secured by a Deed of Trust, ensuring lenders have a legal claim to the property’s equity. Unlike traditional loans or deeds that rely on borrower credit and fluctuating market values, HEIAs are backed by tangible home improvements—real, measurable assets that increase the property’s worth.

How does lending on HEIAs allow me to invest in more properties at once?

Instead of locking your capital into a single, large mortgage or home purchase, HEIAs allow you to fund the hard costs (materials, labor, renovations) of multiple properties simultaneously. This diversification spreads risk and accelerates return cycles.

What guarantees that my investment is protected?

HEIAs are legally structured with recorded Deeds of Trust, ensuring lenders are prioritized for repayment before any unsecured creditors. Your investment is secured by the property itself and not dependent on borrower credit scores or fluctuating appraisals. You are guaranteed your equity as soon as you sign, and as long as you perform and do not break your agreement. You receive your equity value when the home is sold or the end of the HEIA term set.

Who actually receives my funding in an HEIA deal?

Unlike traditional real estate loans that send money to homeowners or third parties, HEIA funding goes directly to self accountable contractors who are paid in the properties equity too—ensuring transparency, accountability, and proper use of funds.

What happens if a homeowner sells their home before the HEIA is paid off?

If the home is sold, lenders receive their payout first, before any profits go to the homeowner and contractor. Because HEIAs are tied directly to home equity, the transaction is settled automatically at closing, ensuring timely repayment.

Can I liquidate my investment faster than traditional real estate loans?

Yes! HEIA investments offer faster liquidity cycles because they are based on project completions, not long-term mortgages. Once the home is improved and sold, your capital can be quickly reinvested into new HEIA deals without traditional transaction and underwriting times.

How do HEIAs reduce the risk of foreclosure?

Since HEIAs don’t rely on traditional loan payments, there’s no risk of missed mortgage payments or defaults impacting your return. Your repayment is tied to property appreciation, home equity, and successful renovation completion. If the home goes to foreclosure, the hard costs (material and labour) of the HEIA project are protected and follow the homeowner and/or property if not satisfied.

Why is lending on home improvements better than lending on speculative home values?

Traditional real estate investments depend on market speculation—which fluctuates with interest rates and economic conditions. HEIAs focus on tangible improvements that directly increase property value, making them a more stable, predictable investment with direct equity compensation.

What kinds of returns can I expect from HEIA lending?

Returns vary based on property type and project scope, but HEIA lenders often achieve higher returns with shorter hold times compared to traditional real estate investing. Since funds are secured by home equity and tied to improvement value, ROI is predictable and scalable.

How do I get started as an HEIA lender?

Becoming an HEIA lender is simple. You can start funding secure, equity-backed real estate deals immediately by partnering with vetted HEIA contractors and homeowners in need of capital. Grab a HEIA Liaison license and start funding contractors today!

30 Day No-Questions Money Back Guarantee

Copyright 2025 | WealthTradie™ | Privacy Policy | Terms & Conditions