"Smarter Hard Money through simple aligned leverage for all"

The Master strategy for Loan Brokers

Boost Your Loan Brokerage Business with the HEIA Master License

Unlock Creative Real Estate Equity Solutions and Outperform the Competition

Revolutionize your offerings with innovative equity-based financing that empowers homeowners, contractors, and investors while boosting your revenue.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

Contractors, homeowners, and investors lose out because equity is locked behind cash-based models

Struggling to Attract and Retain Homeowners Ready to Sell?

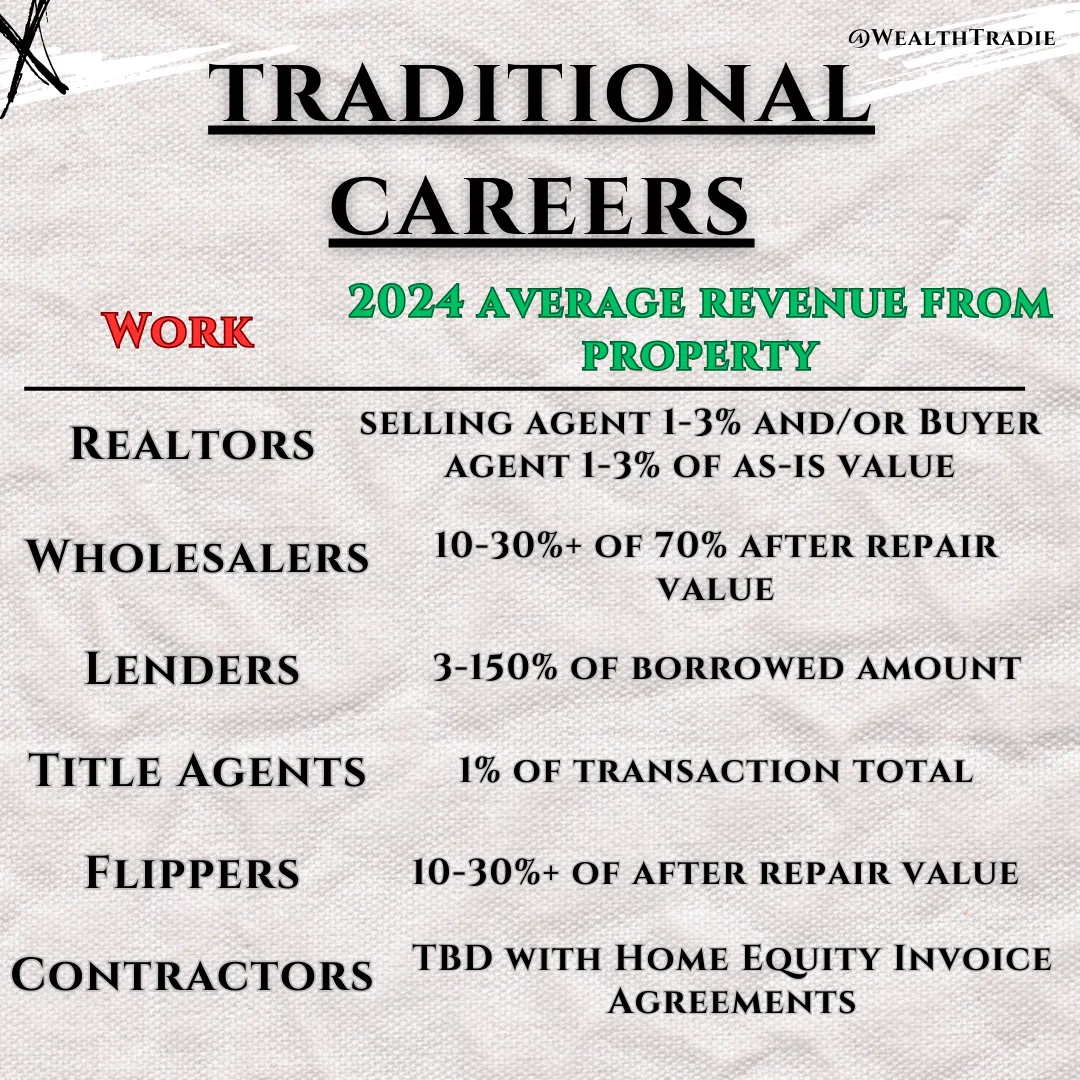

As a loan broker, the market is getting tougher every day. Homeowners are inundated with financing options: from traditional HELOCs and cash-out refinancing to unconventional hard money loans. The competition is fierce, and offering the same products as every other broker makes it nearly impossible to stand out. Add the challenge of working with homeowners in distressed situations or those with limited liquidity, and it can feel like an uphill battle to consistently attract and retain profitable clients.

Home Equity Invoice Agreements (HEIA).

Instead of relying solely on cash-based lending products, are a revolutionary, equity-based solution. By helping homeowners unlock their home’s value without taking on additional debt. Solving real problems instead of pitching the same old options for renovations. Homeowners trusted it because it's a way to access equity without the barriers of traditional loans.

With HEIA, you’ll not only differentiate yourself in the competitive loan market but also break into lucrative niches like distressed property investing. This proven method helps you connect with homeowners in meaningful ways, offering them creative solutions that eliminate friction and add real value. Whether it’s helping a homeowner fund renovations without upfront cash or giving contractors a stake in their work, HEIA sets you apart as an innovative problem-solver.

By adding HEIA to your portfolio, you’ll not only stand out but also create lasting client relationships, increase referrals, and grow your revenue in ways traditional financing simply can’t match.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Create long-term client trust by solving equity challenges traditional loans can’t address

HERE’S HOW IT WORKS

Expand Your Portfolio

Offer HEIAs as a non-traditional equity solution alongside loans and refinancing.

Maximize Earnings

Earn from both your existing business and HEIA transactions, thanks to our innovative 0.25% contract fee structure.

Capture New Markets

Work with contractors, real estate investors, and homeowners who need creative solutions.

Don’t let traditional models limit your business growth. Join the ranks of forward-thinking loan brokers and real estate professionals transforming the industry

30 Day No-Questions Money Back Guarantee

Unlock the $36 Trillion Home Equity Market

Stand Out in a Competitive Market with Home Equity Invoice Agreements (HEIAs)

Before / Old Way

Saturated Market: High competition makes it difficult to stand out.

Limited Options: Traditional home equity loans and HELOCs don’t work for every client.

Customer Frustration: Homeowners face strict loan requirements, delays, and hidden costs.

Missed Opportunities: Brokers miss out on untapped equity markets because traditional financing doesn’t cover every need.

After / New Way

Creative Financing: Offer homeowners equity access without loans, unlocking opportunities for those who don’t qualify for Financial products.

Unique Selling Point: Differentiate yourself with HEIAs, a proprietary equity solution tool.

Increased Revenue Streams: Earn commissions on HEIA deals while helping homeowners and contractors achieve their goals.

Faster Transactions: Skip the delays of traditional loan approvals and close deals quickly.

30 Day No-Questions Money Back Guarantee

🔥 Exclusive 50% Discount for Licensed Loan Officers 🔥

Your Loan Officer License Just Became a Key to Unprecedented Wealth

—But Only for a Limited Time!

As a licensed Loan Officer, you’re already a trusted expert in your field. Now, WealthTradie invites you to elevate your career with the HEIA Liaison License, exclusively available at 50% off for a limited time.

This is your opportunity to:

✅Earn 100% revenue share by helping homeowners and contractors leverage Home Equity Invoice Agreements (HEIAs).

✅ Offer innovative equity-based financing solutions that deepen trust with buyers and sellers.

✅ Stand out in your market as a Loan Broker who provides next-level services.

Why is this offer exclusive?

We want to empower licensed Loan Officers like YOU to lead the charge in transforming the equity industry.

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Loan Brokers

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

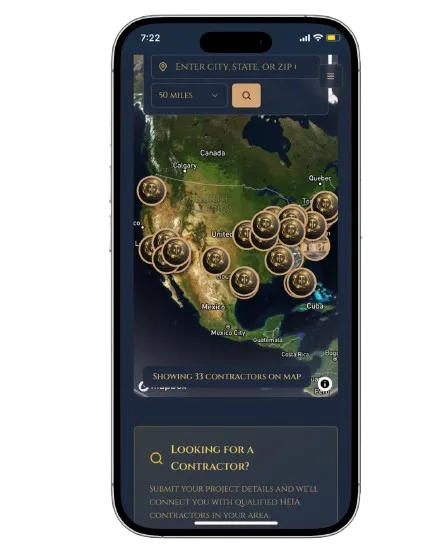

Connect with a contractor today!

We wouldn't be at the tip of the spear leading this movement without understanding how hard it is to teach an old dog (investors) new tricks. don't believe our shiny red dress, connect with the boots on the ground and see for yourself with your current properties. WE guarantee that you will be able to see the difference and want your license on your next project.

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Your All-in-One Toolbox for Scaling Success

The WealthTradie Apprentice Membership provides access to premium tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. Additionally, gain access to an exclusive support network of real estate professionals to help you troubleshoot and optimize your strategies.

Bonus 2: Pro Membership

Master the Art of Real Estate Success

The WealthTradie Pro Membership gives you step-by-step training to implement HEIA in your business. Learn how to attract homeowners, negotiate equity-based deals, and create win-win solutions for sellers and contractors alike. From beginner-friendly guidance to advanced deal strategies, this program equips you with everything you need to grow your business confidently.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Build Your Business

As a 100% revenue share affiliate, you can introduce HEIA and WealthTradie memberships to other real estate professionals while keeping 100% of the referral income. This provides an additional revenue stream that grows alongside your core real estate business.

These bonuses are designed to help you scale faster, work smarter, and earn more. With the WealthTradie Apprenticeship, Pro Membership, and Affiliate Program, you’ll have everything you need to dominate your market.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

Business Acquisition Managers Unlock Hidden Real Estate Wealth

Business acquisition managers have found a new frontier. While traditionally focused on optimizing and flipping entire companies, these strategic minds are now turning their attention to a revolutionary approach in real estate and the construction industry: Home Equity Invoice Agreements (HEIAs).

The shift represents more than just a new investment vehicle. It signals a fundamental restructuring of how construction businesses can transform standard payments into lasting wealth through property equity.

This evolution comes at a critical time for both the construction industry and acquisition specialists seeking diversification beyond traditional business purchases.

The HEIA Revolution

Home Equity Invoice Agreements allow construction businesses to convert standard monetary invoices into equity percentages in properties. The concept is elegantly simple yet profound in its implications.

Rather than contractors accepting ordinary cash payments that face heavy taxation, they can now acquire portions of equity in the very properties they improve. This approach creates a win-win scenario: homeowners conserve cash while contractors build wealth through appreciating assets.

Business acquisition managers are discovering these agreements create opportunities 80% easier than conventional methods, providing a revolutionary alternative to traditional construction business purchases.

The mechanics work like this: A contractor starts renovation work on a property. Instead of receiving full payment in cash, they accept a percentage of the property's equity equivalent to their invoice value. As the property appreciates, so does the value of their equity stake. They can even still be distrubuted cash payments based on their equities value to still save on tax's while accepting near the same amount of cash upfront.

For acquisition managers, this presents a unique opportunity to help construction businesses implement a system that dramatically increases their long-term wealth potential and yearly profit.

Why Acquisition Managers Are Taking Notice

The appeal for business acquisition managers is multifaceted. First, construction businesses with HEIA capabilities become more valuable acquisition targets due to their diversified revenue streams and equity holdings in actual real estate already.

Second, acquisition managers themselves can participate directly in the real estate market through HEIA liaison licenses, which enable them to connect contractors and homeowners while taking a percentage of the resulting equity arrangements.

This creates a powerful new business model. Acquisition managers can build portfolios of fractional real estate holdings without the capital requirements of traditional property investment or additional liabilities of a construction business.

The tax advantages are equally compelling. By accepting equity instead of cash, contractors can defer tax liabilities until equity positions are liquidated, potentially at more favorable capital gains rates rather than ordinary income tax rates.

Transforming Construction Business Models

For acquisition managers specializing in construction businesses, HEIAs represent a transformative optimization strategy. Implementing these agreements can dramatically improve a construction company's financial profile.

Traditional construction businesses operate on high margins with significant cash flow costs. When acquisition managers introduce HEIAs, they create a pathway to building a real estate portfolio alongside the core construction business.

This dual-revenue model significantly increases business valuation multiples. A construction business with substantial equity holdings becomes more resilient to market fluctuations and more attractive to potential buyers.

The implementation process typically follows three phases:

First, acquisition managers help construction businesses structure appropriate HEIA operational frameworks. Next, they develop systems for evaluating which projects are suitable for equity conversion versus cash payment. Finally, they create portfolio management processes to track and eventually monetize equity positions.

Market Adoption and Growth Trajectory

The HEIA model is gaining traction rapidly across multiple segments of the real estate and construction industry. While initially embraced by renovation contractors, the approach is now spreading to new construction, property management, and real estate development.

HEIAs offer a groundbreaking equity-based solution designed to combat predatory lending practices in real estate, allowing contractors, business managers, and investors to convert standard monetary construction invoices into equity percentages without needing traditional loans or high-interest rates controled by third party banks and lenders.

Business acquisition managers are particularly well-positioned to accelerate this adoption curve. Their expertise in optimizing business models and identifying strategic opportunities makes them natural evangelists for the HEIA approach.

The market potential is substantial. With approximately 3.7 million construction businesses in the United States alone, the opportunity to transform even a fraction of these operations through HEIAs represents billions in potential equity value for everyone to share.

Implementation Challenges and Solutions

Despite the compelling advantages, implementing HEIAs isn't without challenges. Acquisition managers must navigate several key hurdles when introducing these agreements to construction businesses.

Valuation methodology stands as the primary challenge. Determining the fair equity percentage for a given invoice amount requires sophisticated understanding of both construction costs and real estate valuation principles.

Legal documentation represents another significant hurdle. HEIA agreements must be carefully structured to protect all parties while complying with relevant securities regulations and real estate laws. Public recording procedures are needed to be known or hired out to a title company.

Finally, portfolio management processes must be established. Construction businesses accustomed to simple cash transactions need systems for tracking, managing, and eventually monetizing diverse equity holdings apprciating .

Acquisition managers add tremendous value by bringing solutions to each of these challenges. Their experience with complex business transactions and optimization strategies positions them perfectly to implement HEIAs into construction business's.

The Future Landscape

As HEIAs continue gaining adoption, several trends are emerging that will shape the future landscape for business acquisition managers in the home service business.

First, specialized acquisition firms focusing exclusively on HEIA-enabled construction businesses are beginning to form. These firms recognize the unique value proposition and are developing expertise specifically for this market segment.

Second, technology platforms facilitating HEIA transactions are emerging. These platforms streamline documentation, valuation, and portfolio management, making implementation significantly easier for acquisition managers and construction businesses alike that use electronic signatures.

Third, financial institutions are starting to recognize HEIAs as legitimate assets against which construction businesses can borrow from HEIA Liaison's. This creates additional leverage opportunities for acquisition managers to optimize liquid capital structures too.

For forward-thinking acquisition managers, the opportunity is clear: by helping construction businesses implement HEIAs, they can simultaneously increase business valuations and create new revenue streams through equity participation in real estate wealth.

Taking Action

Business acquisition managers interested in exploring the HEIA opportunity should begin by thoroughly understanding the legal and financial frameworks involved. This includes studying successful implementation benefits and connecting with organizations specializing in these agreements.

The next step involves identifying construction businesses that would benefit most from HEIA implementation. Ideal candidates include established operations with strong reputations for quality work but struggling with cash flow or growth limitations.

Finally, acquisition managers should develop systematic implementation approaches that can be replicated across multiple construction businesses, creating scalable value-add strategies.

The construction industry has long been characterized by thin margins and limited wealth-building opportunities. Through HEIAs, business acquisition managers now have a powerful tool to transform this dynamic, creating substantial value for themselves and the construction businesses they serve.

The revolution in construction wealth building has begun. Business acquisition managers who recognize this opportunity early stand to benefit tremendously as the approach gains wider market adoption.

Best tools for real estate financing professionals

"The Real Game Made Simple"

–A Must-Read for Loan Brokers

is more than just a book – it’s your guide to unlocking success in the real estate industry. Packed with actionable insights and real-world strategies, it’s designed to help realtors navigate challenges, build wealth, and thrive in a competitive market.

Here’s why top real estate agents are calling it a

game-changer:

✅ Deepen Your Expertise:

Learn how to align with clients' needs, understand market dynamics, and position yourself as the go-to realtor in your area.

✅ Build Wealth Smarter:

Explore innovative equity-based strategies, like HEIAs, to elevate your client relationships and close deals that benefit everyone.

✅ Avoid Common Pitfalls:

Uncover hidden industry challenges and learn how to sidestep them with confidence.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

Do I need to be a licensed loan officer to become a HEIA Liaison?

No, you don’t need a loan officer license to become a HEIA Liaison. Home Equity Invoice Agreements (HEIAs) are equity-based contracts...AKA a joint venture deed of trusts, not a traditional financial loan products, so they fall outside the scope of lending regulations when used properly. This allows professionals from diverse backgrounds—whether you're a loan broker, realtor, or contractor—to easily incorporate HEIAs as a tool into your business.

Do I need a real estate license to use HEIA?

No, you don’t need a real estate license to use or facilitate HEIA. This agreement is structured as a joint venture, not a real estate sales or brokerage contract. It allows you to work creatively and legally in the real estate market without the need for licensure.

How does HEIA differ from a traditional HELOC or cash-out refinance?

HEIA is not a loan. Unlike HELOCs or cash-out refinancing products, HEIAs don’t require homeowners to take on additional debt or monthly payments. Instead, homeowners can unlock a portion of their home’s equity by exchanging it for the equivalent contractors invoice price. This creates a win-win for contractors, homeowners, and investors while reducing friction and costs in renovations. Unless the contractor still requests a portion to be paid in cash which either the homeowner can fund or the HEIA Liaison, there are no monthly payments or interest.

What makes HEIA a great addition to my loan brokerage business?

HEIA sets you apart by offering a secured equity (fair) solution. While traditional loan products often come with strict qualifications and delays, HEIAs provide a creative financing option that works for homeowners or contractors who might not qualify for traditional loans or prefer not to increase their debt burden. This allows you to serve a broader client base and increase your income streams.

Can HEIA help me grow my business in the distressed property market?

Absolutely. Many homeowners in distressed situations struggle to qualify for traditional loans or feel trapped by limited options. HEIAs offer a unique way for them to unlock equity without cash upfront, enabling you to position yourself as a problem-solver in this proprietary niche. By providing a real alternative, you can attract and retain more clients in this lucrative market.

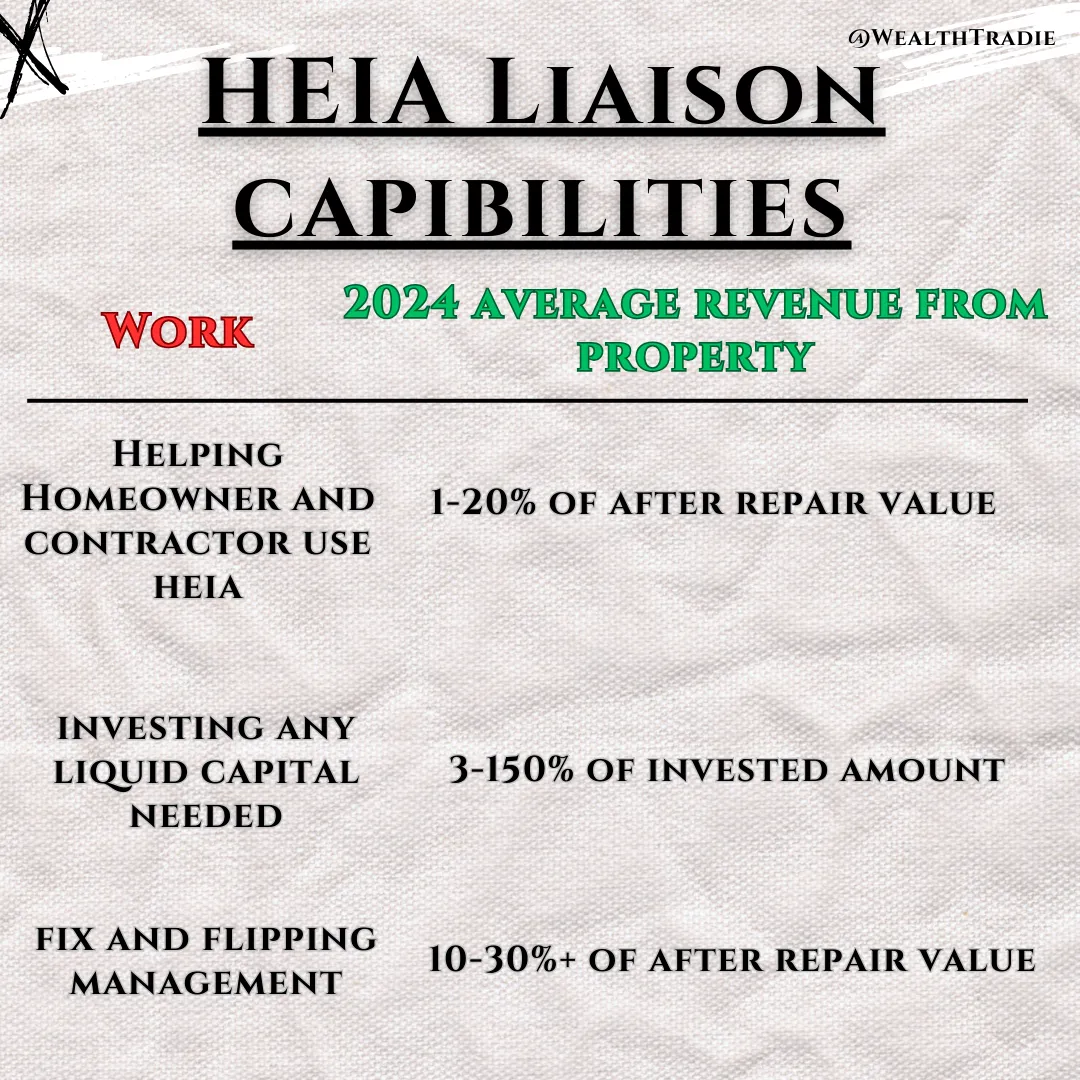

How much can I earn as a HEIA Liaison?

As a HEIA Liaison, your earnings are tied to every transaction you facilitate. With a proprietary 0.25% HEIA structure fee per use to WealthTradie, you set and earn a percentage of each HEIA deal, which can quickly add up when managing high-value real estate projects as traditional fix and flip investors do for 20% percentages in full market value properties. Combined with your existing loan brokerage income, HEIA can significantly boost your earnings.

What training and tools do I get as a HEIA Liaison?

When you become a HEIA Liaison, you’ll receive comprehensive training on how to structure, present, and close HEIA deals. You’ll also gain access to exclusive tools like the Wealth Multiplier Calculator and proprietary HEIA contracts, which make it easy to implement this model in your business right away.

How quickly can I start earning with HEIAs?

Once you complete your training and receive your HEIA Liaison license, you can start facilitating deals immediately. thanks to the simplicity and appeal of this model.

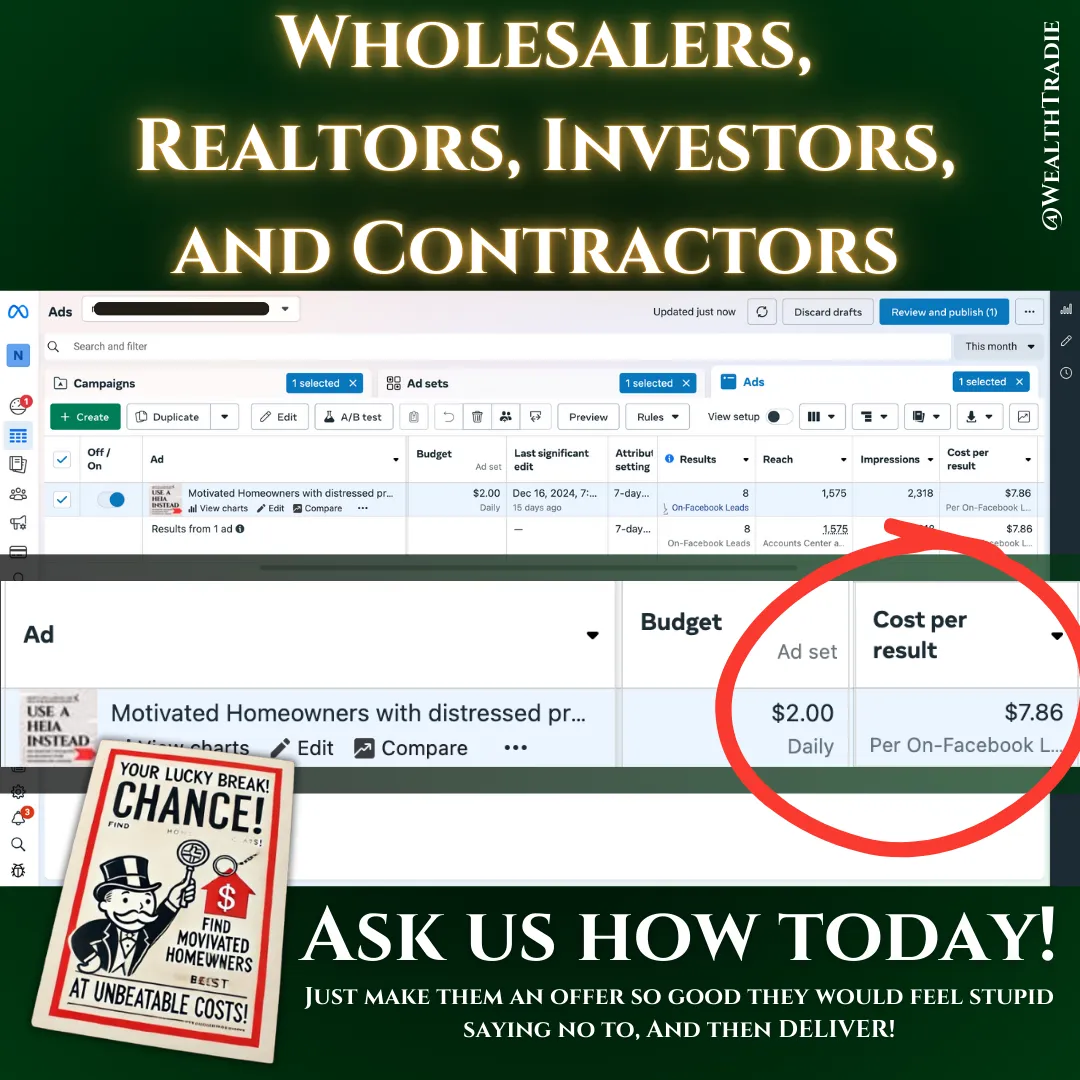

Are there marketing resources to help me attract clients?

Yes, WealthTradie provides you with proven marketing resources, templates, and strategies to help you attract homeowners, contractors, and investors. You’ll learn how to position yourself as an equity expert and build a steady pipeline of clients who value creative real estate solutions.

Will I be competing with other HEIA Liaisons in my area?

The HEIA model is still in its early stages of market adoption, meaning the market is wide open. By becoming a HEIA Liaison now, you’ll gain first-mover advantage in your region, positioning yourself as a leader in this emerging market. This unique offering will help you stand out from competitors who only offer traditional loan products.

30 Day No-Questions Money Back Guarantee

Copyright 2026 | WealthTradie™ | Privacy Policy | Terms & Conditions