"Smarter Hard Money through simple aligned leverage for all"

The Master strategy for Loan Brokers

Boost Your Loan Brokerage Business with the HEIA Master License

Unlock Creative Real Estate Equity Solutions and Outperform the Competition

Revolutionize your offerings with innovative equity-based financing that empowers homeowners, contractors, and investors while boosting your revenue.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

Contractors, homeowners, and investors lose out because equity is locked behind cash-based models

Struggling to Attract and Retain Homeowners Ready to Sell?

As a loan broker, the market is getting tougher every day. Homeowners are inundated with financing options: from traditional HELOCs and cash-out refinancing to unconventional hard money loans. The competition is fierce, and offering the same products as every other broker makes it nearly impossible to stand out. Add the challenge of working with homeowners in distressed situations or those with limited liquidity, and it can feel like an uphill battle to consistently attract and retain profitable clients.

Home Equity Invoice Agreements (HEIA).

Instead of relying solely on cash-based lending products, are a revolutionary, equity-based solution. By helping homeowners unlock their home’s value without taking on additional debt. Solving real problems instead of pitching the same old options for renovations. Homeowners trusted it because it's a way to access equity without the barriers of traditional loans.

With HEIA, you’ll not only differentiate yourself in the competitive loan market but also break into lucrative niches like distressed property investing. This proven method helps you connect with homeowners in meaningful ways, offering them creative solutions that eliminate friction and add real value. Whether it’s helping a homeowner fund renovations without upfront cash or giving contractors a stake in their work, HEIA sets you apart as an innovative problem-solver.

By adding HEIA to your portfolio, you’ll not only stand out but also create lasting client relationships, increase referrals, and grow your revenue in ways traditional financing simply can’t match.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Create long-term client trust by solving equity challenges traditional loans can’t address

HERE’S HOW IT WORKS

Expand Your Portfolio

Offer HEIAs as a non-traditional equity solution alongside loans and refinancing.

Maximize Earnings

Earn from both your existing business and HEIA transactions, thanks to our innovative 0.25% contract fee structure.

Capture New Markets

Work with contractors, real estate investors, and homeowners who need creative solutions.

Don’t let traditional models limit your business growth. Join the ranks of forward-thinking loan brokers and real estate professionals transforming the industry

30 Day No-Questions Money Back Guarantee

Unlock the $36 Trillion Home Equity Market

Stand Out in a Competitive Market with Home Equity Invoice Agreements (HEIAs)

Before / Old Way

Saturated Market: High competition makes it difficult to stand out.

Limited Options: Traditional home equity loans and HELOCs don’t work for every client.

Customer Frustration: Homeowners face strict loan requirements, delays, and hidden costs.

Missed Opportunities: Brokers miss out on untapped equity markets because traditional financing doesn’t cover every need.

After / New Way

Creative Financing: Offer homeowners equity access without loans, unlocking opportunities for those who don’t qualify for Financial products.

Unique Selling Point: Differentiate yourself with HEIAs, a proprietary equity solution tool.

Increased Revenue Streams: Earn commissions on HEIA deals while helping homeowners and contractors achieve their goals.

Faster Transactions: Skip the delays of traditional loan approvals and close deals quickly.

30 Day No-Questions Money Back Guarantee

🔥 Exclusive 50% Discount for Licensed Loan Officers 🔥

Your Loan Officer License Just Became a Key to Unprecedented Wealth

—But Only for a Limited Time!

As a licensed Loan Officer, you’re already a trusted expert in your field. Now, WealthTradie invites you to elevate your career with the HEIA Liaison License, exclusively available at 50% off for a limited time.

This is your opportunity to:

✅Earn 100% revenue share by helping homeowners and contractors leverage Home Equity Invoice Agreements (HEIAs).

✅ Offer innovative equity-based financing solutions that deepen trust with buyers and sellers.

✅ Stand out in your market as a Loan Broker who provides next-level services.

Why is this offer exclusive?

We want to empower licensed Loan Officers like YOU to lead the charge in transforming the equity industry.

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Loan Brokers

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

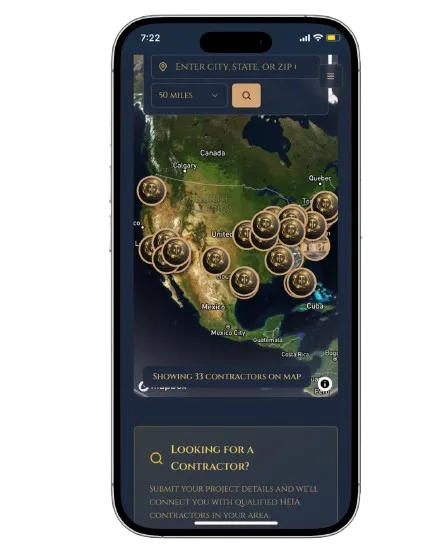

Connect with a contractor today!

We wouldn't be at the tip of the spear leading this movement without understanding how hard it is to teach an old dog (investors) new tricks. don't believe our shiny red dress, connect with the boots on the ground and see for yourself with your current properties. WE guarantee that you will be able to see the difference and want your license on your next project.

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Your All-in-One Toolbox for Scaling Success

The WealthTradie Apprentice Membership provides access to premium tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. Additionally, gain access to an exclusive support network of real estate professionals to help you troubleshoot and optimize your strategies.

Bonus 2: Pro Membership

Master the Art of Real Estate Success

The WealthTradie Pro Membership gives you step-by-step training to implement HEIA in your business. Learn how to attract homeowners, negotiate equity-based deals, and create win-win solutions for sellers and contractors alike. From beginner-friendly guidance to advanced deal strategies, this program equips you with everything you need to grow your business confidently.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn While You Build Your Business

As a 100% revenue share affiliate, you can introduce HEIA and WealthTradie memberships to other real estate professionals while keeping 100% of the referral income. This provides an additional revenue stream that grows alongside your core real estate business.

These bonuses are designed to help you scale faster, work smarter, and earn more. With the WealthTradie Apprenticeship, Pro Membership, and Affiliate Program, you’ll have everything you need to dominate your market.

30 Day No-Questions Money Back Guarantee

Revolutionary

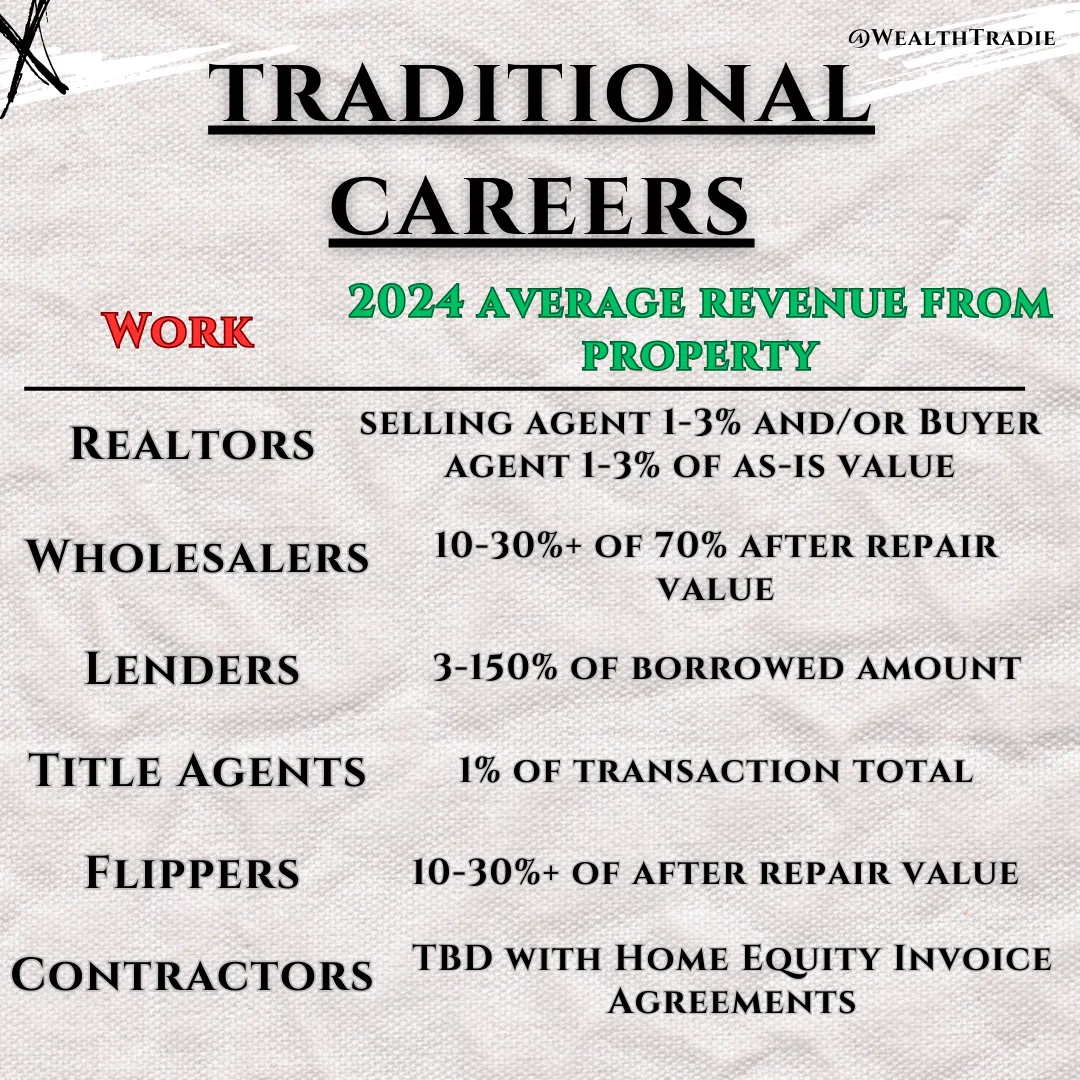

How others are utilizing HEIA

How Contractors Finally Access Real Estate Wealth

I watched my dad build million-dollar homes for other people while we lived in a modest house across town.

The disconnect was obvious. Every swing of his hammer added thousands to someone else's net worth. Every perfect joint, every custom cabinet, every detail that made properties sell for top dollar.

But at the end of the day, he got paid a fixed fee and walked away.

That childhood observation sparked something that would take three decades to fully understand. Growing up in the family construction business, serving as a Marine, then diving into real estate investing, I kept seeing the same pattern everywhere.

Contractors create the value. Property owners capture the wealth.

The construction industry represents a $1.27 trillion market with 8.2 million workers. Average hourly wage? $35.21. Meanwhile, the average homeowner sits on $266,000 in equity.

The math tells the story. Contractors build wealth but rarely own it.

The Payment Revolution You Haven't Heard About

Home Equity Invoice Agreements (HEIAs) change everything.

Instead of getting paid in cash, you get paid in property equity. Your invoice becomes a percentage of the home's value. When the property appreciates, so does your payment.

You're not just a contractor anymore. You're a real estate investor.

Most contractors already offer flexible payment options. "I need this much down, I can take monthly payments." HEIAs work the same way, but with bank-level security tied directly to the property.

The difference? You're stepping into real estate wealth instead of staying trapped in the cash-only cycle.

How One Contractor Acquired Commercial Real Estate Without Buying It

Our first HEIA was a commercial short-term rental property. The owner wanted to add three units to increase rental income. Materials were already on-site.

All he needed was labor.

The contractor didn't need to front material costs. The property owner didn't want to sell for four years. Perfect setup for an equity agreement.

Here's what happened: The contractor invoiced for equity on a $2 million appraised property. Instead of paying a $2 million acquisition price, he simply attached his labor value to the property's equity.

Four years of appreciation at market rates. Four years of long-term capital gains treatment. The contractor became a commercial real estate investor without the typical barriers.

Even fix-and-flip investors can't match this efficiency. Traditional real estate investing requires acquisition costs, general partners, fund models, and property management. HEIAs eliminate all of that.

Getting Started With WealthTradie

The setup process is straightforward. Visit contractor.wealthtradie.com and fill out the form. If you prefer, print it and email it back.

The website includes extensive resources, blog articles, and case studies showing exactly how contractors use HEIAs to build wealth.

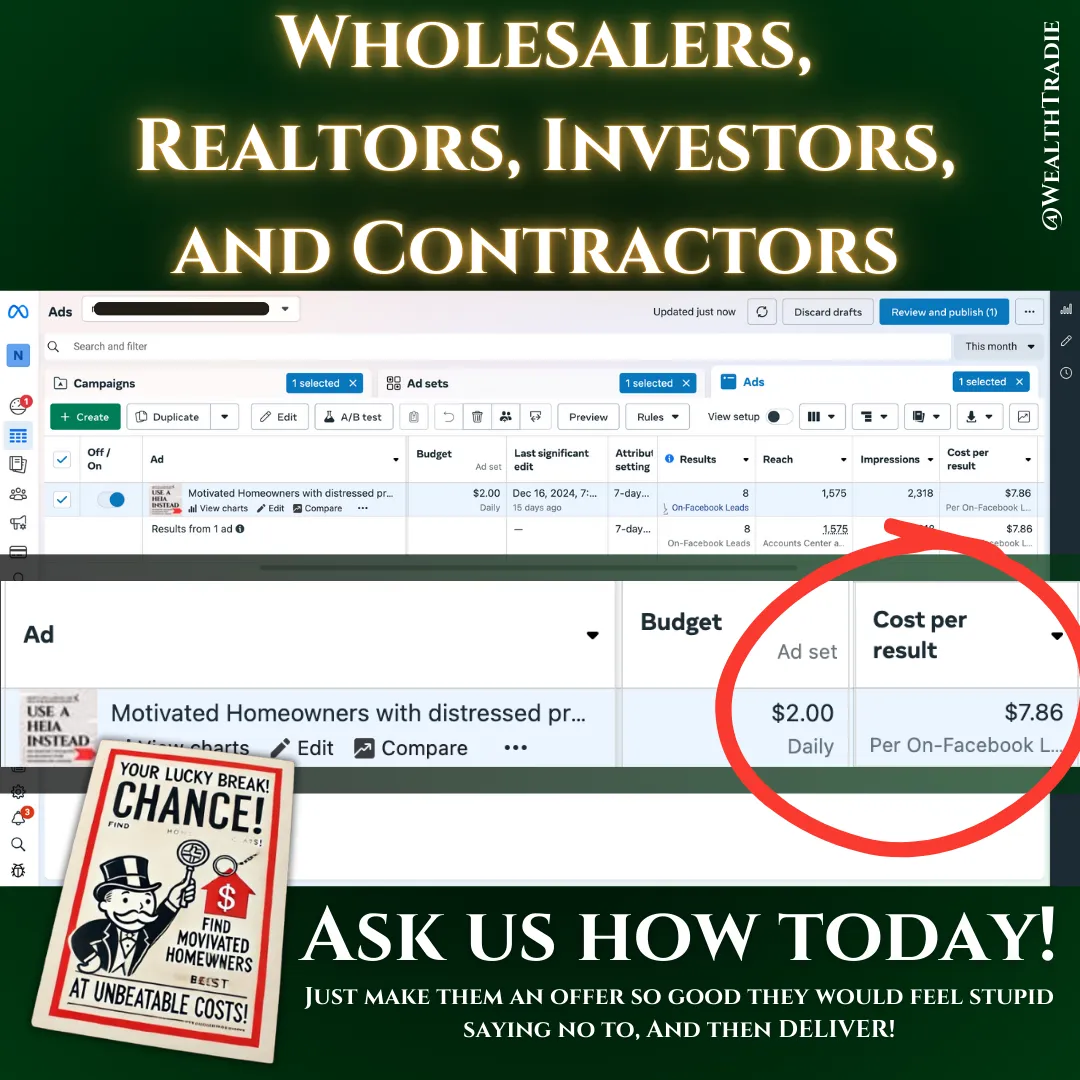

WealthTradie lists your business on their platform, connecting you with homeowners and investors ready to offer equity instead of cash. Free leads. Qualified prospects. People who understand the value of equity-based payments.

The marketing materials are already built. Templates, designs, posts, infographics. Everything you need to explain to clients: "You can pay me with your home's equity instead of cash."

No more stumbling through explanations or building marketing campaigns from scratch.

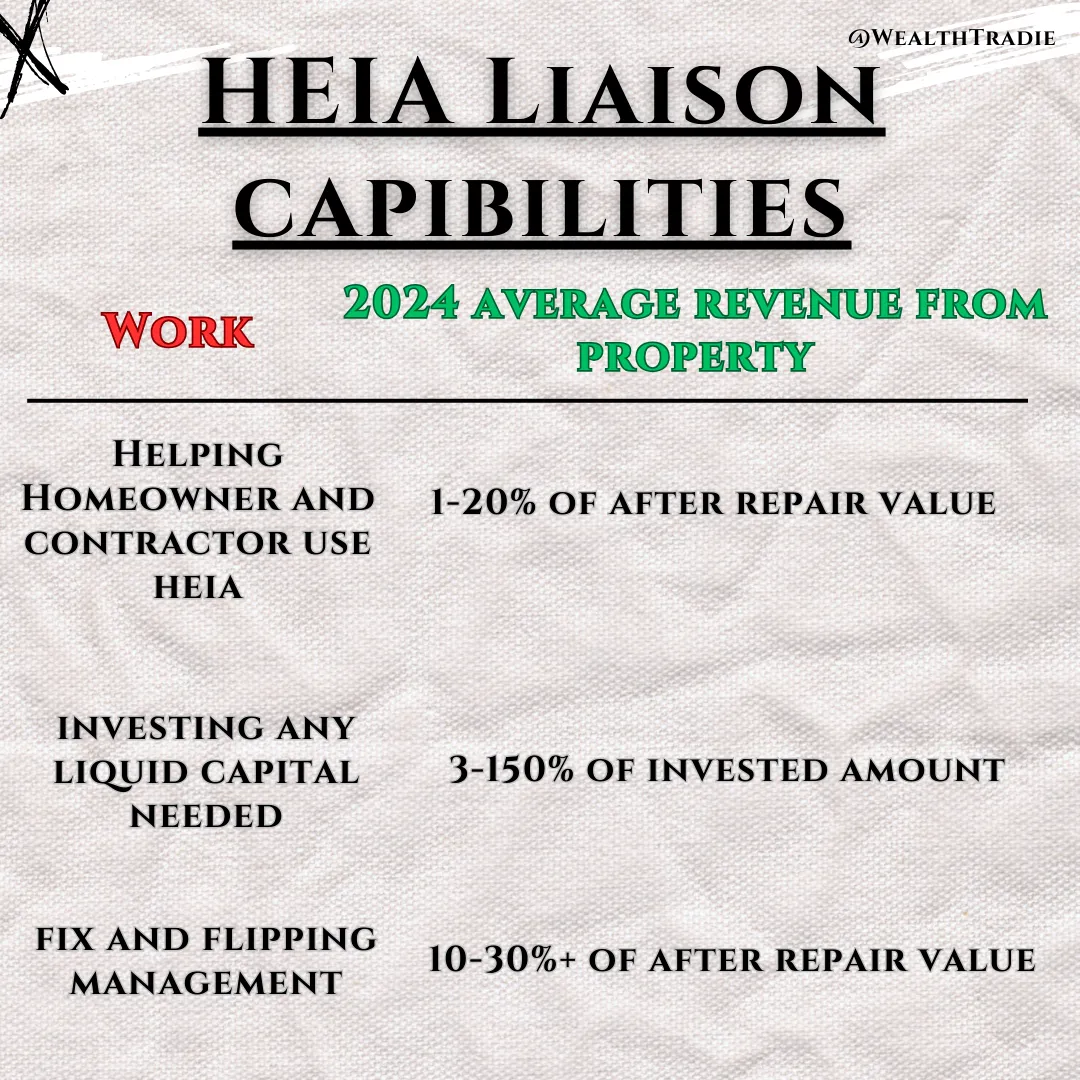

Building Your Equity Portfolio

Think like any investor. You want short-term and long-term plays.

Short-term strategy: Target fix-and-flip investors and real estate agents. Complete the work, wait for the property to sell, get paid out. Timeline: one to three months.

Long-term strategy: Focus on homeowners planning to hold for years. You get appreciation plus capital gains tax advantages after the one-year mark. That's roughly 17% tax savings compared to ordinary income.

The home equity market securitized $1.1 billion in the first 10 months of 2024. Institutional backing is strong. The infrastructure exists.

Start offering homeowners flexible payment options. "I can offer you this through the security of your property's equity. We both gain equity, capital gains, and tax savings."

Simple conversation. Powerful results.

Overcoming the Familiarity Challenge

The biggest obstacle? Homeowners hear "equity" and think banks, debt, interest, origination fees.

HEIAs strip all of that away. No monthly payments. No interest. No origination fees. Just pure equity sharing based on property value.

You're giving homeowners the key to their equity without the traditional banking complications.

WealthTradie provides comprehensive education for both contractors and homeowners. Free real estate books, apprentice programs, and an eight-hour online course explaining how HEIAs benefit everyone involved.

The upcoming Home Equity Invoice Agreement Field Manual will be the definitive guide for implementation.

The Five-Year Vision

Within five years, HEIAs will be as well-known as HELOCs in the real estate industry.

Not just construction. The entire real estate ecosystem will adopt this model. When real estate professionals surrounding construction start using HEIAs, contractors will naturally follow.

Instead of third-party banks and lenders controlling flexible payment options, contractors will offer in-house equity agreements. Homeowners and investors will expect this option.

The goal: Redistribute wealth to the working class without requiring new skills or knowledge. Use existing construction expertise to build real estate portfolios.

For contractors looking to enter real estate investing, HEIAs represent the fastest and easiest path. Even existing fix-and-flip investors can streamline their operations through equity-based agreements.

You're not just building homes anymore. You're building wealth.

The bridge between construction and real estate finally exists. Start here.

Best tools for real estate financing professionals

"The Real Game Made Simple"

–A Must-Read for Loan Brokers

is more than just a book – it’s your guide to unlocking success in the real estate industry. Packed with actionable insights and real-world strategies, it’s designed to help realtors navigate challenges, build wealth, and thrive in a competitive market.

Here’s why top real estate agents are calling it a

game-changer:

✅ Deepen Your Expertise:

Learn how to align with clients' needs, understand market dynamics, and position yourself as the go-to realtor in your area.

✅ Build Wealth Smarter:

Explore innovative equity-based strategies, like HEIAs, to elevate your client relationships and close deals that benefit everyone.

✅ Avoid Common Pitfalls:

Uncover hidden industry challenges and learn how to sidestep them with confidence.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

Do I need to be a licensed loan officer to become a HEIA Liaison?

No, you don’t need a loan officer license to become a HEIA Liaison. Home Equity Invoice Agreements (HEIAs) are equity-based contracts...AKA a joint venture deed of trusts, not a traditional financial loan products, so they fall outside the scope of lending regulations when used properly. This allows professionals from diverse backgrounds—whether you're a loan broker, realtor, or contractor—to easily incorporate HEIAs as a tool into your business.

Do I need a real estate license to use HEIA?

No, you don’t need a real estate license to use or facilitate HEIA. This agreement is structured as a joint venture, not a real estate sales or brokerage contract. It allows you to work creatively and legally in the real estate market without the need for licensure.

How does HEIA differ from a traditional HELOC or cash-out refinance?

HEIA is not a loan. Unlike HELOCs or cash-out refinancing products, HEIAs don’t require homeowners to take on additional debt or monthly payments. Instead, homeowners can unlock a portion of their home’s equity by exchanging it for the equivalent contractors invoice price. This creates a win-win for contractors, homeowners, and investors while reducing friction and costs in renovations. Unless the contractor still requests a portion to be paid in cash which either the homeowner can fund or the HEIA Liaison, there are no monthly payments or interest.

What makes HEIA a great addition to my loan brokerage business?

HEIA sets you apart by offering a secured equity (fair) solution. While traditional loan products often come with strict qualifications and delays, HEIAs provide a creative financing option that works for homeowners or contractors who might not qualify for traditional loans or prefer not to increase their debt burden. This allows you to serve a broader client base and increase your income streams.

Can HEIA help me grow my business in the distressed property market?

Absolutely. Many homeowners in distressed situations struggle to qualify for traditional loans or feel trapped by limited options. HEIAs offer a unique way for them to unlock equity without cash upfront, enabling you to position yourself as a problem-solver in this proprietary niche. By providing a real alternative, you can attract and retain more clients in this lucrative market.

How much can I earn as a HEIA Liaison?

As a HEIA Liaison, your earnings are tied to every transaction you facilitate. With a proprietary 0.25% HEIA structure fee per use to WealthTradie, you set and earn a percentage of each HEIA deal, which can quickly add up when managing high-value real estate projects as traditional fix and flip investors do for 20% percentages in full market value properties. Combined with your existing loan brokerage income, HEIA can significantly boost your earnings.

What training and tools do I get as a HEIA Liaison?

When you become a HEIA Liaison, you’ll receive comprehensive training on how to structure, present, and close HEIA deals. You’ll also gain access to exclusive tools like the Wealth Multiplier Calculator and proprietary HEIA contracts, which make it easy to implement this model in your business right away.

How quickly can I start earning with HEIAs?

Once you complete your training and receive your HEIA Liaison license, you can start facilitating deals immediately. thanks to the simplicity and appeal of this model.

Are there marketing resources to help me attract clients?

Yes, WealthTradie provides you with proven marketing resources, templates, and strategies to help you attract homeowners, contractors, and investors. You’ll learn how to position yourself as an equity expert and build a steady pipeline of clients who value creative real estate solutions.

Will I be competing with other HEIA Liaisons in my area?

The HEIA model is still in its early stages of market adoption, meaning the market is wide open. By becoming a HEIA Liaison now, you’ll gain first-mover advantage in your region, positioning yourself as a leader in this emerging market. This unique offering will help you stand out from competitors who only offer traditional loan products.

30 Day No-Questions Money Back Guarantee

Copyright 2026 | WealthTradie™ | Privacy Policy | Terms & Conditions