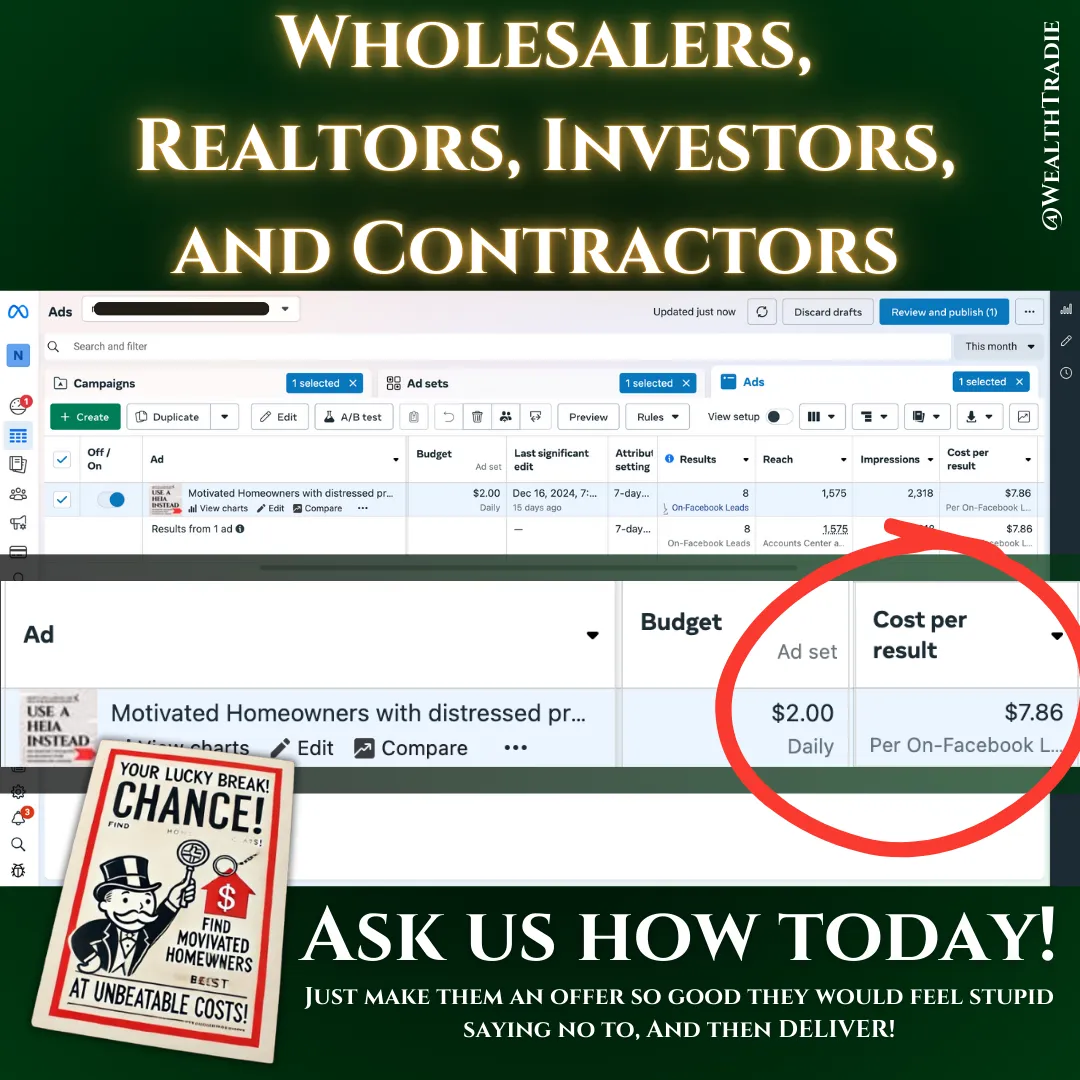

The Master strategy for Wholesalers

Revolutionize Real Estate Wholesaling with the HEIA Liaison License

Take your real estate wholesaling to the next level with the HEIA Liaison License. Simplify deals, grow your network, and maximize profits with equity-based solutions that transform how property assignments are executed for maximum Leverage and value.

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

Close More Deals Faster

Why Real Estate Wholesalers Are Switching to HEIA

With HEIA (Home Equity Invoice Agreements), you can solve property capital issues that often delay or derail wholesaling or real estate deals. HEIA gives property owners the flexibility to unlock their equity, ensuring smoother transactions and faster closings for full market values.

Maximize Your Profit Potential

Earn equity-based payouts in addition to traditional assignment fees on full property value.

Expand your deal scope by working with properties that require capital solutions.

Position yourself as the go-to wholesaler who solves tough problems for property owners to win the most.

Gain a Competitive Edge in the Market

By offering HEIA to sellers and contractors, you’ll differentiate yourself as an innovative wholesaler who provides real solutions. Stand out from the crowd and build a reputation for getting deals done, no matter the obstacles.

HERE’S HOW IT WORKS

How HEIA Works for Wholesalers

Identify Properties in Need of Financing Solutions

Target properties where equity can be used as a tool to cover renovation costs or other obligations.

Present HEIA to Sellers and Contractors

Showcase how HEIA allows sellers to unlock equity without upfront cash and provides contractors with more favorable terms that investors or lenders would profit from usually.

Execute the Deal and Earn More

Close your wholesaling deals faster while earning additional income from equity-based arrangements that is a win-win for all.

Key Benefits of the HEIA Liaison License

Build Stronger Relationships

By leveraging HEIA, you’ll develop a reputation as a problem-solver, attracting more repeat business from Contractors and sellers who trust you to provide innovative solutions.

Expand Your Deal Volume

With HEIA, you can take on deals that other wholesalers pass up, such as properties requiring renovations that sellers struggle with loosing out on their profit. Expand your deal volume and boost your revenue.

Diversify Your Income Streams

Earn from assignment fees, equity-based payouts, and property appreciation.

Create new opportunities with properties that other wholesalers overlook do to homeowners wanting full market profits.

Don’t miss out on the chance to revolutionize your wholesaling business. With the HEIA Wholesaler License, you’ll unlock new opportunities, close deals faster, and earn more. Take the first step toward maximizing your potential today!

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold You Back

Transform Your Wholesaling Game with The

HEIA Liaison License

Before / Old Way

Frustration with Limited Capital: Struggling to secure cash buyers quickly enough to close deals at a high enough price.

Risk of Losing Deals: Fear of losing properties under contract due to financing delays or backing out buyers.

Intense Competition: Getting outbid or undercut in hot markets by cash-heavy investors with large ad spend.

High and Long Lead Costs: Spending thousands on marketing campaigns with long wait times for seller responses.

Limited Scalability: Cash constraints and dependency on hard money lenders restrict the number of deals you can handle.

After / New Way

Capital-Free Deals: Use HEIA to structure deals without needing immediate cash or relying solely on buyer funding.

Lock in Deals Faster: HEIA agreements provide flexibility to structure deals and eliminate investor buyer dependency

Unique Selling Proposition: Leverage HEIA to offer property owners a new, equity-based alternative to wholesaling.

More Efficient Leads: Use HEIA to close deals faster and create repeatable win-win offers that attract motivated sellers.

Unlimited Deal Flow: Structure more deals simultaneously by replacing cash with creative equity-based agreements.

30 Day No-Questions Money Back Guarantee

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

Connect with a contractor today!

We wouldn't be at the tip of the spear leading this movement without understanding how hard it is to teach an old dog (investors) new tricks. don't believe our shiny red dress, connect with the boots on the ground and see for yourself with your current properties. WE guarantee that you will be able to see the difference and want your license on your next project.

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Essential Tools to Close More Deals

Gain access to cutting-edge tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. With these resources, you’ll be able to analyze, negotiate, and execute HEIA deals more efficiently than ever before.

Bonus 2: Pro Membership

Learn to Structure Deals with Confidence

This comprehensive program teaches you how to use HEIA agreements to close deals faster, create win-win arrangements, and unlock opportunities that traditional wholesaling can’t touch. From negotiation strategies to equity-based structures, you’ll gain the skills needed to transform your wholesaling business by leveraging other real estate professionals needs.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn as You Build Your Business

Use your network to promote HEIA solutions and WealthTradie memberships to other wholesalers and real estate professionals. Keep 100% of the revenue earned through your referrals, providing an additional income stream while scaling your core business.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

Home Equity Invoice Agreements Transform Foreclosure Investing

Real estate investors face a common challenge when dealing with foreclosure properties: finding the right balance between risk, capital requirements, and profit margins. The traditional approach of purchasing distressed properties outright, renovating, and reselling them comes with significant risks and capital demands. But what if there was a more efficient way to leverage foreclosure opportunities while minimizing risk and maximizing returns?

Enter the Home Equity Invoice Agreement (HEIA), an innovative financing structure developed by WealthTradie that's revolutionizing how investors approach foreclosure properties. This breakthrough solution allows investors to convert a contractor's monetary invoice into an equity percentage of a property, unlocking value without the need for significant capital investment.

Understanding Home Equity Invoice Agreements

At its core, a HEIA converts a contractor's monetary invoice into a property's equivalent equity percentage. This allows all parties to pay for renovations with the after-repair equity value instead of cash. Unlike traditional financing options such as HELOCs or hard money loans, a HEIA functions as a joint venture deed of trust or novation agreement that gives contractors an equity stake in the property rather than just cash payment.

"A HEIA is a joint venture deed of trust or in essence a novation agreement that allows a contractor's cash invoice to be converted to an equity percentage," explains Shane Walsh, founder of WealthTradie. "The traditional route of HELOCs, hard money, or high-taxed cash transactions is avoided, and the savings of 3-30% is now passed on to the homeowner, contractor, or HEIA liaison at their control instead of a third-party bank or lender's control."

This proprietary protected contract and structure is fundamentally changing how renovation costs are handled in real estate transactions, especially for properties in or approaching foreclosure.

Step-by-Step Implementation During Foreclosure Periods

Implementing a HEIA during a foreclosure redemption period follows a specific process:

1. Identify the opportunity: Target properties that are facing foreclosure, in a redemption period, or owned by homeowners needing to downsize but requiring repairs before selling.

2. Connect the parties: A HEIA Liaison (typically a real estate investor, agent, wholesaler, or general contractor) connects the homeowner with a contractor willing to postpone payment until the renovated property sells.

3. Create the estimate: The contractor provides a detailed estimate breaking down hard costs and business costs.

4. Convert to equity percentage: The liaison helps convert these monetary figures into an equivalent equity percentage based on the property's projected after-repair value, using licensed professionals' assessments.

5. Document and record: The HEIA is signed and officially recorded, securing everyone's profits with both deed and material lien security.

6. Complete renovations: The contractor performs the agreed-upon work.

7. Sell the property: The renovated property is sold at full market value before the foreclosure or redemption period expires.

Even if the property completes the foreclosure process, the HEIA's dual protection mechanism ensures that contractors and liaisons recover at minimum the hard costs of the value added to the property when it transfers to a new owner.

The Dual Protection Mechanism

What makes HEIAs particularly powerful is their dual-layer security system that protects all parties' investments without requiring full property ownership. This mechanism consists of two key components:

Deed Position: Recorded Equity Security

HEIA participants record their equity position through a notarized and recorded instrument, such as a Deed of Trust, Performance Deed, or Equity Agreement Lien (depending on the state). This puts the contractor or HEIA Liaison in an official position on title, subordinate only to existing primary liens like mortgages.

In the event of a foreclosure, this recorded position:

• Gives notice to all parties (lenders, buyers, title companies) that an equity claim exists

• Creates a right to be paid out through a reconveyance or lien release process

• Protects the contractor's or liaison's share of post-improvement equity

Material Lien Rights: Value-Backed Legal Leverage

Separate from the deed, the HEIA relies on material invoice documentation that provides:

• A legally enforceable record of labor and materials contributed

• A foundation for a Mechanic's Lien or Materialman's Lien

• An indisputable record that improvements added real, appraised value

This gives HEIA participants another layer of protection: even if the deed position is challenged, the value created through services remains protected by lien law.

The combination of these two security mechanisms allows participants to avoid full property ownership while still securing their portion of created equity, receive payment before homeowner profits (even in a forced sale), and operate within standard property law protections.

Real Numbers: How HEIAs Work in Practice

To understand the financial benefits of HEIAs, consider this practical example:

A property with a full market value of $1,000,000 needs $100,000 in renovations. The homeowner faces foreclosure proceedings on their first mortgage of $500,000 but cannot afford the necessary repairs.

In a traditional scenario, an investor might offer $550,000 cash, giving the homeowner $50,000 while taking on all renovation costs and risks. The investor would likely use hard money or private capital costing 3-10% of the combined purchase and renovation costs ($650,000).

With a HEIA approach:

1. The investor offers cashless renovations without purchasing the property outright

2. The 3-10% that would normally go to capital providers is redirected to the homeowner or contractor

3. The contractor's $100,000 renovation invoice converts to 10% of the property's $1,000,000 after-repair value

4. The agreement is secured by the HEIA, ensuring all parties receive their fair share only after work completion and property sale

This structure provides additional benefits through potential tax savings, as ordinary income tax can become capital gains tax. Most importantly, homeowners typically receive two to three times the amount they would from traditional cash offers, giving them more resources to move into a new property and avoid future foreclosure situations.

Scaling Your Business with HEIAs

For investors, the HEIA model offers significant advantages for scaling operations:

Reduced capital requirements: Capital needs are minimized or eliminated for the hard costs of property improvements. The contractor doing the work determines these costs, creating built-in self accountability for quality and pricing.

Lower risk profile: Investors don't take full ownership of the property, avoiding the risks associated with purchasing capital, mortgages, and property management responsibilities.

Increased deal flow: With reduced capital requirements and responsibilities, investors can take on more projects simultaneously.

Focus on core competencies: This structure allows investors to concentrate on recognizing opportunities and creating value by facilitating relationships between subject matter experts like contractors and appraisers.

By functioning as HEIA Liaisons, investors can leverage their market knowledge and networking abilities without tying up significant capital in each project.

Avoiding Common Pitfalls

While HEIAs offer numerous advantages, there are potential pitfalls to avoid:

Timing miscalculations: The most common mistake is waiting too long to start renovations. Weather delays, material shortages, or unexpected issues can push timelines beyond foreclosure deadlines.

Communication failures: Ensure all parties clearly understand the scope of work, timeline, and projected sale period. Homeowners must have complete information before agreeing to a HEIA over other options.

Legal oversights: Know your state and county laws regarding foreclosures, liens, and deeds to fully understand security measures and risks. Treat all real estate deadlines as worst-case scenarios and develop contingency plans.

Back-up planning: Always have a refinancing option or potential buyer ready to purchase after renovations to prevent foreclosure from finalizing and potentially compromising everyone's interests.

Material Verification and Quality Assurance

A critical aspect of the HEIA process is ensuring that promised value is actually delivered. This happens through a structured verification process:

1. The scope of work precisely outlines the materials, designs, permits, and other costs needed to add value to the property.

2. To "Perfect" the HEIA equity stake, all parties must sign a completion of work document, confirming the work is actually completed. This protects homeowners from paying for unfinished work.

3. Foreclosure clauses in the HEIA protect contractors and liaisons, guaranteeing at minimum the hard costs of work even if the property sells for less than expected.

4. All parties must agree to the licensed real estate agent's competitive market analysis or licensed appraisal value and risk adjustment before work begins.

The HEIA structure naturally attracts higher-quality contractors willing to postpone payment, as they have skin in the game. This self-accountability reduces risk by aligning financial incentives among all parties, even banks and lenders.

Flexible Equity Structures

Unlike standardized financing options, HEIAs offer remarkable flexibility in equity distribution. The equity percentage allocated to contractors and liaisons varies based on multiple factors:

• The property's condition and foreclosure timeline

• Risk levels and market conditions

• Services provided by each party

• Capital contributions (if any)

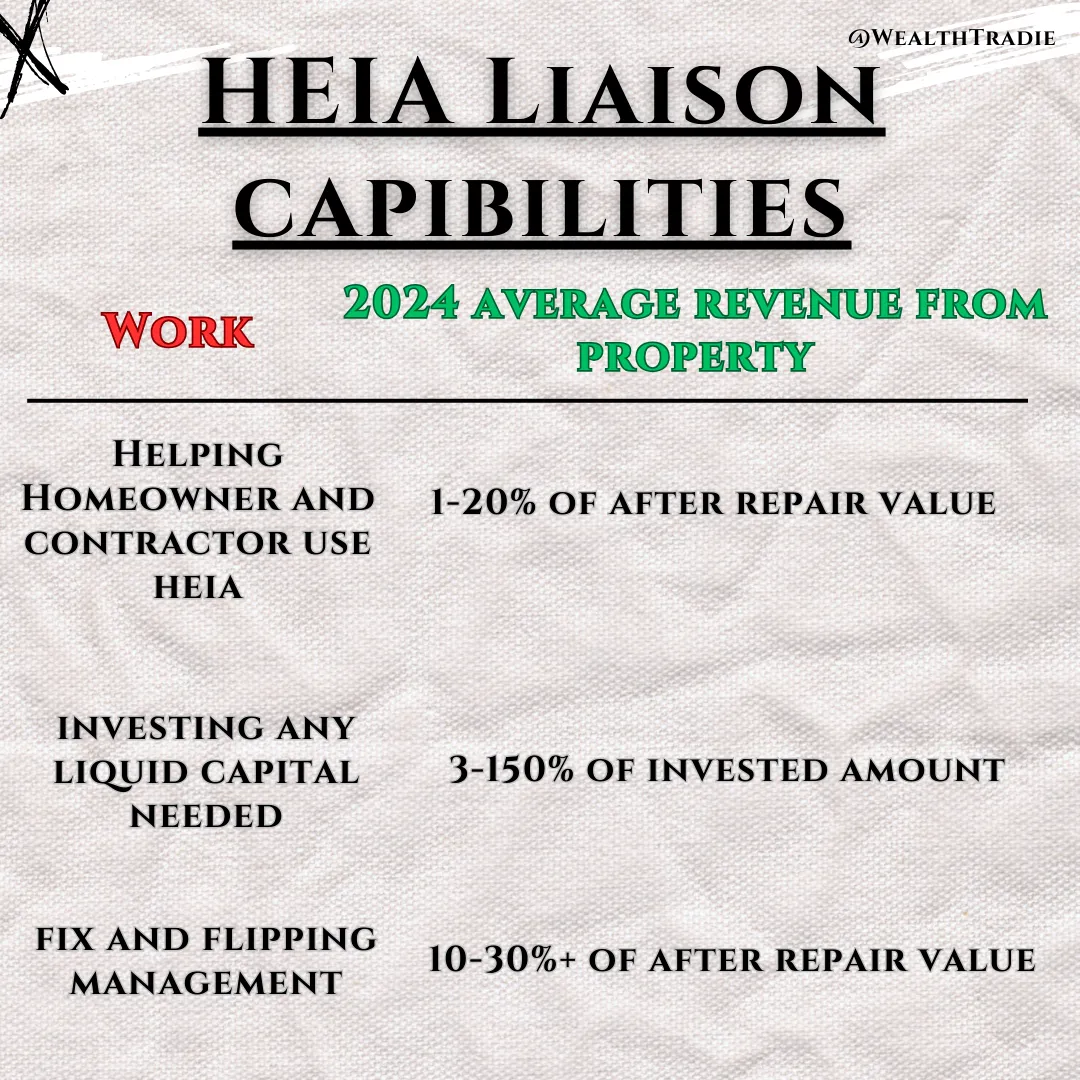

For example, a higher-risk property with less than six months before foreclosure finalization will typically command a higher equity percentage for contractors and liaisons. A liaison simply connecting parties might receive less than 1% of the equity, while one who provides multiple services could earn 10-20%. In development projects, liaisons might take up to 80% of the equity.

The HEIA provides transparency by clearly documenting how equity is allocated based on actual value contribution, making real estate transactions more equitable for all involved.

Advantages Over Other Creative Financing Methods

When compared to other creative financing approaches like subject-to deals or wraparound mortgages, HEIAs offer distinct advantages for foreclosure properties. While subject-to and wraparound mortgages typically require upfront capital to satisfy impending foreclosure obligations, HEIAs can reduce or eliminate this initial capital requirement.

HEIAs also provide faster value capture than the gradual appreciation homeowners must wait for with subject-to deals. Though not as quick as a cash offer, HEIAs typically generate much higher profits for homeowners, contractors, and investors by reducing costs associated with renovations or repairs, transaction, and capital costs. All work that would eventually need to be done regardless of the financing method.

For homeowners facing foreclosure, the HEIA represents a lifeline that traditional financing cannot match with outdated real estate strategies. Instead of walking away with minimal proceeds from a distressed sale, they can capture a significantly larger portion of their property's true market value without needing to qualify for new financing or trust in conventional novation agreements with less accountable contractor and investors.

By implementing Home Equity Invoice Agreements in foreclosure situations, real estate investors can transform their business model, reduce capital requirements, minimize risk, and create win-win scenarios that benefit all parties involved. This innovative approach not only helps individual transactions succeed but enables investors to scale their operations more effectively than traditional fix-and-flip or distressed property investing models ever could. The right path has always been an equitable one in the game.

Master the Strategies That Make Wholesaling More Profitable and Scalable

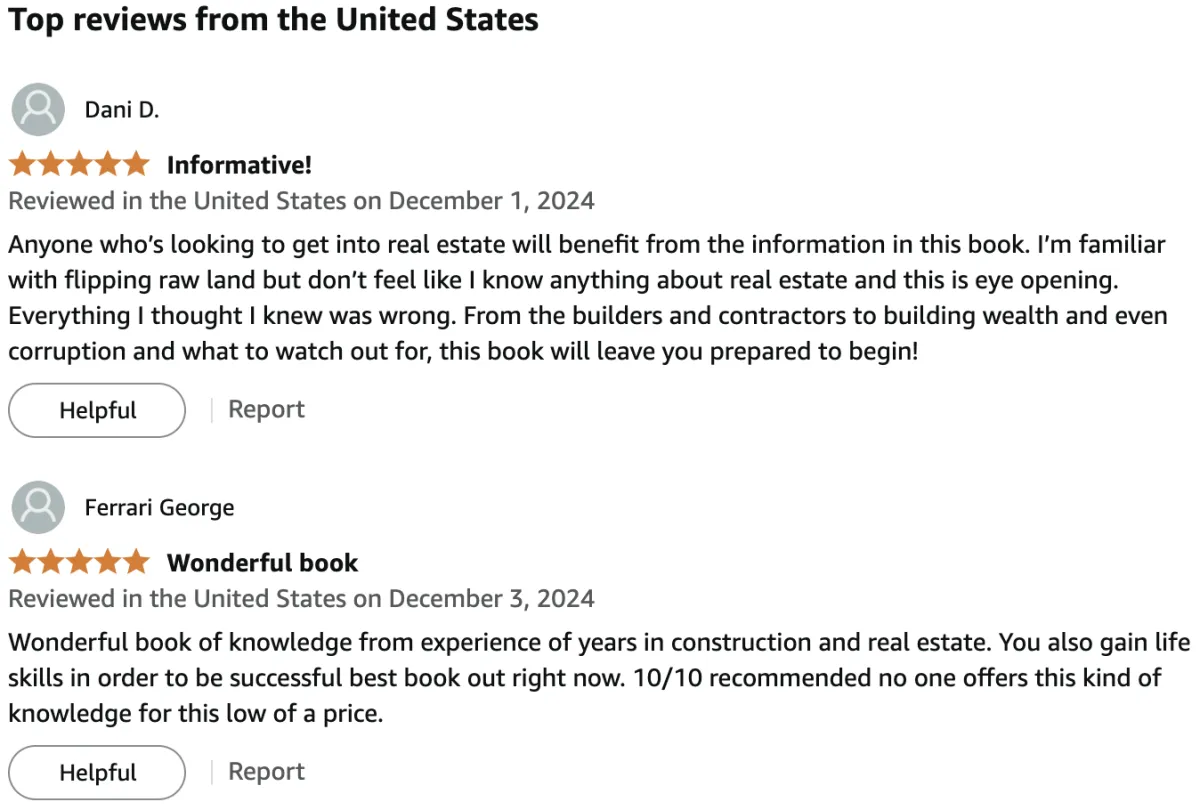

"The Real Game Made Simple"

–A Must Have for Wholesalers

Whether you’re new to the game or a seasoned professional, this book equips you with the tools to scale your business and maximize profitability.

Here’s what makes it a game-changer for wholesalers:

✅ Close Deals Smarter:

Learn how to leverage Home Equity Invoice Agreements (HEIAs) to increase your deal flow and add value to your services with repeated selling homeowners.

✅ Solve Common Challenges:

Navigate pricing inconsistencies, equity issues, and market fluctuations with confidence.

✅ Build Lasting Wealth:

Discover innovative strategies that go beyond the immediate flip to create long-term financial success.

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

How does HEIA apply to real estate wholesaling?

HEIA agreements allow wholesalers to structure deals using the seller’s equity instead of needing immediate cash to purchase the property from them to let an investor hire a contractor to renovate. This flexibility eliminates the pressure of finding cash buyers quickly and opens the door to deals traditional wholesalers might pass on to investors.

Do I need a real estate license to use HEIA for wholesaling?

No, because HEIA is structured as a joint venture agreement rather than a real estate listing or brokerage contract. As long as your activities focus on structuring adding value to a property and not acting as a real estate agent or broker consulting homeowners for compensation, you don’t need a license. However, always verify with your state’s regulations to ensure compliance.

What if I don’t have a buyer lined up?

That’s the beauty of HEIA. With this model, you don’t need to rush to secure a buyer. HEIA’s equity structure allows you to secure and improve deals while building value without requiring a property purchase.

Is this legal in all states?

Yes, but it’s essential to still consult a local attorney to confirm compliance with state-specific processes with public recordings and title. HEIA operates as a joint venture agreement on a deed of trust, which falls outside the scope of real estate licensing requirements when used correctly.

What makes HEIA different from other wholesaling strategies?

HEIA eliminates reliance on cash buyers, reduces the pressure of quick closings, and provides property owners with a unique, equity-based solution. This sets you apart from competitors and gives you more options to structure deals.

How do I learn to use HEIA in my wholesaling business?

The WealthTradie Apprenticeship is the perfect place to start. This bonus program equips you with all the tools and knowledge you need to master HEIA and scale your wholesaling business.

What kind of support do I get?

Our Pro Membership offers access to advanced tools and resources. plus priority Master support to help you structure and close HEIA deals with confidence. You’re never on your own with WealthTradie.

Can HEIA help me scale my business?

Absolutely! By removing cash and buyer constraints, HEIA allows you to bring in and take on more deals simultaneously, giving you the freedom to scale your business faster than ever.

How does HEIA protect me legally compared to traditional wholesaling?

Traditional wholesaling often operates in gray legal areas due to assignment contracts and hiding profits and gains from homeowners. HEIA, however, is structured as a joint venture agreement, which aligns with property owner consent and reduces future regulation concerns.

What is an HEIA Liaison License?

The HEIA Liaison License allows you to facilitate Home Equity Invoice Agreements, helping property owners unlock equity to finance deals and renovations while earning additional income. Through converting a contractor cash invoice into the properties equivalent after repairs equity percentage.

30 Day No-Questions Money Back Guarantee

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

Copyright 2026 | WealthTradie™ | Privacy Policy | Terms & Conditions