The Master strategy for Wholesalers

Real Results for Homeowners, Real Opportunities for You

Break Free from High Lead Costs and Unstable Deal Flow Wholesaling

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

MOST wholesalers ARe STRUGGLING WITh offering homeowners enough value

Struggling with Consistent Deal Flow and High Lead Costs?

If you’re like most wholesalers, you’re tired of pouring thousands into marketing campaigns, waiting weeks or even months for sellers to finally sell. Even when leads come through, they’re often unmotivated, want more than the property is worth, or back out at the last minute. The result? Missed opportunities, inconsistent deal flow, and endless frustration.

We know exactly how it feels to struggle with inconsistent leads and costly marketing that rarely delivers the results you expect. Early in our wholesaling career, I was burning through cash on postcards, digital ads, and paid leads, only to face unmotivated sellers or stiff competition. It felt like a never-ending grind, one where even small wins came at a huge expense.

That all changed when I discovered the power of Home Equity Invoice Agreements (HEIA).

By offering homeowners a true solution—equity-based renovations tied to the property’s value. You can stop chasing sellers and started attracting them. Suddenly, be the one they want to work with.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Break Free from High Lead Costs and Unstable Deal Flow

HERE’S HOW IT WORKS

Attract More Homeowners

HEIA gives you a unique offer homeowners can’t resist: no cash upfront renovations and a profit-sharing model that lets them benefit from full market value of their property.

Close More Deals

Stop competing solely on price. With HEIA, you can structure win-win deals that align your goals with the seller’s, even on properties that don’t qualify for traditional wholesaling.

Increase Profits

By working with full market values, HEIA deals create higher profit margins for you and your homeowners, helping you scale faster with fewer deals.

It’s time to stop grinding and start scaling. Ready to break free from high lead costs and inconsistent deal flow? Let HEIA show you how to take your wholesaling business to the next level.

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold You Back

Transform Your Wholesaling Game with The

HEIA Liaison License

Before / Old Way

Frustration with Limited Capital: Struggling to secure cash buyers quickly enough to close deals at a high enough price.

Risk of Losing Deals: Fear of losing properties under contract due to financing delays or backing out buyers.

Intense Competition: Getting outbid or undercut in hot markets by cash-heavy investors with large ad spend.

High and Long Lead Costs: Spending thousands on marketing campaigns with long wait times for seller responses.

Limited Scalability: Cash constraints and dependency on hard money lenders restrict the number of deals you can handle.

After / New Way

Capital-Free Deals: Use HEIA to structure deals without needing immediate cash or relying solely on buyer funding.

Lock in Deals Faster: HEIA agreements provide flexibility to structure deals and eliminate investor buyer dependency

Unique Selling Proposition: Leverage HEIA to offer property owners a new, equity-based alternative to wholesaling.

More Efficient Leads: Use HEIA to close deals faster and create repeatable win-win offers that attract motivated sellers.

Unlimited Deal Flow: Structure more deals simultaneously by replacing cash with creative equity-based agreements.

30 Day No-Questions Money Back Guarantee

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Essential Tools to Close More Deals

Gain access to cutting-edge tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. With these resources, you’ll be able to analyze, negotiate, and execute HEIA deals more efficiently than ever before.

Bonus 2: Pro Membership

Learn to Structure Deals with Confidence

This comprehensive program teaches you how to use HEIA agreements to close deals faster, create win-win arrangements, and unlock opportunities that traditional wholesaling can’t touch. From negotiation strategies to equity-based structures, you’ll gain the skills needed to transform your wholesaling business by leveraging other real estate professionals needs.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn as You Build Your Business

Use your network to promote HEIA solutions and WealthTradie memberships to other wholesalers and real estate professionals. Keep 100% of the revenue earned through your referrals, providing an additional income stream while scaling your core business.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

The Equity Revolution - HEIA Reshapes Real Estate Hard Money

Farewell to Hard Money Lenders

The real estate investing world stands on the brink of transformation. Home Equity Invoice Agreements (HEIA) are set to revolutionize the industry, potentially phasing out the need for hard money lenders. This innovative approach promises to streamline the investing process, eliminating the need for capital to fix and flip properties.

Traditional hard money lending often falls short at crucial moments - during closing or when construction draws are needed. In contrast, HEIA offers a simplified, equity-based solution. It's a publicly recorded agreement that bypasses the lengthy underwriting process typically associated with property renovation funding.

Empowering Homeowners and Investors

HEIA shifts the balance of power back to homeowners and investors. Unlike traditional methods, where lenders control property funding and renovation timelines, HEIA involves only the parties directly adding value to the property. This approach eliminates the risk of last-minute fee revelations or loan adjustments that can derail projects.

With HEIA, the property remains in the homeowner's possession, while investors secure their interests through a deed of trust. This arrangement mirrors the security of hard money lending but without the associated pitfalls. Renovation funds flow directly between contractors and homeowners, removing dependence on third-party control.

Redistributing Wealth in Real Estate

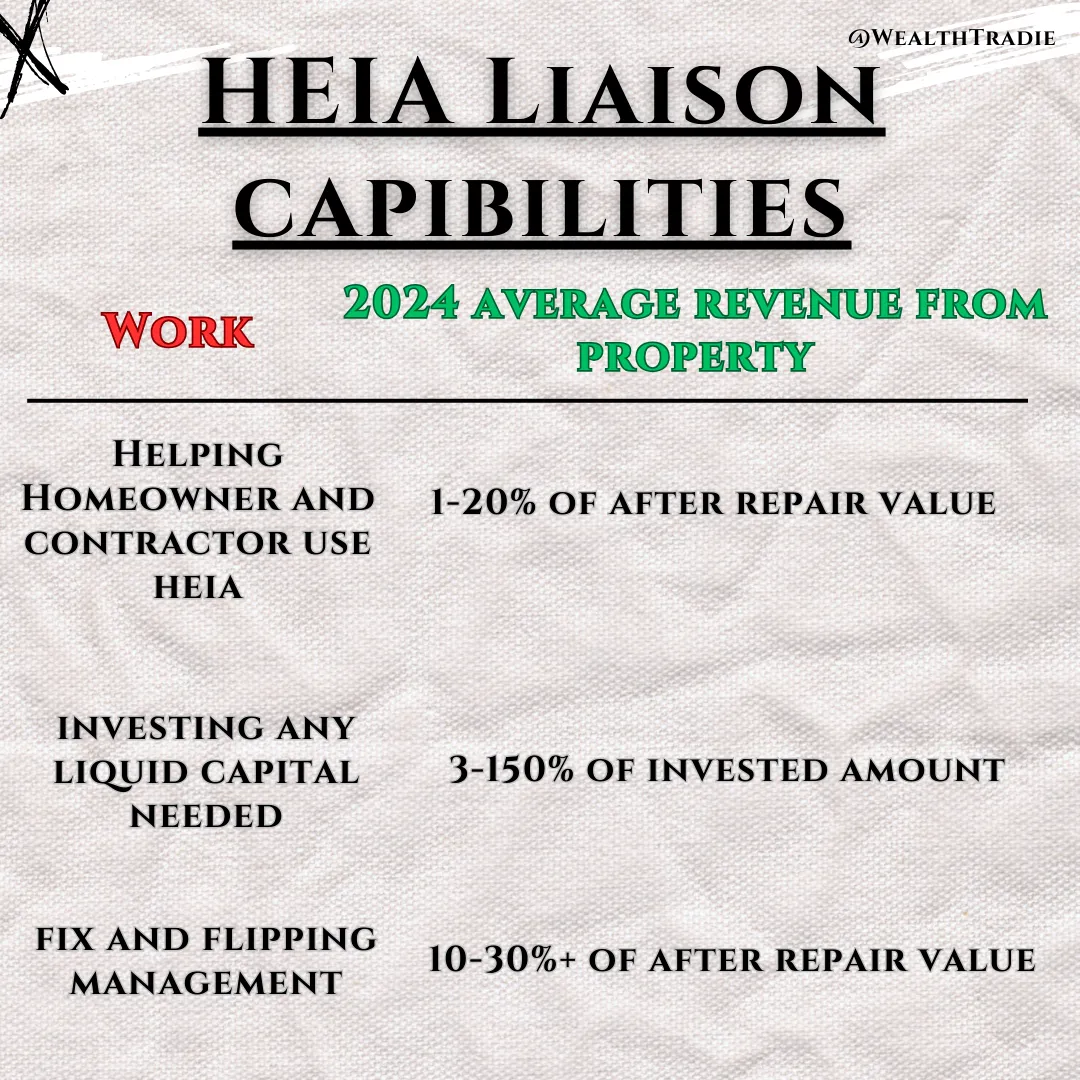

HEIA's potential to redistribute wealth within the real estate industry is significant. By eliminating fees and costs associated with traditional capital sources, HEIA channels more resources to service providers who contribute tangible value to properties. This shift promises to reward the actual work done in the real estate sector more fairly.

The HEIA structure fosters self-accountability among investors and contractors. It incentivizes accuracy and quality in property improvements while protecting the value brought to each project. This alignment of interests creates a more secure relationship between homeowners and contractors, reducing the need for aggressive marketing tactics and ensuring timely project completion.

Reshaping the Real Estate Market

As HEIA gains traction, its impact on the broader real estate market could be profound. This superior investing strategy, with its cost savings and built-in accountability, is poised to phase out traditional wholesaling while reinventing the fix-and-flip industry. We can expect more accurate property valuations as service industry and third-party lending costs are stripped away, potentially making home ownership more affordable and improving overall housing quality.

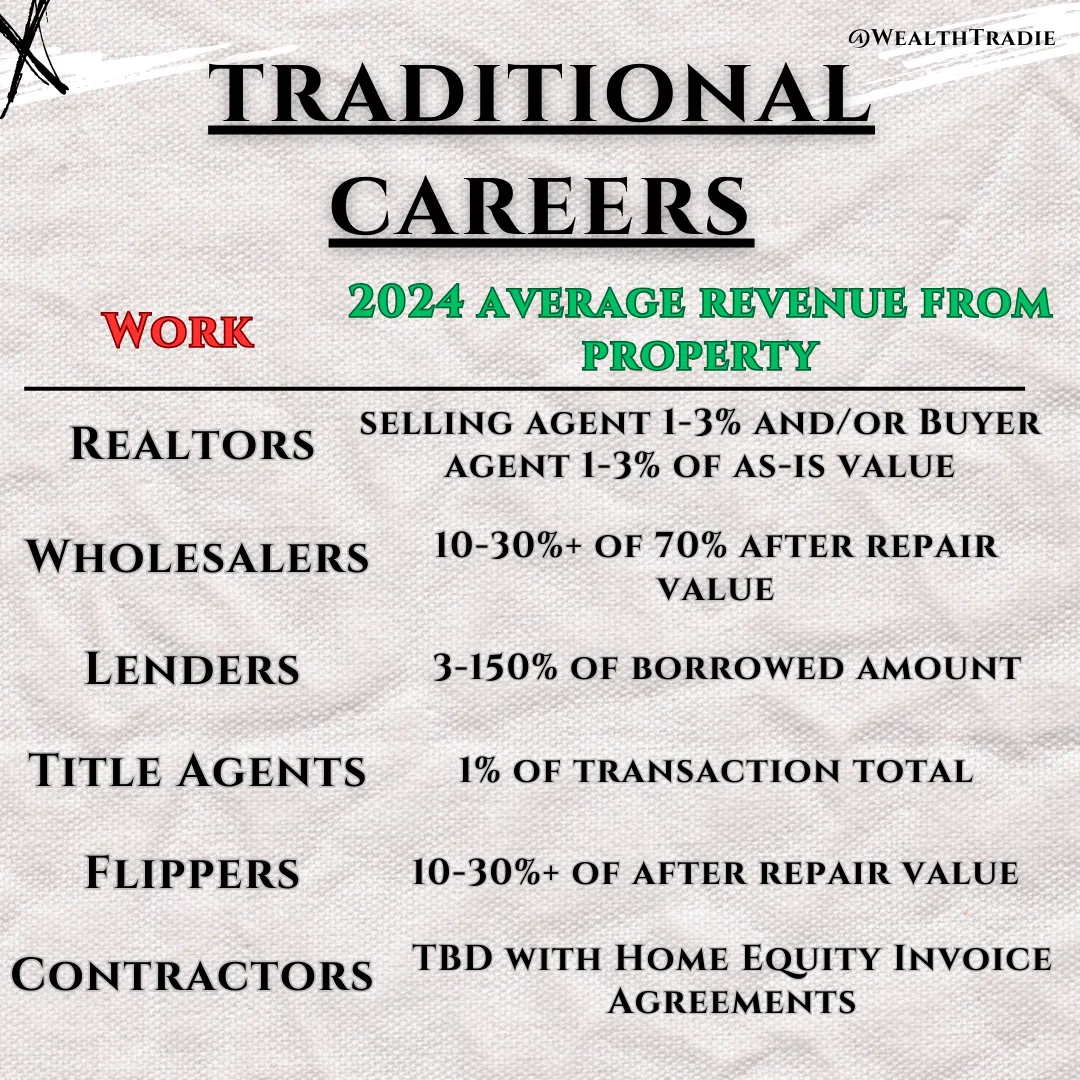

The transition to HEIA won't be without challenges. Change, even positive change, often faces resistance, especially from profit-driven sectors of the industry. However, WealthTradie, the founder of HEIA, is committed to educating the masses about the realities of the real estate industry. Their goal is to demystify the actual requirements and expose unnecessary practices that have been marketed as essential for job security and profit. As noted in their published Apprentice book "The Real Game Made Simple".

Technology's Role in the HEIA Revolution

Technology will play a crucial role in facilitating the implementation and management of HEIAs. Software solutions have already democratized home valuation by making public data readily accessible. This shift has put the power of real estate valuation into the hands of the general public, challenging the traditional gatekeeping roles of realtors and appraisers.

Looking ahead, WealthTradie plans to release an app to further streamline the HEIA process. Collaborations with title companies are also in the works to simplify the public recording of HEIAs. These technological advancements promise to make the HEIA process more efficient and user-friendly.

The Future of Real Estate Financing

As HEIA gains widespread adoption, it's set to dramatically alter real estate investing finance. The focus will shift from securing funds for high property purchase prices to only financing renovation costs. This change could make real estate investing more accessible to a broader range of individuals and potentially increase the number of properties being improved rather than built from scratch.

The ripple effects of this shift will be felt across the industry. Wholesalers may transition to becoming fix-and-flippers, hard money lenders might evolve into construction lenders, and realtors could find new opportunities in the distressed property market. The end result? A more affordable housing market with fewer inflated costs.

Global Implications and Long-Term Impact

The HEIA model isn't confined to the United States. Plans are underway to introduce it internationally, adapting to various countries' regulations, real estate processes, and tax systems. This global expansion could reshape real estate markets worldwide, offering a more equitable approach to property investment and improvement.

In the long term, HEIA is poised to standardize construction prices in local markets and redistribute wealth to the working class. By tying compensation directly to a property's success and quality, HEIA creates a fairer system that rewards skill and hard work rather than financial manipulation.

As we stand on the cusp of this equity revolution in real estate, it's clear that HEIA represents more than just a new financial tool. It's a paradigm shift that promises to make real estate investing more accessible, transparent, and equitable for all involved. The future of real estate may well be one where the value of work is truly recognized, and the benefits of property improvement are shared more fairly among all stakeholders.

Master the Strategies That Make Wholesaling More Profitable and Scalable

"The Real Game Made Simple"

–A Must-Have for Wholesalers

Whether you’re new to the game or a seasoned professional, this book equips you with the tools to scale your business and maximize profitability.

Here’s what makes it a game-changer for wholesalers:

✅ Close Deals Smarter:

Learn how to leverage Home Equity Invoice Agreements (HEIAs) to increase your deal flow and add value to your services with repeated selling homeowners.

✅ Solve Common Challenges:

Navigate pricing inconsistencies, equity issues, and market fluctuations with confidence.

✅ Build Lasting Wealth:

Discover innovative strategies that go beyond the immediate flip to create long-term financial success.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

How does HEIA apply to real estate wholesaling?

HEIA agreements allow wholesalers to structure deals using the seller’s equity instead of needing immediate cash to purchase the property for them. This flexibility eliminates the pressure of finding cash buyers quickly and opens the door to deals traditional wholesalers might pass on.

Do I need a real estate license to use HEIA for wholesaling?

No, because HEIA is structured as a joint venture agreement rather than a real estate listing or brokerage contract. As long as your activities focus on structuring adding value to a property and not acting as a real estate agent or broker consulting homeowners for compensation, you don’t need a license. However, always verify with your state’s regulations to ensure compliance.

What if I don’t have a buyer lined up?

That’s the beauty of HEIA. With this model, you don’t need to rush to secure a buyer. HEIA’s equity structure allows you to secure and improve deals while building value without requiring a property purchase.

Is this legal in all states?

Yes, but it’s essential to still consult a local attorney to confirm compliance with state-specific processes with public recordings and title. HEIA operates as a joint venture agreement on a deed of trust, which falls outside the scope of real estate licensing requirements when used correctly.

What makes HEIA different from other wholesaling strategies?

HEIA eliminates reliance on cash buyers, reduces the pressure of quick closings, and provides property owners with a unique, equity-based solution. This sets you apart from competitors and gives you more options to structure deals.

How do I learn to use HEIA in my wholesaling business?

The WealthTradie Apprenticeship is the perfect place to start. This bonus program equips you with all the tools and knowledge you need to master HEIA and scale your wholesaling business.

What kind of support do I get?

Our Pro Membership offers access to advanced tools and resources. plus priority Master support to help you structure and close HEIA deals with confidence. You’re never on your own with WealthTradie.

Can HEIA help me scale my business?

Absolutely! By removing cash and buyer constraints, HEIA allows you to bring in and take on more deals simultaneously, giving you the freedom to scale your business faster than ever.

How does HEIA protect me legally compared to traditional wholesaling?

Traditional wholesaling often operates in gray legal areas due to assignment contracts and hiding profits and gains from homeowners. HEIA, however, is structured as a joint venture agreement, which aligns with property owner consent and reduces future regulation concerns.

30 Day No-Questions Money Back Guarantee

Copyright 2024 | WealthTradie™ | Privacy Policy | Terms & Conditions