The Master strategy for Wholesalers

Real Results for Homeowners, Real Opportunities for You

Break Free from High Lead Costs and Unstable Deal Flow Wholesaling

CLICK BELOW TO WATCH FIRST!

30 Day No-Questions Money Back Guarantee

MOST wholesalers ARe STRUGGLING WITh offering homeowners enough value

Struggling with Consistent Deal Flow and High Lead Costs?

If you’re like most wholesalers, you’re tired of pouring thousands into marketing campaigns, waiting weeks or even months for sellers to finally sell. Even when leads come through, they’re often unmotivated, want more than the property is worth, or back out at the last minute. The result? Missed opportunities, inconsistent deal flow, and endless frustration.

We know exactly how it feels to struggle with inconsistent leads and costly marketing that rarely delivers the results you expect. Early in our wholesaling career, I was burning through cash on postcards, digital ads, and paid leads, only to face unmotivated sellers or stiff competition. It felt like a never-ending grind, one where even small wins came at a huge expense.

That all changed when I discovered the power of Home Equity Invoice Agreements (HEIA).

By offering homeowners a true solution—equity-based renovations tied to the property’s value. You can stop chasing sellers and started attracting them. Suddenly, be the one they want to work with.

INTRODUCING:

Home Equity Invoice Agreement Liaison License

Break Free from High Lead Costs and Unstable Deal Flow

HERE’S HOW IT WORKS

Attract More Homeowners

HEIA gives you a unique offer homeowners can’t resist: no cash upfront renovations and a profit-sharing model that lets them benefit from full market value of their property.

Close More Deals

Stop competing solely on price. With HEIA, you can structure win-win deals that align your goals with the seller’s, even on properties that don’t qualify for traditional wholesaling.

Increase Profits

By working with full market values, HEIA deals create higher profit margins for you and your homeowners, helping you scale faster with fewer deals.

It’s time to stop grinding and start scaling. Ready to break free from high lead costs and inconsistent deal flow? Let HEIA show you how to take your wholesaling business to the next level.

30 Day No-Questions Money Back Guarantee

Stop Letting capital Hold You Back

Transform Your Wholesaling Game with The

HEIA Liaison License

Before / Old Way

Frustration with Limited Capital: Struggling to secure cash buyers quickly enough to close deals at a high enough price.

Risk of Losing Deals: Fear of losing properties under contract due to financing delays or backing out buyers.

Intense Competition: Getting outbid or undercut in hot markets by cash-heavy investors with large ad spend.

High and Long Lead Costs: Spending thousands on marketing campaigns with long wait times for seller responses.

Limited Scalability: Cash constraints and dependency on hard money lenders restrict the number of deals you can handle.

After / New Way

Capital-Free Deals: Use HEIA to structure deals without needing immediate cash or relying solely on buyer funding.

Lock in Deals Faster: HEIA agreements provide flexibility to structure deals and eliminate investor buyer dependency

Unique Selling Proposition: Leverage HEIA to offer property owners a new, equity-based alternative to wholesaling.

More Efficient Leads: Use HEIA to close deals faster and create repeatable win-win offers that attract motivated sellers.

Unlimited Deal Flow: Structure more deals simultaneously by replacing cash with creative equity-based agreements.

30 Day No-Questions Money Back Guarantee

Introducing:

HEIA Master Liaison License

The #1 Scaling Method for Real Estate Investors

Here's Everything you get:

Step-by-Step Training Value: $5,611

A structured video series that walks you through each phase, ensuring you have everything you need to achieve using HEIA efficiently.

Personalized Implementation Plan Value: $250

A customized roadmap tailored to your specific goals, ensuring you take the right steps toward success with your real estate strategies.

Exclusive Q&A Sessions Value: $recurring

Get direct access to WealthTradie experts for ongoing support and clarity, helping you overcome challenges quickly.

Lifetime Wealth Multiplier Calculator Value: $270

Receive all future updates to the program, ensuring you stay ahead with the latest tools.

Done-for-You Contracts Value: $3,714

Save time and effort with ready-to-use documents that are designed for immediate implementation.

Normally: $an entire college degree

Today: A fraction of the costs

30 Day No-Questions Money Back Guarantee

PLUS, YOU ALSO GET

Amazing Bonuses When You Join Today

Bonus 1: WealthTradie Apprenticeship

Essential Tools to Close More Deals

Gain access to cutting-edge tools like equity exchange calculators, client generation resources, and advanced deal structuring contracts. With these resources, you’ll be able to analyze, negotiate, and execute HEIA deals more efficiently than ever before.

Bonus 2: Pro Membership

Learn to Structure Deals with Confidence

This comprehensive program teaches you how to use HEIA agreements to close deals faster, create win-win arrangements, and unlock opportunities that traditional wholesaling can’t touch. From negotiation strategies to equity-based structures, you’ll gain the skills needed to transform your wholesaling business by leveraging other real estate professionals needs.

Bonus 3: Full 100% Revenue Share Affiliate Membership

Earn as You Build Your Business

Use your network to promote HEIA solutions and WealthTradie memberships to other wholesalers and real estate professionals. Keep 100% of the revenue earned through your referrals, providing an additional income stream while scaling your core business.

30 Day No-Questions Money Back Guarantee

Revolutionary

How others are utilizing HEIA

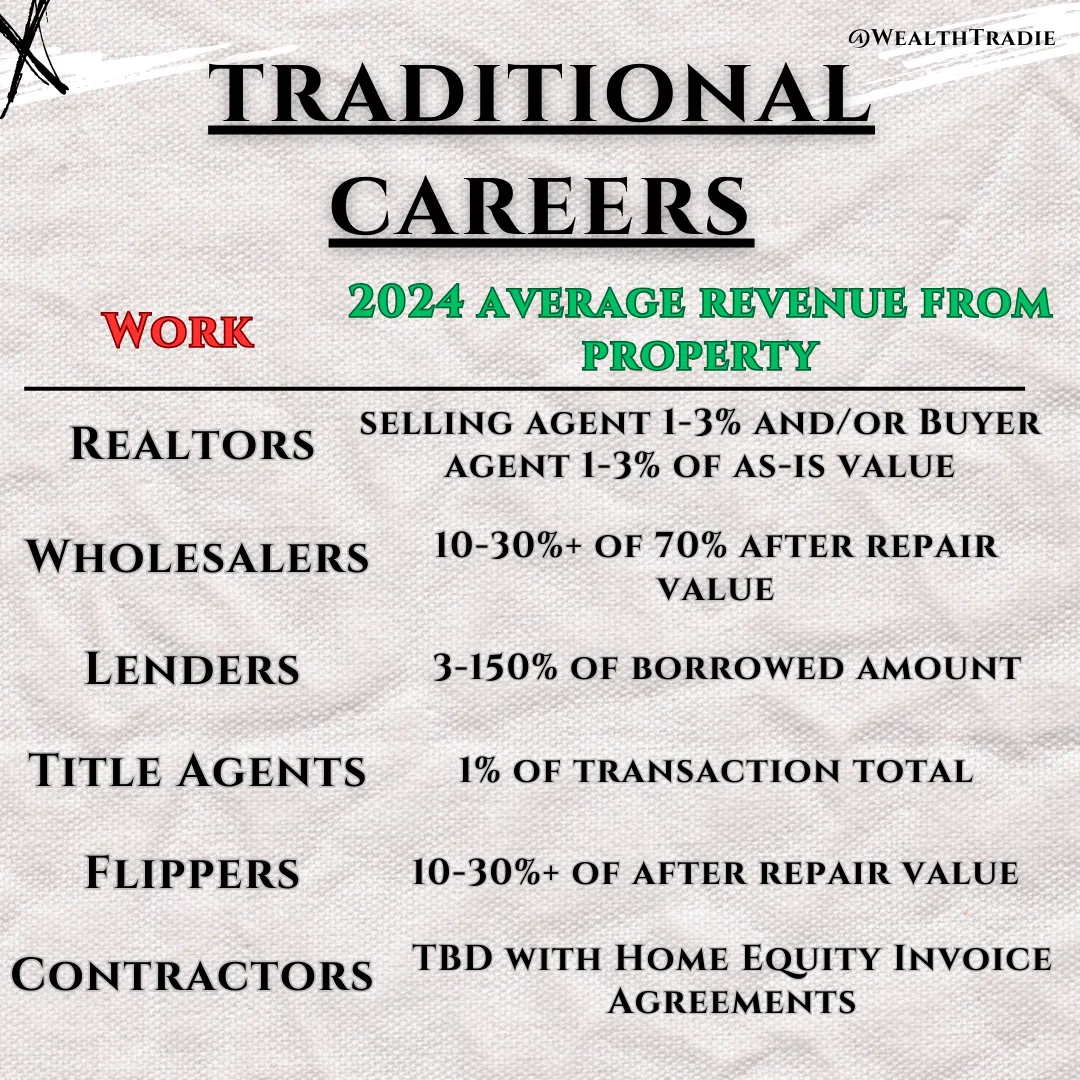

Traditional Real Estate Finance is Dead

Here's Why Contractors Are Becoming Property Moguls

Hard money lenders playing poker at closing tables. Month-long waits for construction draws. Interest rates that would make a loan shark blush. The traditional real estate financing model isn't just broken - it's actively working against everyone except the middlemen taking their 20% cut.

Let's talk about construction for a moment. It's basically surgery on buildings, but imagine if surgeons got paid by the hour regardless of whether the patient lived or died. That's the current model for contractors. You open up a wall expecting a simple repair, and suddenly you're face-to-face with decades of DIY disasters that would make HGTV hosts cry.

Quality? That's become a four-letter word in the industry, gone. When contractors are racing against time-based budgets, craftsmanship takes a backseat to speed. The result? Properties that look like mansions on the surface but have the structural integrity of a treehouse built by kindergarteners.

The numbers tell the ugly truth. Over 20% of a property's value gets sucked into the void of fees, interest rates, and middleman markups. That's money that could be going into better materials, skilled labor, or heaven forbid, the contractors actually doing the work.

But here's where it gets interesting.

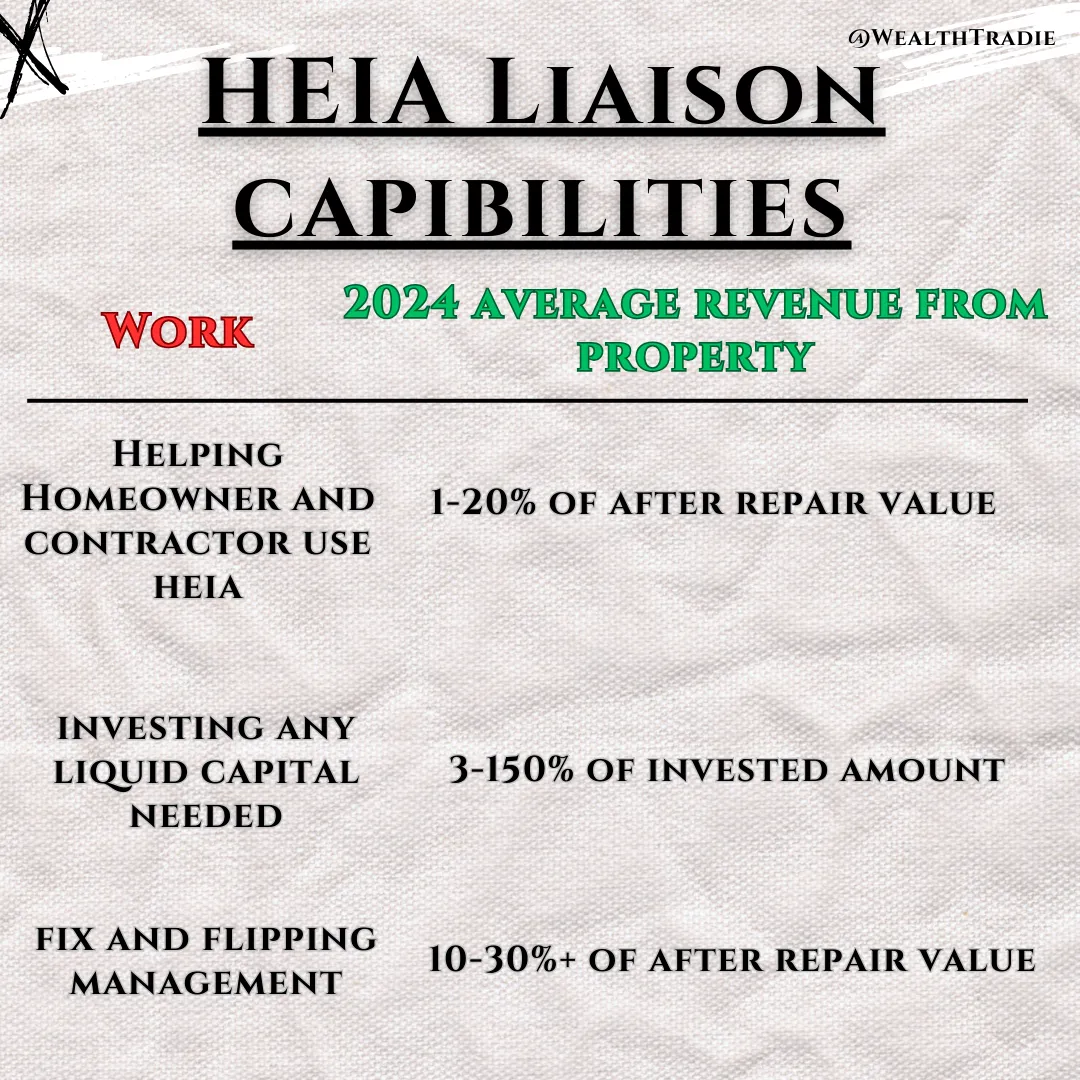

Home Equity Invoice Agreements (HEIAs) are flipping this broken system on its head. Instead of contractors being mere service providers hoping to get paid before their credit cards max out, they're becoming stakeholders in the properties they improve.

Think about it. When was the last time you heard of a contractor walking off a job because they were excited about the long-term value they were creating? Never, because the current system treats them like interchangeable parts rather than skilled artisans investing in real estate's future.

The transformation is already happening. Contractors who adopt HEIAs are taking their time, focusing on quality, and thinking like investors rather than hourly workers. They're not just building walls - they're building wealth.

Some of the best contractors in the business have walked away from projects mid-renovation because of payment delays from traditional lenders. With HEIAs, they're not just waiting for the next draw - they're calculating their stake in the property's future value.

The standardization of quality assessment isn't just paperwork - it's revolution in work boots. When contractors own a piece of every property they improve, suddenly those extra hours spent ensuring perfect joints and level surfaces aren't cost overruns - they're investments in their own future.

This isn't theoretical. Real contractors are already converting their invoices into equity percentages, bypassing the traditional financing circus entirely. No more juggling credit card promotions or begging banks for construction loans that come with more strings attached than a puppet show.

The market is responding. Properties improved under HEIA arrangements are showing superior quality and better long-term value retention. Why? Because when your paycheck is tied to the property's actual value rather than just billable hours, you tend to care a lot more about doing things right.

Welcome to construction's new reality, where contractors aren't just building properties - they're building portfolios. The fix-and-flip model isn't just dying; it's being rebuilt from the foundation up, with the people who actually know how to hold a hammer finally getting their piece of the pie.

Master the Strategies That Make Wholesaling More Profitable and Scalable

"The Real Game Made Simple"

–A Must-Have for Wholesalers

Whether you’re new to the game or a seasoned professional, this book equips you with the tools to scale your business and maximize profitability.

Here’s what makes it a game-changer for wholesalers:

✅ Close Deals Smarter:

Learn how to leverage Home Equity Invoice Agreements (HEIAs) to increase your deal flow and add value to your services with repeated selling homeowners.

✅ Solve Common Challenges:

Navigate pricing inconsistencies, equity issues, and market fluctuations with confidence.

✅ Build Lasting Wealth:

Discover innovative strategies that go beyond the immediate flip to create long-term financial success.

TRY IT OUT RISK FREE

Get a 30 Day No-Questions Money Back Guarantee

That’s how confident we are that you’ll love your experience.

How it works

We’re confident you’ll love your experience, but if for any reason you don’t, you’re covered!

Try us out for 30 days, and if you’re not completely satisfied, simply reach out to us at [email protected], and we’ll refund your full investment—no questions asked. It’s that simple.

We want to ensure that you feel confident in making this decision, knowing you have nothing to lose and everything to gain.

30 Day No-Questions Money Back Guarantee

STILL NOT SURE IF THIS IS FOR YOU?

POWER QUESTIONS

How does HEIA apply to real estate wholesaling?

HEIA agreements allow wholesalers to structure deals using the seller’s equity instead of needing immediate cash to purchase the property for them. This flexibility eliminates the pressure of finding cash buyers quickly and opens the door to deals traditional wholesalers might pass on.

Do I need a real estate license to use HEIA for wholesaling?

No, because HEIA is structured as a joint venture agreement rather than a real estate listing or brokerage contract. As long as your activities focus on structuring adding value to a property and not acting as a real estate agent or broker consulting homeowners for compensation, you don’t need a license. However, always verify with your state’s regulations to ensure compliance.

What if I don’t have a buyer lined up?

That’s the beauty of HEIA. With this model, you don’t need to rush to secure a buyer. HEIA’s equity structure allows you to secure and improve deals while building value without requiring a property purchase.

Is this legal in all states?

Yes, but it’s essential to still consult a local attorney to confirm compliance with state-specific processes with public recordings and title. HEIA operates as a joint venture agreement on a deed of trust, which falls outside the scope of real estate licensing requirements when used correctly.

What makes HEIA different from other wholesaling strategies?

HEIA eliminates reliance on cash buyers, reduces the pressure of quick closings, and provides property owners with a unique, equity-based solution. This sets you apart from competitors and gives you more options to structure deals.

How do I learn to use HEIA in my wholesaling business?

The WealthTradie Apprenticeship is the perfect place to start. This bonus program equips you with all the tools and knowledge you need to master HEIA and scale your wholesaling business.

What kind of support do I get?

Our Pro Membership offers access to advanced tools and resources. plus priority Master support to help you structure and close HEIA deals with confidence. You’re never on your own with WealthTradie.

Can HEIA help me scale my business?

Absolutely! By removing cash and buyer constraints, HEIA allows you to bring in and take on more deals simultaneously, giving you the freedom to scale your business faster than ever.

How does HEIA protect me legally compared to traditional wholesaling?

Traditional wholesaling often operates in gray legal areas due to assignment contracts and hiding profits and gains from homeowners. HEIA, however, is structured as a joint venture agreement, which aligns with property owner consent and reduces future regulation concerns.

30 Day No-Questions Money Back Guarantee

Copyright 2024 | WealthTradie™ | Privacy Policy | Terms & Conditions